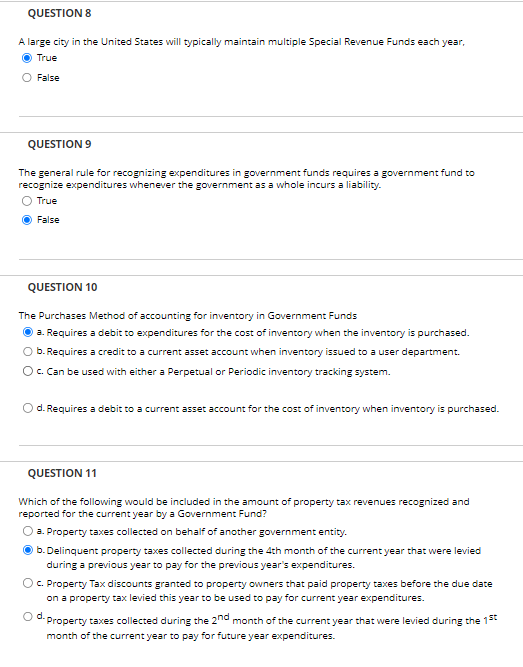

Question: Please answer all QUESTION 8 A large city in the United States will typically maintain multiple Special Revenue Funds each year, True False QUESTION 9

Please answer all

QUESTION

A large city in the United States will typically maintain multiple Special Revenue Funds each year,

True

False

QUESTION

The general rule for recognizing expenditures in government funds requires a government fund to

recognize expenditures whenever the government as a whole incurs a liability.

True

False

QUESTION

The Purchases Method of accounting for inventory in Government Funds

a Requires a debit to expenditures for the cost of inventory when the inventory is purchased.

b Requires a credit to a current asset account when inventory issued to a user department.

c Can be used with either a Perpetual or Periodic inventory tracking system.

d Requires a debit to a current asset account for the cost of inventory when inventory is purchased.

QUESTION

Which of the following would be included in the amount of property tax revenues recognized and

reported for the current year by a Government Fund?

a Property taxes collected on behalf of another government entity.

b Delinquent property taxes collected during the th month of the current year that were levied

during a previous year to pay for the previous year's expenditures.

c Property Tax discounts granted to property owners that paid property taxes before the due date

on a property tax levied this year to be used to pay for current year expenditures.

d Property taxes collected during the nd month of the current year that were levied during the st

month of the current year to pay for future year expenditures.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock