Question: please answer all questions All final answers must be rounded to the nearest $10 1. Spouses Bill and Betty Baker, ages 78 and 69, maintain

please answer all questions

All final answers must be rounded to the nearest $10

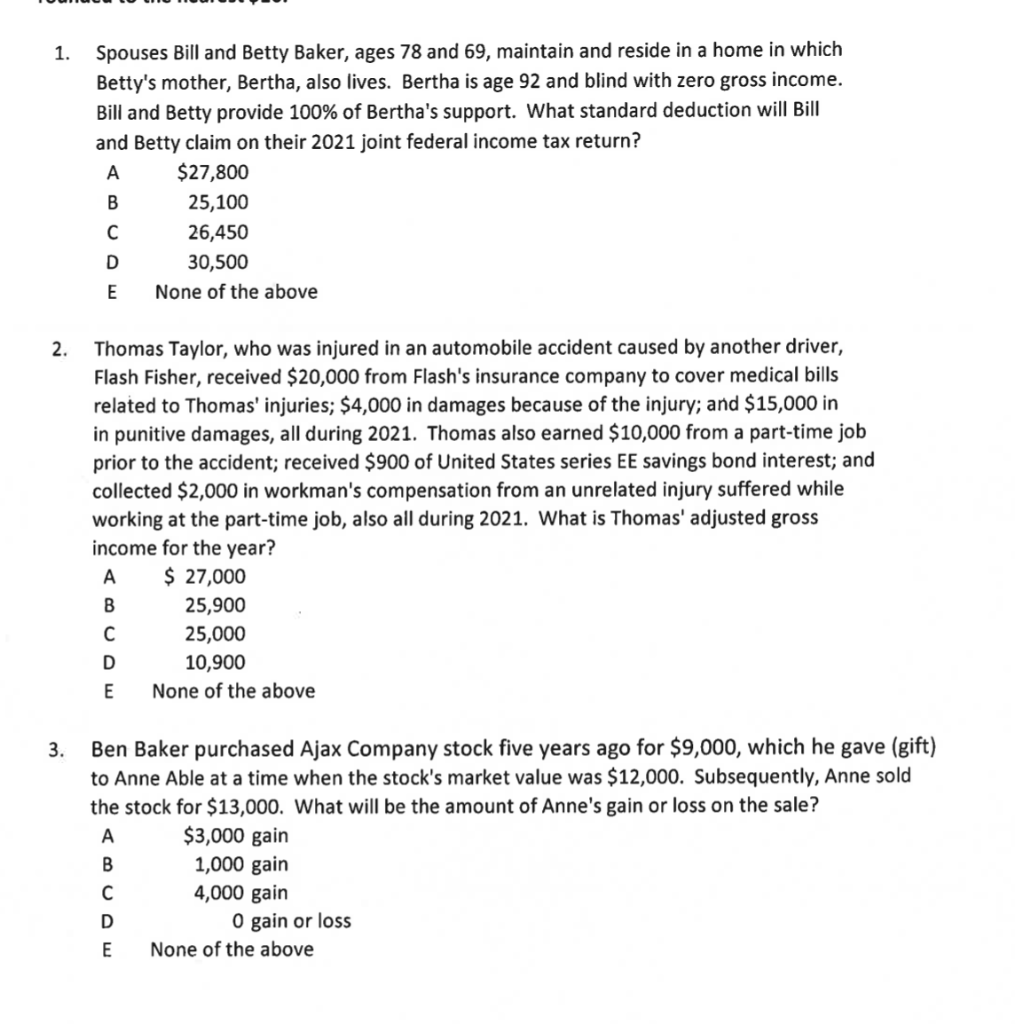

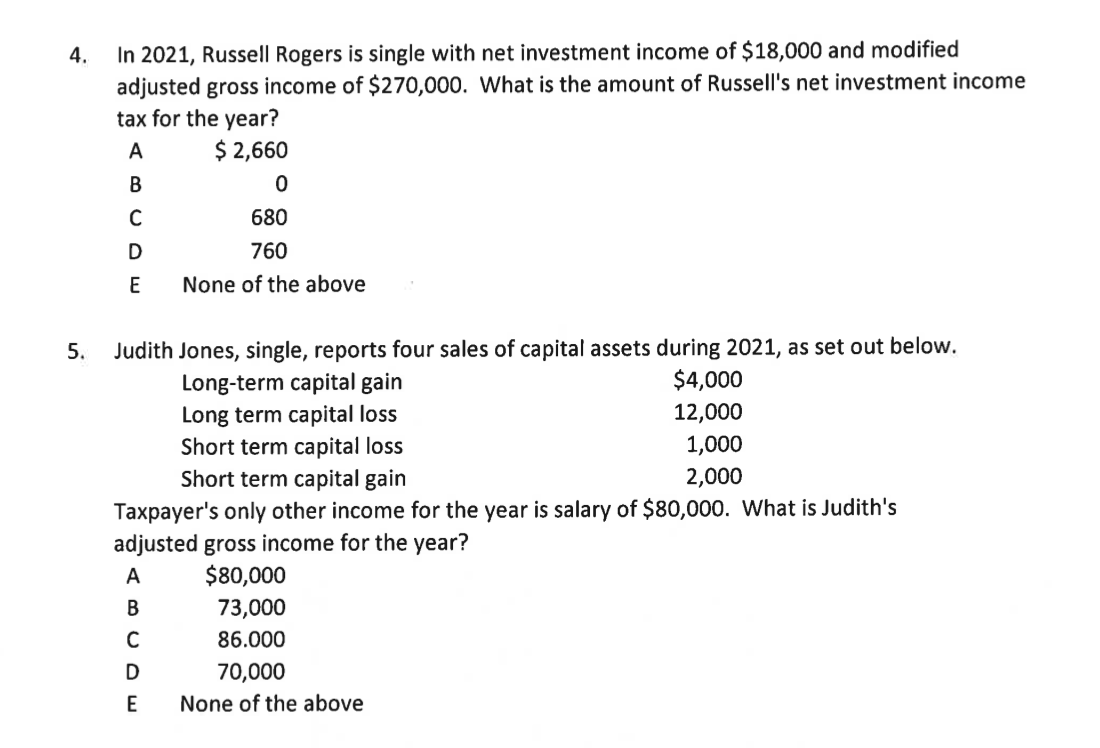

1. Spouses Bill and Betty Baker, ages 78 and 69, maintain and reside in a home in which Betty's mother, Bertha, also lives. Bertha is age 92 and blind with zero gross income. Bill and Betty provide 100% of Bertha's support. What standard deduction will Bill and Betty claim on their 2021 joint federal income tax return? A $27,800 B 25,100 26,450 D 30,500 E None of the above 2. Thomas Taylor, who was injured in an automobile accident caused by another driver, Flash Fisher, received $20,000 from Flash's insurance company to cover medical bills related to Thomas' injuries; $4,000 in damages because of the injury; and $15,000 in in punitive damages, all during 2021. Thomas also earned $10,000 from a part-time job prior to the accident; received $900 of United States series EE savings bond interest; and collected $2,000 in workman's compensation from an unrelated injury suffered while working at the part-time job, also all during 2021. What is Thomas' adjusted gross income for the year? A $ 27,000 B 25,900 C 25,000 10,900 None of the above D E 3. Ben Baker purchased Ajax Company stock five years ago for $9,000, which he gave (gift) to Anne Able at a time when the stock's market value was $12,000. Subsequently, Anne sold the stock for $13,000. What will be the amount of Anne's gain or loss on the sale? A $3,000 gain 1,000 gain C 4,000 gain D O gain or loss E None of the above B 4. In 2021, Russell Rogers is single with net investment income of $18,000 and modified adjusted gross income of $270,000. What is the amount of Russell's net investment income tax for the year? A $ 2,660 B 0 680 D 760 E None of the above 5. Judith Jones, single, reports four sales of capital assets during 2021, as set out below. Long-term capital gain $4,000 Long term capital loss 12,000 Short term capital loss 1,000 Short term capital gain 2,000 Taxpayer's only other income for the year is salary of $80,000. What is Judith's adjusted gross income for the year? A $80,000 B 73,000 86.000 D 70,000 E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts