Question: please answer all question Lang Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is

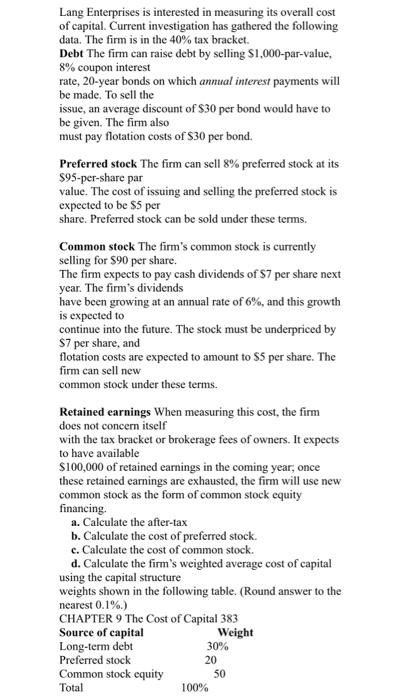

Lang Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. Debt The firm can raise debt by selling \$1,000-par-value, 8% coupon interest rate, 20-year bonds on which annual interest payments will be made. To sell the issue, an average discount of $30 per bond would have to be given. The firm also must pay flotation costs of $30 per bond. Preferred stock The firm can sell 8% preferred stock at its \$95-per-share par value. The cost of issuing and selling the preferred stock is expected to be $5 per share. Preferred stock can be sold under these terms. Common stock The firm's common stock is currently selling for $90 per share. The firm expects to pay cash dividends of $7 per share next year. The firm's dividends have been growing at an annual rate of 6%, and this growth is expected to continue into the future. The stock must be underpriced by $7 per share, and flotation costs are expected to amount to $5 per share. The firm can sell new common stock under these terms. Retained earnings When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $100,000 of retained earnings in the coming year, once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. a. Calculate the after-tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts