Question: please answer all Question 3 (20 marks) Peter, who has retired for several years, is considering investing in two stocks: A and B. The returns

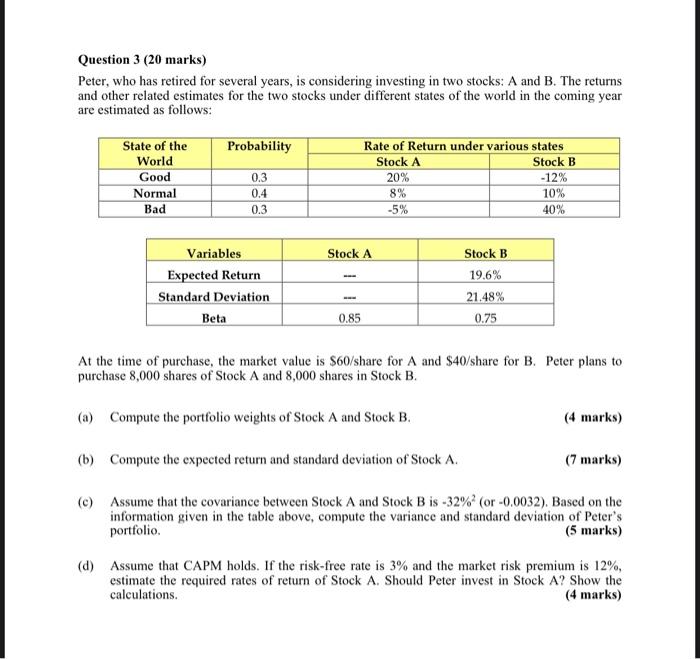

Question 3 (20 marks) Peter, who has retired for several years, is considering investing in two stocks: A and B. The returns and other related estimates for the two stocks under different states of the world in the coming year are estimated as follows: Probability State of the World Good Normal Bad 0.3 0.4 0.3 Rate of Return under various states Stock A Stock B 20% -12% 8% 10% -5% 40% Stock A Stock B 19.6% Variables Expected Return Standard Deviation Beta 21.48% 0.75 0.85 At the time of purchase, the market value is $60/share for A and $40/share for B. Peter plans to purchase 8,000 shares of Stock A and 8,000 shares in Stock B. (a) Compute the portfolio weights of Stock A and Stock B. (4 marks) (b) Compute the expected return and standard deviation of Stock A. (7 marks) () Assume that the covariance between Stock A and Stock B is -32% (or -0.0032). Based on the information given in the table above, compute the variance and standard deviation of Peter's portfolio (5 marks) (d) Assume that CAPM holds. If the risk-free rate is 3% and the market risk premium is 12%, estimate the required rates of return of Stock A. Should Peter invest in Stock A? Show the calculations. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts