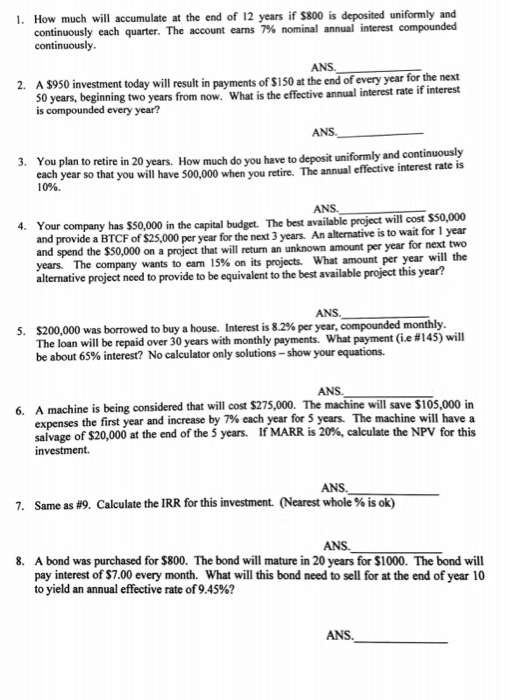

Question: Please answer all question 1. How much will accumulate at the end of 12 years if $800 is deposited uniformly and continuously each quarter. The

1. How much will accumulate at the end of 12 years if $800 is deposited uniformly and continuously each quarter. The account earns 7% nominal annual interest compounded ANS 2. A $950 investment today will result in payments of S150 at the end of every year for the next What is the effective annual interest rate if interest 50 years, beginning two years from now. is compounded every year? and continuously rate is You plan to retire in 20 years. How much do you have to deposit uniformly each year so that you will have 500,000 when you retire. 10%. 3. The annual effective interest ANS. capital budget. The best available project will cost $50,000 An alternative is to wait for 1 year on a project that will return an unknown amount per year for next two our company has $50,000 in the and 4. Y provide a BTCF of $25,000 per year for the next 3 years. and spend the $50,000 years. The company wants to eam 15% on its projects. What amount per year alternative project need to provide to be equivalent to the best available project this year? will the ANS. $200,000 was borrowed to buy a house. The loan will be repaid over 30 years with monthly payments. What payment (ie #145) will be about 65% interest? No calculator only solutions-show your equations. 5, Interest is 82% per year, compounded monthly ANS A machine is being considered that will cost $275,000. The machine will save $105,000 in expenses the first year and increase by 7% each year for 5 years. The machine will have a salvage of $20,000 at the end of the 5 years. If MARR is 20%, calculate the NPV for this 6. ANS. 7. Same as Calculate the IRR for this investment. (Nearest whole % is ok) ANS. 8, A bond was purchased for $800. The bond will mature in 20 years for $1000The bond will pay interest of $7.00 every month. What will this bond need to sell for at the end of year 10 to yield an annual effective rate of 9.45%? ANS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts