Question: Please answer all questions 1 through 5. Airbus' Dollar Exposure Airbus sold an A400 aircraft to Delta Airlines, a U.S. company, and billed $150 million

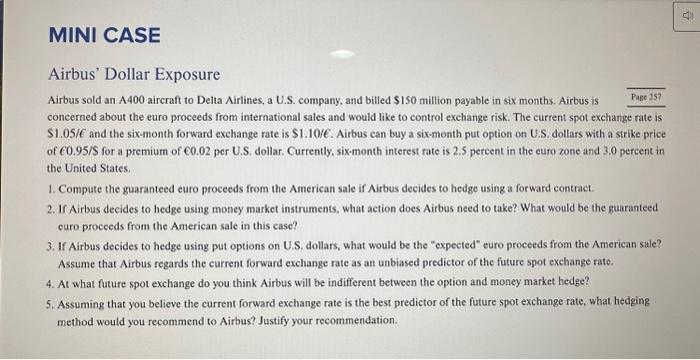

Airbus' Dollar Exposure Airbus sold an A400 aircraft to Delta Airlines, a U.S. company, and billed $150 million payable in six months. Airbus is Page 257 concerned about the euro proceeds from international sales and would like to control exchange risk. The current spot exchange rate is $1.05/C and the six-month forward exchange rate is $1.10/. Airbus can buy a six-month put option on U.S. dollars with a strike price of 0.95/S for a premium of 60.02 per U.S. dollar. Currently, six-month interest rate is 2.5 percent in the euro zone and 3.0 percent in the United States. 1. Compute the guaranteed euro proceeds from the American sale if Airbus decides to hedge using a forward contract. 2. If Airbus decides to hedge using money market instruments, what action does Airbus need to take? What would be the guaranteed curo proceeds from the American sale in this case? 3. If Airbus decides to hedge using put options on U.S. dollars, what would be the "expected" euro proceeds from the American sale? Assume that Airbus regards the current forward exchange rate as an unbiased predictor of the future spot exchange rate. 4. At what future spot exchange do you think Airbus will be indifferent between the option and money market hedge? 5. Assuming that you believe the current forward exchange rate is the best predictor of the future spot exchange rate, what hedging method would you recommend to Airbus? Justify your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts