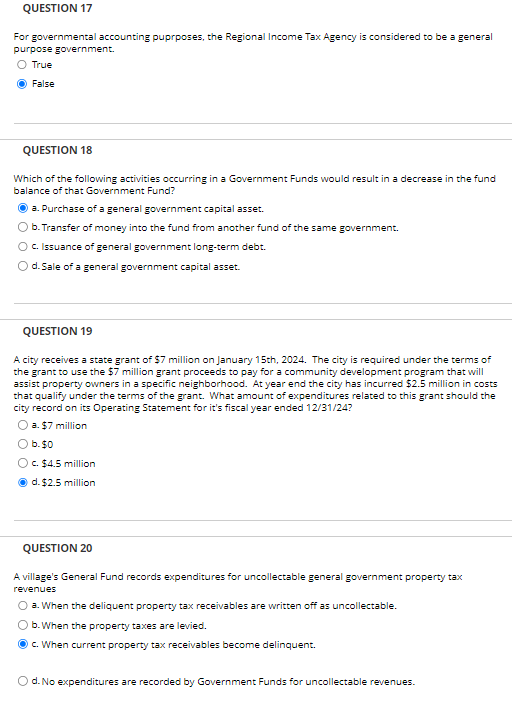

Question: Please answer all QUESTION 1 7 For governmental accounting purposes, the Regional Income Tax Agency is considered to be a general purpose government. True False

Please answer all

QUESTION

For governmental accounting purposes, the Regional Income Tax Agency is considered to be a general

purpose government.

True

False

QUESTION

Which of the following activities occurring in a Government Funds would result in a decrease in the fund

balance of that Government Fund?

a Purchase of a general government capital asset.

b Transfer of money into the fund from another fund of the same government.

c Issuance of general government longterm debt.

d Sale of a general government capital asset.

QUESTION

A city receives a state grant of $ million on January th The city is required under the terms of

the grant to use the $ million grant proceeds to pay for a community development program that will

assist property owners in a specific neighborhood. At year end the city has incurred $ million in costs

that qualify under the terms of the grant. What amount of expenditures related to this grant should the

city record on its Operating Statement for it's fiscal year ended

a $ million

b $

c $ million

d $ million

QUESTION

A village's General Fund records expenditures for uncollectable general government property tax

revenues

a When the deliquent property tax receivables are written off as uncollectable.

b When the property taxes are levied.

c When current property tax receivables become delinquent.

d No expenditures are recorded by Government Funds for uncollectable revenues.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock