Question: please answer all questions A-K Narrative: You are working for a firm and have been tasked with considering the following information and estimating the firm's

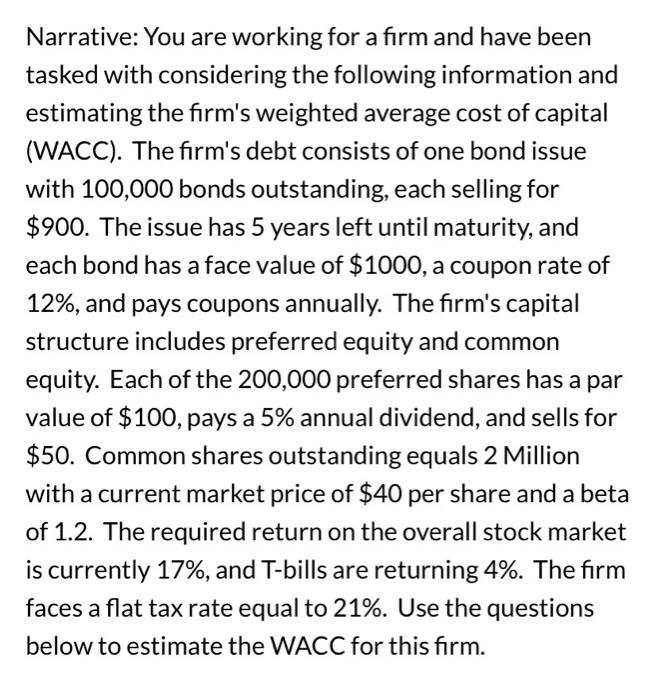

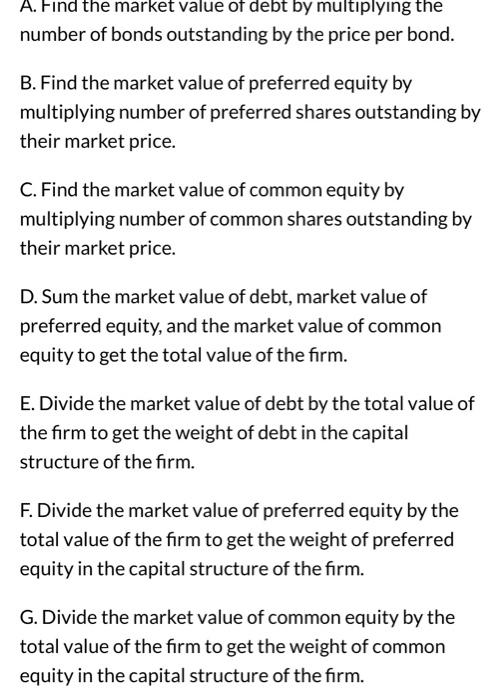

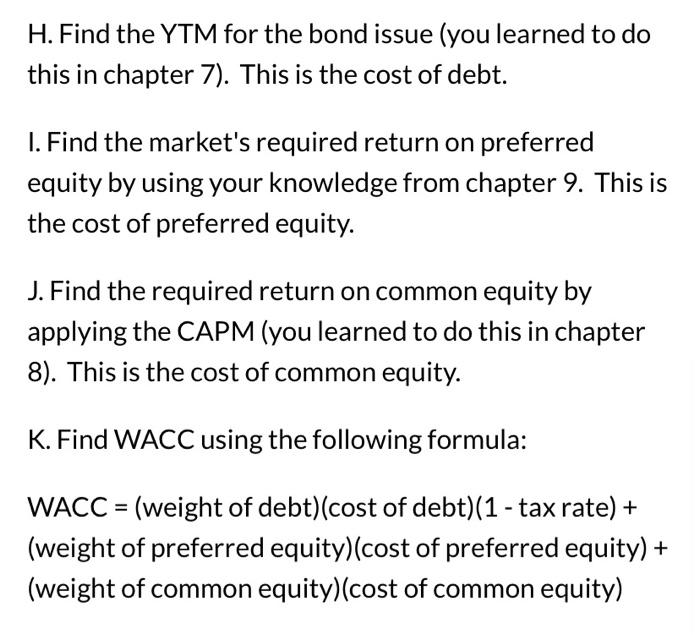

Narrative: You are working for a firm and have been tasked with considering the following information and estimating the firm's weighted average cost of capital (WACC). The firm's debt consists of one bond issue with 100,000 bonds outstanding, each selling for $900. The issue has 5 years left until maturity, and each bond has a face value of $1000, a coupon rate of 12%, and pays coupons annually. The firm's capital structure includes preferred equity and common equity. Each of the 200,000 preferred shares has a par value of $100, pays a 5% annual dividend, and sells for $50. Common shares outstanding equals 2 Million with a current market price of $40 per share and a beta of 1.2. The required return on the overall stock market is currently 17%, and T-bills are returning 4%. The firm faces a flat tax rate equal to 21%. Use the questions below to estimate the WACC for this firm. A. Find the market value of debt by multiplying the number of bonds outstanding by the price per bond. B. Find the market value of preferred equity by multiplying number of preferred shares outstanding by their market price. C. Find the market value of common equity by multiplying number of common shares outstanding by their market price. D. Sum the market value of debt, market value of preferred equity, and the market value of common equity to get the total value of the firm. E. Divide the market value of debt by the total value of the firm to get the weight of debt in the capital structure of the firm. F. Divide the market value of preferred equity by the total value of the firm to get the weight of preferred equity in the capital structure of the firm. G. Divide the market value of common equity by the total value of the firm to get the weight of common equity in the capital structure of the firm. H. Find the YTM for the bond issue (you learned to do this in chapter 7). This is the cost of debt. I. Find the market's required return on preferred equity by using your knowledge from chapter 9 . This is the cost of preferred equity. J. Find the required return on common equity by applying the CAPM (you learned to do this in chapter 8). This is the cost of common equity. K. Find WACC using the following formula: WACC =( weight of debt )( cost of debt )(1 - tax rate )+ (weight of preferred equity)(cost of preferred equity) + (weight of common equity)(cost of common equity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts