Question: please answer all question please and thank you Entries for Installment Note Transactions On January 1 of Year 1, Bryson Company obtained a $12,000, four-year,

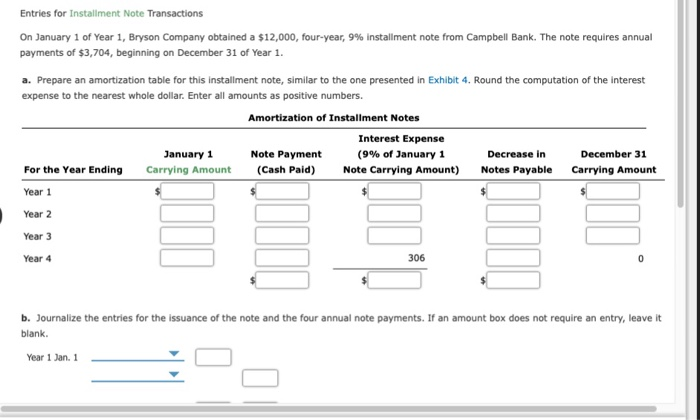

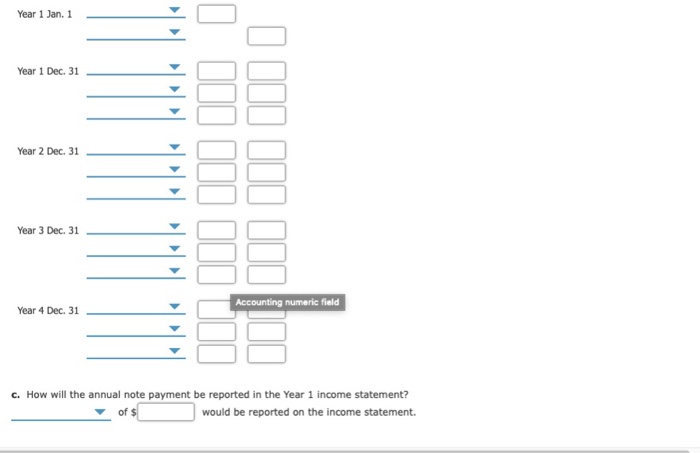

Entries for Installment Note Transactions On January 1 of Year 1, Bryson Company obtained a $12,000, four-year, 9% installment note from Campbell Bank. The note requires annual payments of $3,704, beginning on December 31 of Year 1 a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4. Round the computation of the interest expense to the nearest whole dollar. Enter all amounts as positive numbers Amortization of Installment Notes Interest Expense (9% of January 1 January 1 Note Payment Decrease in December 31 For the Year Ending Carrying Amount (Cash Paid) Note Carrying Amont) Notes Payable Carrying Amount Year 1 Year 2 Year 3 Year 4 306 b. Journalize the entries for the issuance of the note and the four annual note payments. If an amount box does not require an entry, leave it blank. Year 1 Jan. 1 Year 1 Jan. 1 Year 1 Dec. 31 Year 2 Dec. 31 Year 3 Dec. 31 Accounting numeric field Year 4 Dec. 31 c. How will the annual note payment be reported in the Year 1 income statement? of would be reported on the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts