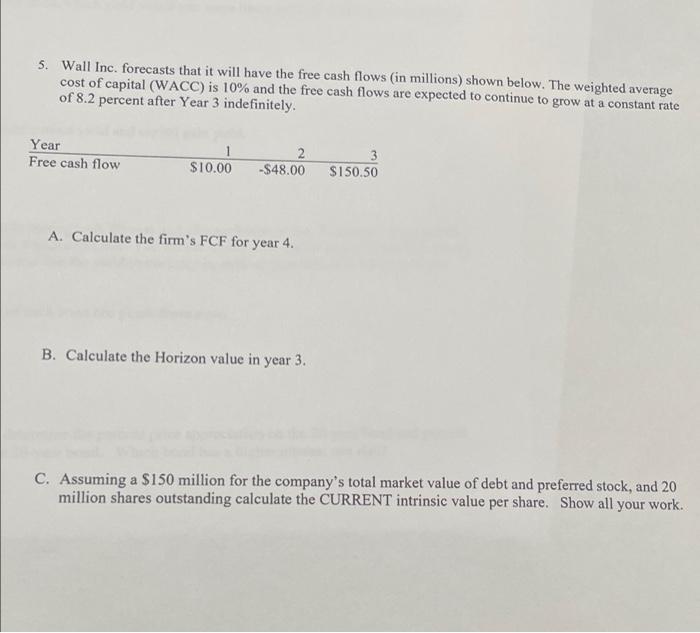

Question: please answer all questions 5. Wall Inc. forecasts that it will have the free cash flows (in millions) shown below. The weighted average cost of

5. Wall Inc. forecasts that it will have the free cash flows (in millions) shown below. The weighted average cost of capital (WACC) is 10% and the free cash flows are expected to continue to grow at a constant rate of 8.2 percent after Year 3 indefinitely Year Free cash flow 1 $10.00 2. -$48.00 $150.50 A. Calculate the firm's FCF for year 4. B. Calculate the Horizon value in year 3. C. Assuming a $150 million for the company's total market value of debt and preferred stock, and 20 million shares outstanding calculate the CURRENT intrinsic value per share. Show all your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts