Question: please answer all question and list detailed steps including Excel function used if any question has multiple parts 03. You purchased 100 contracts of 1200

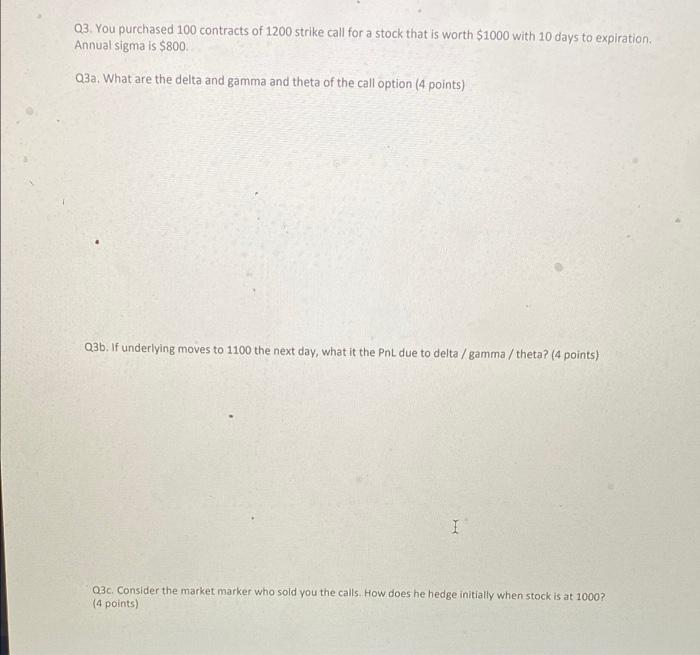

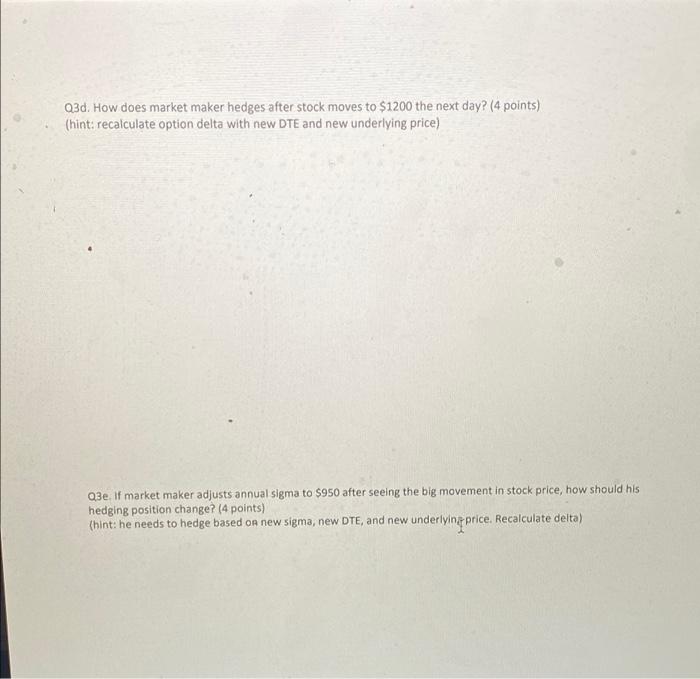

03. You purchased 100 contracts of 1200 strike call for a stock that is worth $1000 with 10 days to expiration Annual sigma is $800 Q3a. What are the delta and gamma and theta of the call option (4 points) Q3b. If underlying moves to 1100 the next day, what it the Pnl due to delta / gamma / theta? (4 points) Q3c. Consider the market marker who sold you the calls. How does he hedge initially when stock is at 1000? (4 points) Q3d. How does market maker hedges after stock moves to $1200 the next day? (4 points) (hint: recalculate option delta with new DTE and new underlying price) Q3e. If market maker adjusts annual sigma to $950 after seeing the big movement in stock price, how should his hedging position change? (4 points) (hint: he needs to hedge based on new sigma, new DTE, and new underly underlying price Recalculate delta) 03. You purchased 100 contracts of 1200 strike call for a stock that is worth $1000 with 10 days to expiration Annual sigma is $800 Q3a. What are the delta and gamma and theta of the call option (4 points) Q3b. If underlying moves to 1100 the next day, what it the Pnl due to delta / gamma / theta? (4 points) Q3c. Consider the market marker who sold you the calls. How does he hedge initially when stock is at 1000? (4 points) Q3d. How does market maker hedges after stock moves to $1200 the next day? (4 points) (hint: recalculate option delta with new DTE and new underlying price) Q3e. If market maker adjusts annual sigma to $950 after seeing the big movement in stock price, how should his hedging position change? (4 points) (hint: he needs to hedge based on new sigma, new DTE, and new underly underlying price Recalculate delta)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts