Question: Please answer all questions, a,b and c. thank you Question 3 (25 marks) Mr Tan saves regularly over last 5 years after graduating from university.

Please answer all questions, a,b and c.

thank you

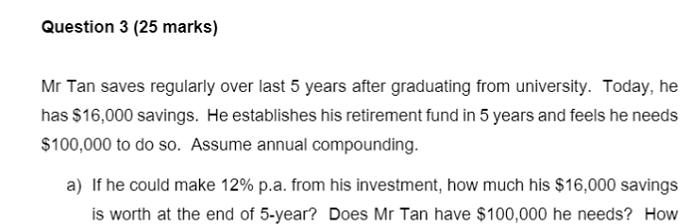

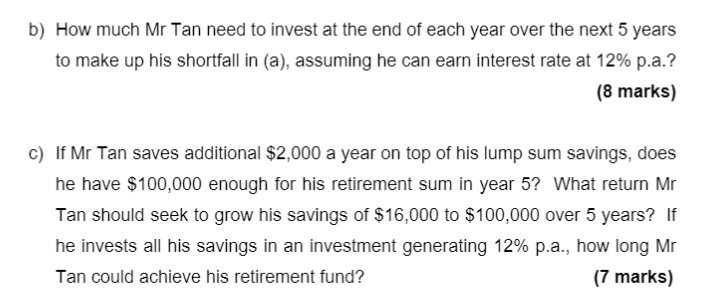

Question 3 (25 marks) Mr Tan saves regularly over last 5 years after graduating from university. Today, he has $16,000 savings. He establishes his retirement fund in 5 years and feels he needs $100,000 to do so. Assume annual compounding. a) If he could make 12% p.a. from his investment, how much his $16,000 savings is worth at the end of 5-year? Does Mr Tan have $100,000 he needs? How b) How much Mr Tan need to invest at the end of each year over the next 5 years to make up his shortfall in (a), assuming he can earn interest rate at 12% p.a.? (8 marks) c) If Mr Tan saves additional $2,000 a year on top of his lump sum savings, does he have $100,000 enough for his retirement sum in year 5? What return Mr Tan should seek to grow his savings of $16,000 to $100,000 over 5 years? If he invests all his savings in an investment generating 12% p.a., how long Mr Tan could achieve his retirement fund? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts