Question: please answer ALL questions A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University

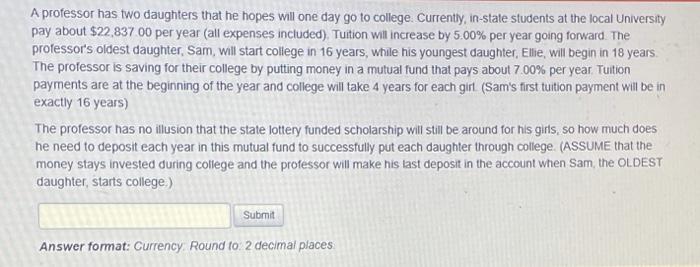

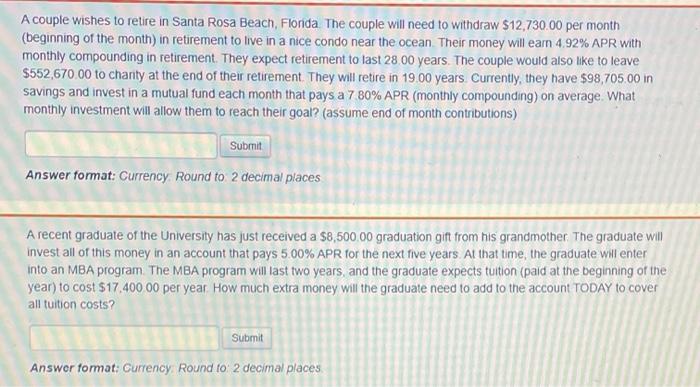

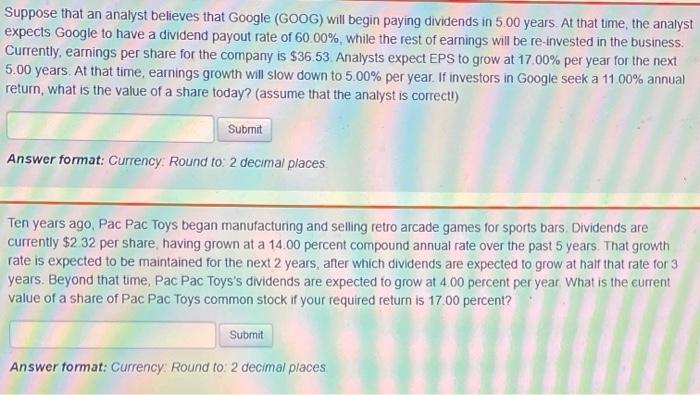

A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $22,837 00 per year (all expenses included), Tuition will increase by 5.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 7.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam the OLDEST daughter, starts college) Submit Answer format: Currency Round fo. 2 decimal places A couple wishes to retire in Santa Rosa Beach, Florida. The couple will need to withdraw 512,730.00 per month (beginning of the month) in retirement to live in a nice condo near the ocean. Their money will earn 4.92% APR with monthly compounding in retirement. They expect retirement to last 28 00 years. The couple would also like to leave $552,670.00 to charity at the end of their retirement. They will retire in 19.00 years. Currently, they have $98,705.00 in savings and invest in a mutual fund each month that pays a 7 80% APR (monthly compounding) on average What monthly investment will allow them to reach their goal? (assume end of month contributions) Submit Answer format: Currency Round to 2 decimal places a A recent graduate of the University has just received a $8,500.00 graduation gift from his grandmother. The graduate will invest all of this money in an account that pays 5.00% APR for the next five years. At that time, the graduate will enter into an MBA program The MBA program will last two years, and the graduate expects tuition (paid at the beginning of the year) to cost $17.40000 per year How much extra money will the graduate need to add to the account TODAY to cover all tuition costs? Submit Answer format: Currency Round to: 2 decimal places Suppose that an analyst believes that Google (GOOG) will begin paying dividends in 5.00 years. At that time, the analyst expects Google to have a dividend payout rate of 60.00%, while the rest of earnings will be re-invested in the business. Currently, earnings per share for the company is $36.53. Analysts expect EPS to grow at 17.00% per year for the next 5.00 years. At that time, earnings growth will slow down to 5.00% per year. If investors in Google seek a 11.00% annual return, what is the value of a share today? (assume that the analyst is correctl) Submit Answer format: Currency Round to 2 decimal places Ten years ago, Pac Pac Toys began manufacturing and selling retro arcade games for sports bars. Dividends are currently $2 32 per share, having grown at a 14.00 percent compound annual rate over the past 5 years. That growth rate is expected to be maintained for the next 2 years, after which dividends are expected to grow at half that rate for 3 years. Beyond that time, Pac Pac Toys's dividends are expected to grow at 4.00 percent per year . What is the current value of a share of Pac Pac Toys common stock if your required return is 17.00 percent? Submit Answer format: Currency: Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts