Question: Please answer ALL questions 14. A decrease in required rate of return or yield maturity or current prevaiting interest rate in the matket (a) increases

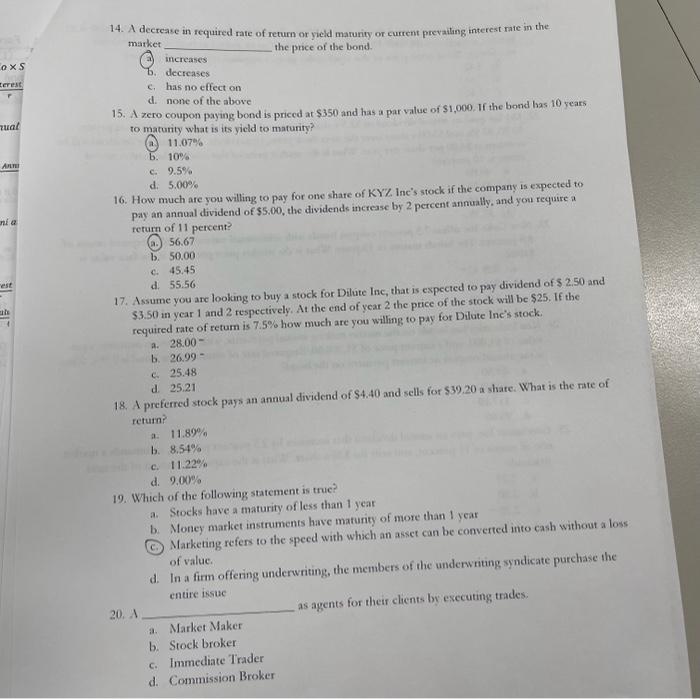

14. A decrease in required rate of return or yield maturity or current prevaiting interest rate in the matket (a) increases the price of the bond. b. decreases c. has no effect on d. none of the above 15. A zero coupon paying bond is priced at $350 and has a par value of $1,000. If the bond has 10 years to maturity what is its yicld to maturiry? (a) 11.07% b. 10% c. 9.5% 16. How much are you willing to pay for owe share of KY% inc's stock if the company is expected to d. 5.00% pay an annual dividend of $5.00, the dividends increase by 2 percent annually, and you require a return of 11 percent? (a.) 56.67 b. 50.00 c. 45.45 17. Assume you are looking to buy a stock for Dilute Inc, that is expected to pay dividend of $2.50 and d. 55.56 $3.50 in year 1 and 2 respectively. At the end of year 2 the price of the stock will be $25. If the required rate of retum is 7.5% how much are you willing to pay for Dilate lnc's stock. a. 28.00 b. 26.99= (c) 25.48 18. A preferred stock pays an annual dividend of $4.40 and sells for $39,20 a shate. What is the rate of d. 25.21 return? a. 11.89% b. 8.54% c. 11.22% d. 9,00% 19. Which of the following statement is true? a. Stocks have a maturity of less than 1 yeat b. Moncy market instruments have maturity of more than I year (c. Marketang refers to the speed with which an asset can be converted into cash wathout a loss d. In a firm offering underwriting, the menbers of the underwntung syndicate purchase the of value. cntire isste 20. 1 as agents for theif clients by exccuting trades. a. Market Maker b. Stock broker c. Immediate Trader d. Commission Broker

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts