Question: Please answer all question Question 3 (Statistical Arbitrage - 5 marks) Wealthy Superannuation Fund decides to investigate if arbitrage trading is profitable using long-short positions.

Please answer all question

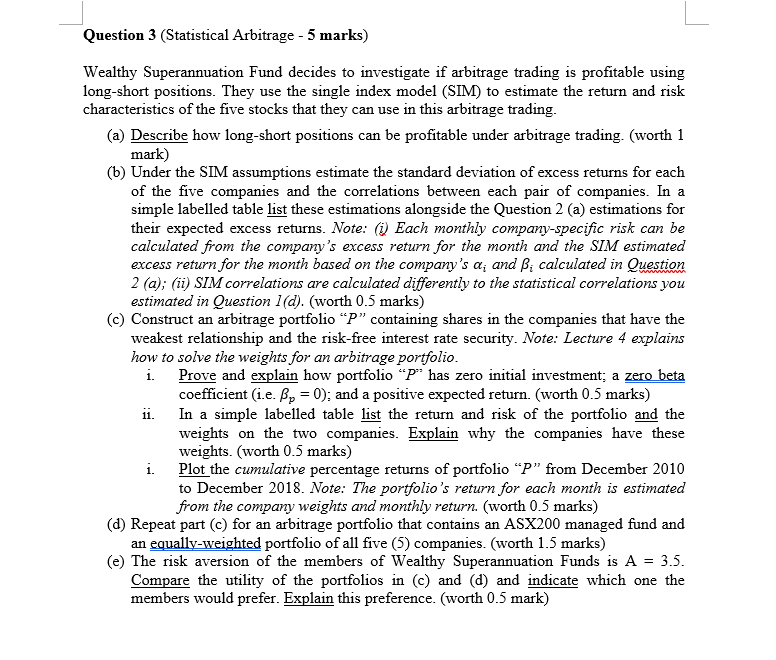

Question 3 (Statistical Arbitrage - 5 marks) Wealthy Superannuation Fund decides to investigate if arbitrage trading is profitable using long-short positions. They use the single index model (SIM) to estimate the return and risk characteristics of the five stocks that they can use in this arbitrage trading. (a) Describe how long-short positions can be profitable under arbitrage trading. (worth 1 mark) (6) Under the SIM assumptions estimate the standard deviation of excess returns for each of the five companies and the correlations between each pair of companies. In a simple labelled table list these estimations alongside the Question 2 (a) estimations for their expected excess returns. Note: Each monthly company-specific risk can be calculated from the company's excess return for the month and the SIM estimated excess return for the month based on the company's a; and B, calculated in Question 2 (a); (ii) SIM correlations are calculated differently to the statistical correlations you estimated in Question 1(d). (worth 0.5 marks) (c) Construct an arbitrage portfolio "P"containing shares in the companies that have the weakest relationship and the risk-free interest rate security. Note: Lecture 4 explains how to solve the weights for an arbitrage portfolio. i. Prove and explain how portfolio "P" has zero initial investment: a zero beta coefficient (i.e. Bp=0); and a positive expected return. (worth 0.5 marks) ii. In a simple labelled table list the return and risk of the portfolio and the weights on the two companies. Explain why the companies have these weights. (worth 0.5 marks) i. Plot the cumulative percentage returns of portfolio "P" from December 2010 to December 2018. Note: The portfolio's return for each month is estimated from the company weights and monthly return. (worth 0.5 marks) (d) Repeat part (c) for an arbitrage portfolio that contains an ASX200 managed fund and an equally-weighted portfolio of all five (5) companies. (worth 1.5 marks) (e) The risk aversion of the members of Wealthy Superannuation Funds is A = 3.5. Compare the utility of the portfolios in c) and (d) and indicate which one the members would prefer. Explain this preference. (worth 0.5 mark) Question 3 (Statistical Arbitrage - 5 marks) Wealthy Superannuation Fund decides to investigate if arbitrage trading is profitable using long-short positions. They use the single index model (SIM) to estimate the return and risk characteristics of the five stocks that they can use in this arbitrage trading. (a) Describe how long-short positions can be profitable under arbitrage trading. (worth 1 mark) (6) Under the SIM assumptions estimate the standard deviation of excess returns for each of the five companies and the correlations between each pair of companies. In a simple labelled table list these estimations alongside the Question 2 (a) estimations for their expected excess returns. Note: Each monthly company-specific risk can be calculated from the company's excess return for the month and the SIM estimated excess return for the month based on the company's a; and B, calculated in Question 2 (a); (ii) SIM correlations are calculated differently to the statistical correlations you estimated in Question 1(d). (worth 0.5 marks) (c) Construct an arbitrage portfolio "P"containing shares in the companies that have the weakest relationship and the risk-free interest rate security. Note: Lecture 4 explains how to solve the weights for an arbitrage portfolio. i. Prove and explain how portfolio "P" has zero initial investment: a zero beta coefficient (i.e. Bp=0); and a positive expected return. (worth 0.5 marks) ii. In a simple labelled table list the return and risk of the portfolio and the weights on the two companies. Explain why the companies have these weights. (worth 0.5 marks) i. Plot the cumulative percentage returns of portfolio "P" from December 2010 to December 2018. Note: The portfolio's return for each month is estimated from the company weights and monthly return. (worth 0.5 marks) (d) Repeat part (c) for an arbitrage portfolio that contains an ASX200 managed fund and an equally-weighted portfolio of all five (5) companies. (worth 1.5 marks) (e) The risk aversion of the members of Wealthy Superannuation Funds is A = 3.5. Compare the utility of the portfolios in c) and (d) and indicate which one the members would prefer. Explain this preference. (worth 0.5 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts