Question: please answer all questions All final answers must be rounded to the nearest $10 6. Spouses, Chip and Carrie Carson, purchased a principal residence in

please answer all questions

All final answers must be rounded to the nearest $10

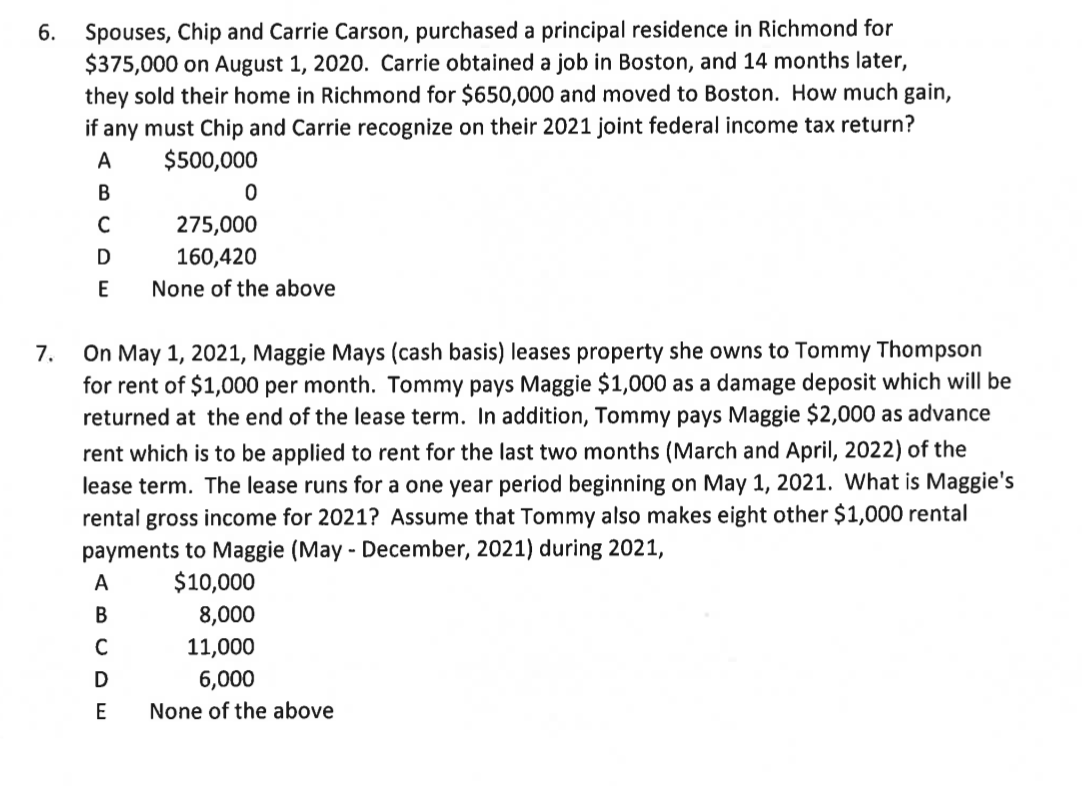

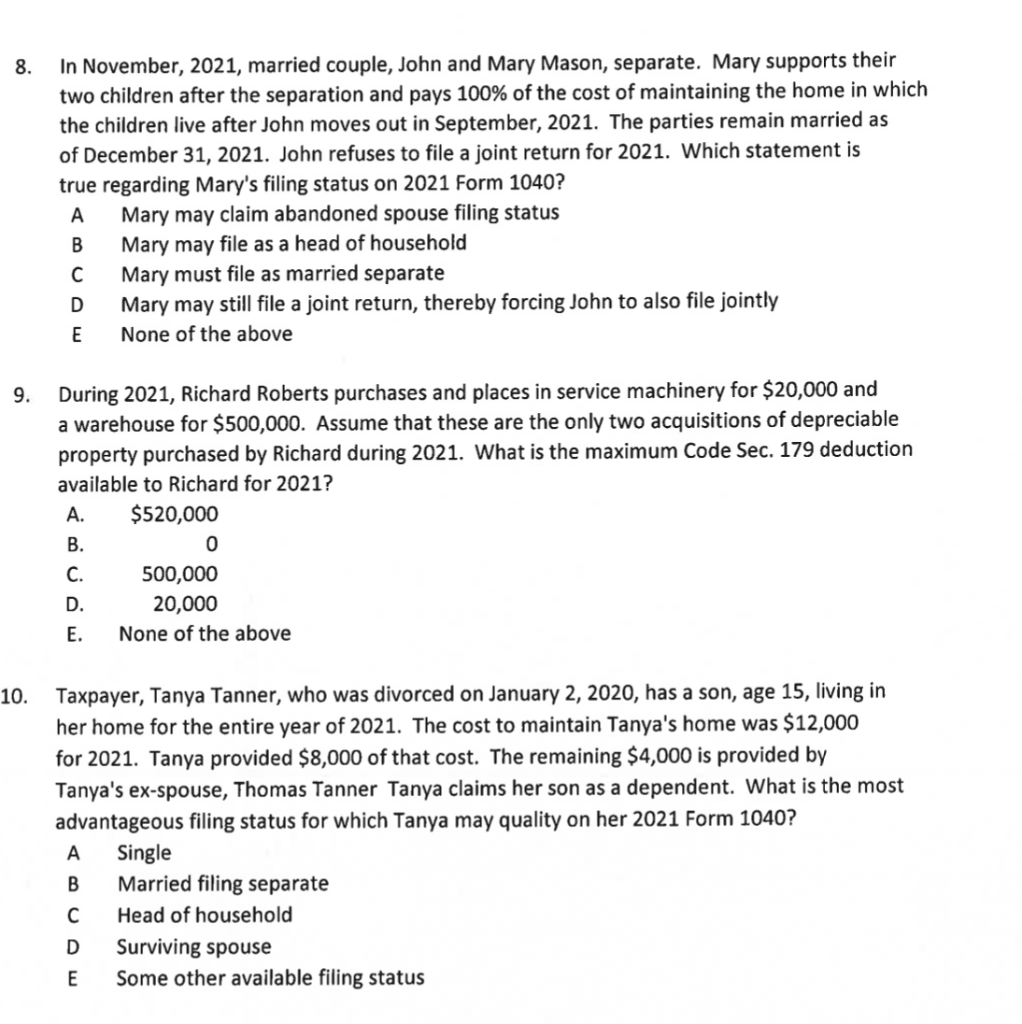

6. Spouses, Chip and Carrie Carson, purchased a principal residence in Richmond for $375,000 on August 1, 2020. Carrie obtained a job in Boston, and 14 months later, they sold their home in Richmond for $650,000 and moved to Boston. How much gain, if any must Chip and Carrie recognize on their 2021 joint federal income tax return? A $500,000 B 0 275,000 D 160,420 E None of the above 7. On May 1, 2021, Maggie Mays (cash basis) leases property she owns to Tommy Thompson for rent of $1,000 per month. Tommy pays Maggie $1,000 as a damage deposit which will be returned at the end of the lease term. In addition, Tommy pays Maggie $2,000 as advance rent which is to be applied to rent for the last two months (March and April, 2022) of the lease term. The lease runs for a one year period beginning on May 1, 2021. What is Maggie's rental gross income for 2021? Assume that Tommy also makes eight other $1,000 rental payments to Maggie (May - December, 2021) during 2021, A $10,000 B 8,000 11,000 D 6,000 E None of the above 8. In November, 2021, married couple, John and Mary Mason, separate. Mary supports their two children after the separation and pays 100% of the cost of maintaining the home in which the children live after John moves out in September, 2021. The parties remain married as of December 31, 2021. John refuses to file a joint return for 2021. Which statement is true regarding Mary's filing status on 2021 Form 1040? A Mary may claim abandoned spouse filing status B Mary may file as a head of household Mary must file as married separate D Mary may still file a joint return, thereby forcing John to also file jointly E None of the above 9. During 2021, Richard Roberts purchases and places in service machinery for $20,000 and a warehouse for $500,000. Assume that these are the only two acquisitions of depreciable property purchased by Richard during 2021. What is the maximum Code Sec. 179 deduction available to Richard for 2021? A. $520,000 B. 0 C. 500,000 D. 20,000 E. None of the above 10. Taxpayer, Tanya Tanner, who was divorced on January 2, 2020, has a son, age 15, living in her home for the entire year of 2021. The cost to maintain Tanya's home was $12,000 for 2021. Tanya provided $8,000 of that cost. The remaining $4,000 is provided by Tanya's ex-spouse, Thomas Tanner Tanya claims her son as a dependent. What is the most advantageous filing status for which Tanya may quality on her 2021 Form 1040? A Single Married filing separate C Head of household Surviving spouse E Some other available filing status B D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts