Question: please answer all question correctly as soon as posssible. i would rate 5 star for u! thanks 8. You purchase 3,000 bonds with a par

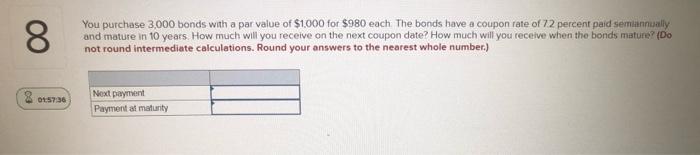

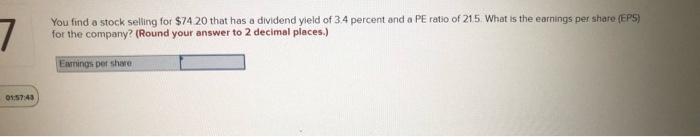

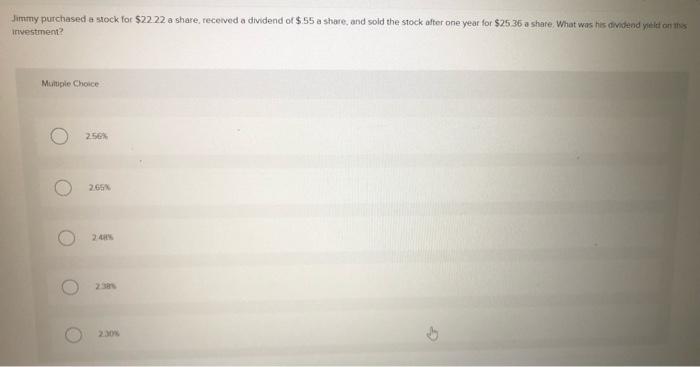

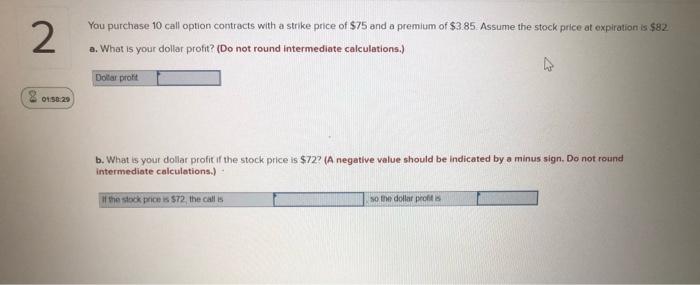

8. You purchase 3,000 bonds with a par value of $1.000 for $980 each. The bands have a coupon rate of 72 percent paid semiannually and mature in 10 years. How much will you receive on the next coupon date? How much will you receive when the bonds mature? (Do not round intermediate calculations. Round your answers to the nearest whole number.) 01:57:36 Next payment Payment al maturity 7 You find a stock selling for $74 20 that has a dividend yield of 3.4 percent and a PE ratio of 215. What is the earnings per share (EPS) for the company? (Round your answer to 2 decimal places.) Earrings pet share 01:57:45 a Jimmy purchased a stock for $22.22. a share, received a dividend of $55 a shore, and sold the stock after one year for $25.36 a share What was his dividend yieket on os investment? Multiple Choice 256 2.65 O 2.4 2.30 2 You purchase 10 call option contracts with a strike price of $75 and a premium of $385. Assume the stock price at expiration is $82 a. What is your dollar profit? (Do not round Intermediate calculations.) Dollar profit 01:50:29 b. What is your dollar profit if the stock price is $72. (A negative value should be indicated by a minus sign. Do not round intermediate calculations.) If the stock price is $72, the calls so to deflor profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts