Question: please answer all question below Use this information to answer questions (a-d). Vail Venture Investors, LLC is trying to find the value of Black Hawk

please answer all question below

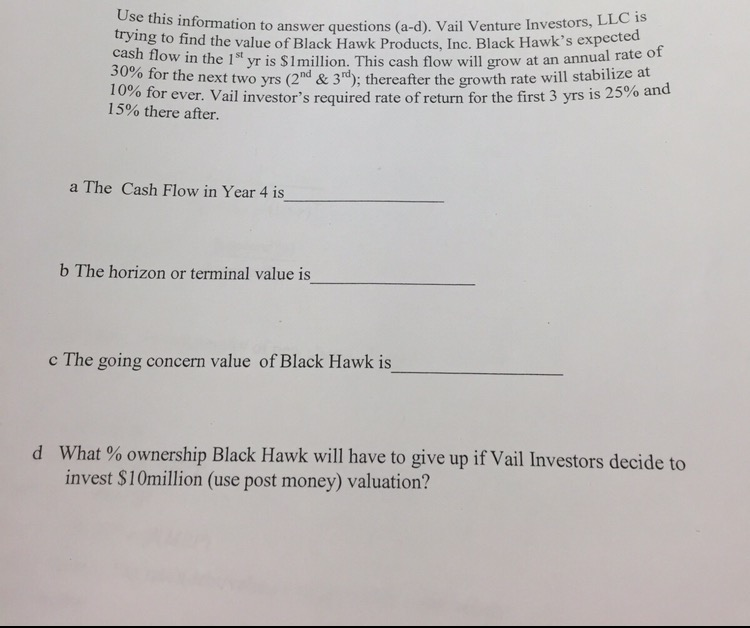

Use this information to answer questions (a-d). Vail Venture Investors, LLC is trying to find the value of Black Hawk Products, Inc. Black Hawk's expected cash flow in the 1^st yr is $1 million. This cash flow will grow at an annual rate 30% for the next two yrs (2^nd & 3^rd); thereafter the growth rate will stabilize at 10% for ever. Vail investor's required rate of return for the first 3 yrs is 25% an 15% there after. a The Cash Flow in Year 4 is b The horizon or terminal value is c The going concern value of Black Hawk is What % ownership Black Hawk will have to give up if Vail Investors decide to invest $10million (use post money) valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts