Question: please answer all questions-- all multiple choice! Question 10 (7 points) Which of the following metrics tells the firm how long it takes to earn

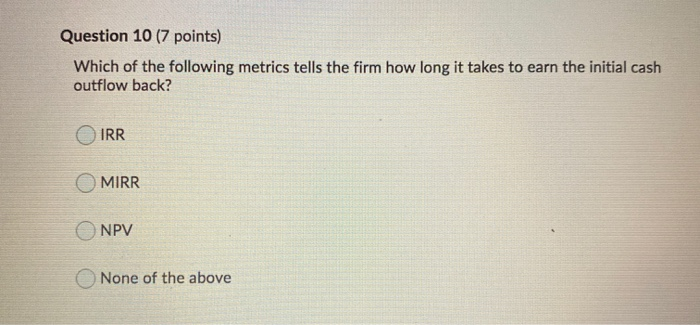

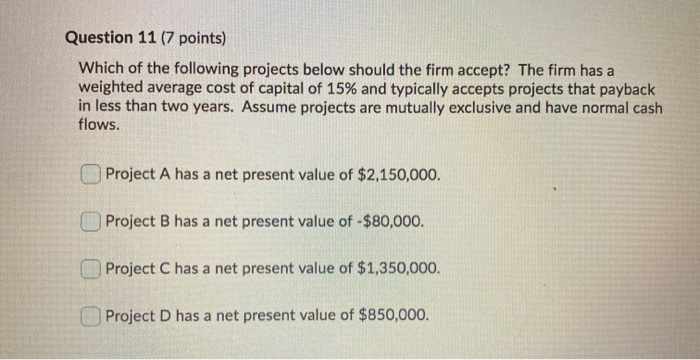

Question 10 (7 points) Which of the following metrics tells the firm how long it takes to earn the initial cash outflow back? IRR MIRR ONPV None of the above Question 11 (7 points) Which of the following projects below should the firm accept? The firm has a weighted average cost of capital of 15% and typically accepts projects that payback in less than two years. Assume projects are mutually exclusive and have normal cash flows. Project A has a net present value of $2,150,000. Project B has a net present value of - $80,000. Project C has a net present value of $1,350,000. Project D has a net present value of $850,000. Question 12 (7 points) Your firm is interested in pursuing a new project. The firm typically accepts projects that payback in two years or less, and the firm has a weighted average cost of capital of 6%. Which of the following statements is true? The project has a MIRR of 8%. The firm should accept the project. The project has a discounted payback of 4.50 years. The firm should accept the project. The project has a payback of 4.02 years. The firm should accept the project. None of the Above Question 13 (7 points) Net present value is the weakest capital budgeting metric. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts