Question: Please answer ALL questions 7. What should be the value of a common stock that has jus pand a dividend of $2/ share and the

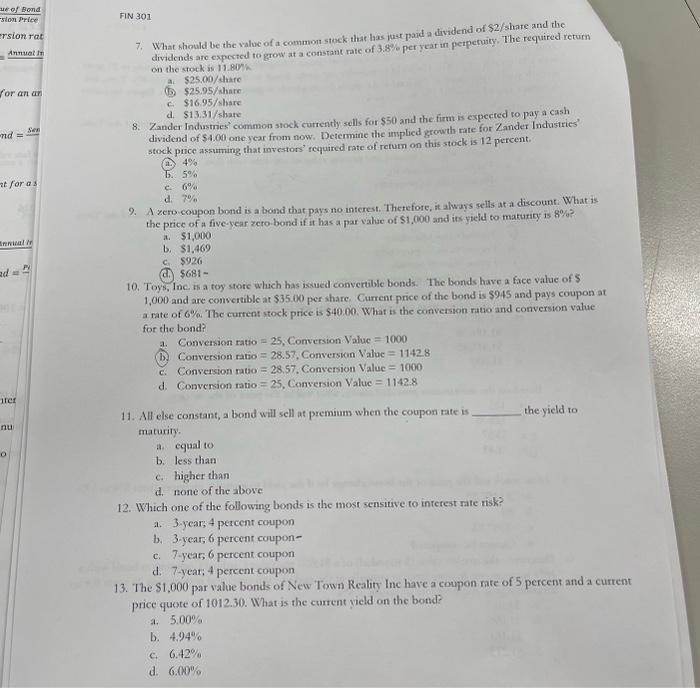

7. What should be the value of a common stock that has jus pand a dividend of $2/ share and the dividends arc expected to grow at a constant ratc of 3.8 e per yeat in perpecuity . The required return on the stock is 11.890 a. 525,00/ share (b) $25.95/ ahare c. $16.95/ share 8. Zander Industries' common stock currently sells for $50 and the firm is expected ro pay a cash d. $13,31/ share dividend of \$4.00 one.year from now. Determine the inplicd growth rate for Zander Industries' stock pnce assurning that investors' required nate of return on this stock is 12 percent. (a.) 4% b. 5% c. 6% d. 7% 9. A sero coupon bond is a bond that pays no interest. Therefore, it always sells at a diveount. What is the price of a five-jear zero-bond if it has a par valie of $1,000 and its yield to maturicy is 8% ? i. 51,000 b. $1.469 c. $920 (ci) $681= 10. Toys, Inc. in a toy stote which has issued converulbe bonds. The bonds have a face value of $ 1,000 and are convertible at $35.00 per share. Current price of the bond is $945 and pays coupon at a rate of 6%. The current stock price is $4000. What is the conversion ratio and conversion vatue for the bond? a. Conversion ratio =25, Conversion Value =1000 (b. Conversion ratio =28.57, Conversion Valuc =11428 c. Converston ratio =28.57, Conversion Value =1000 d. Conversion matio =25, Conversion Value =11428 11. All else constant, a bond will sell at premium when the coupon mate is the yicid to imaturity. a. equal to b. less than c. higher than d. none of the above 12. Which one of the following bonds is the most sensitwe to interest rate risk? a. 3-year; 4 percent coupon b. 3-year, 6 percent coupon - c. 7 -year; 6 percent coupon d. 7-year; 4 percent-coupon 13. The $1,000 par value bonds of New Town Reality Ine have a coupon rate of 5 percent and a curtent price quote of 101230 . What is the current vield on the botnd? a. 5.00% b. 4.94% c. 6.42% d. 6.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts