Question: Please answer all questions and explain . trying to understand how to do this. What were the total financing cash flows in 2017? What were

Please answer all questions and explain . trying to understand how to do this.

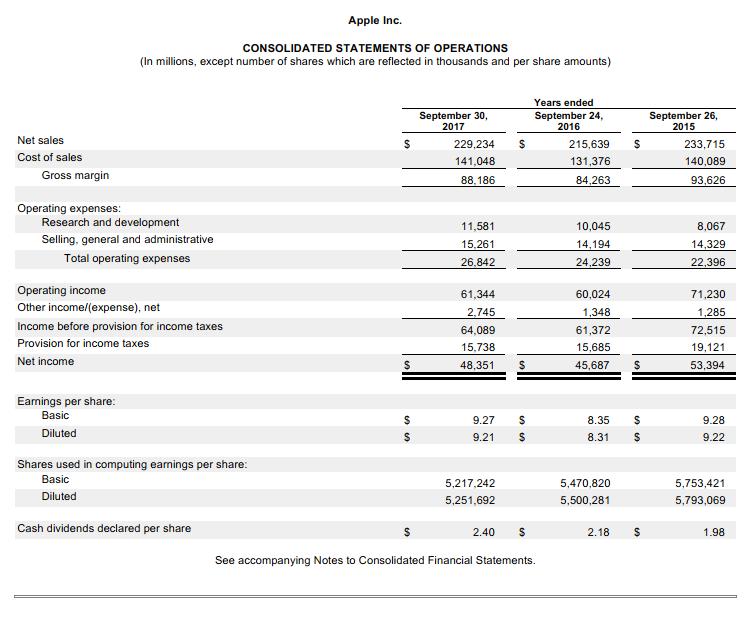

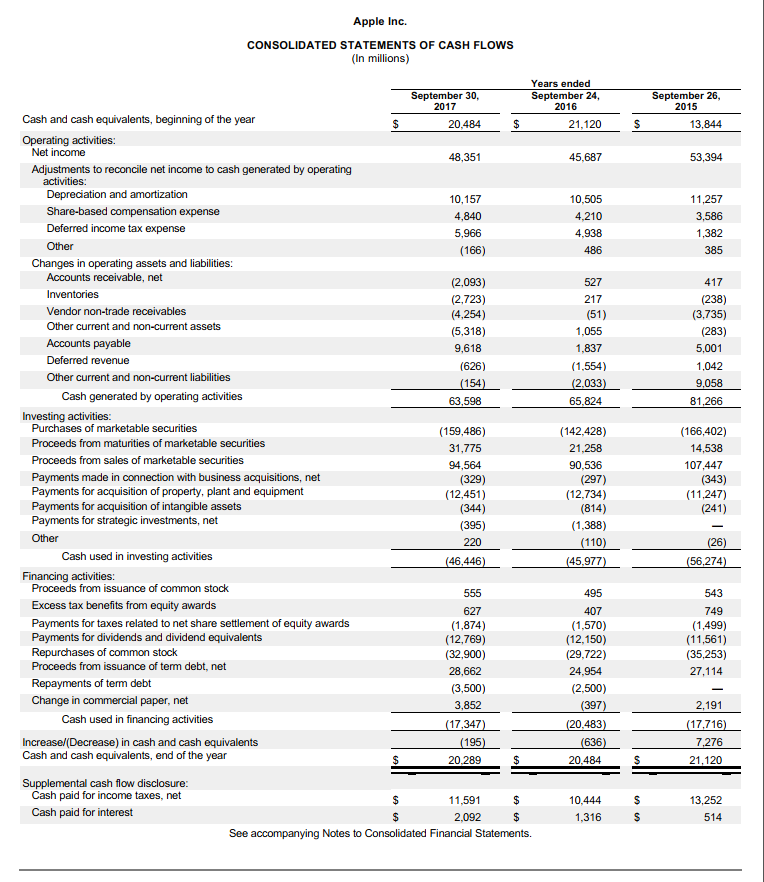

- What were the total financing cash flows in 2017?

- What were the total investing cash flows in 2017?

- What were the total operating cash flows in 2017?

- How much term debt, net did Apple issue in 2017?

- What were capital expenditures in 2017? (Report your answer as a positive number)

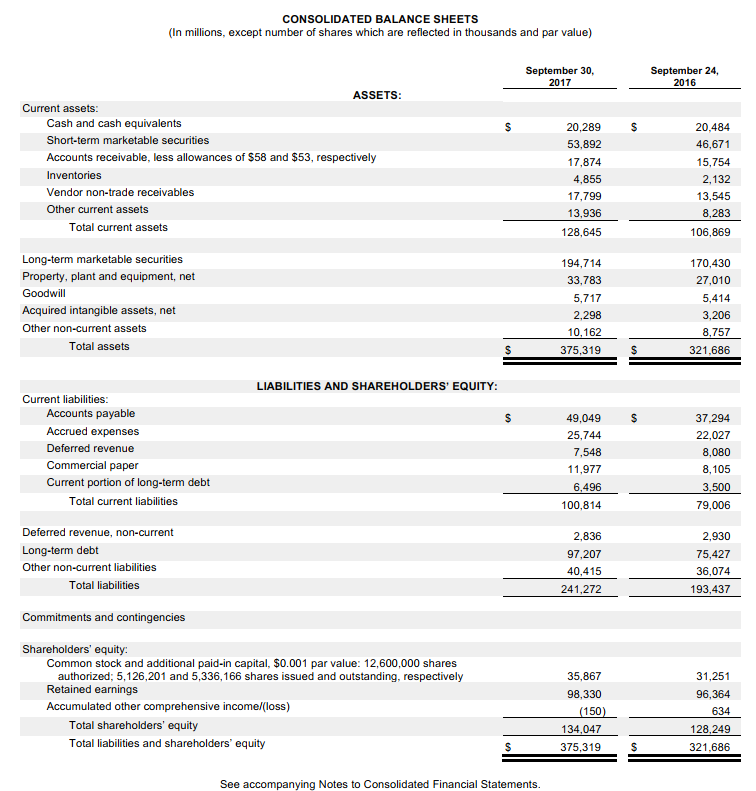

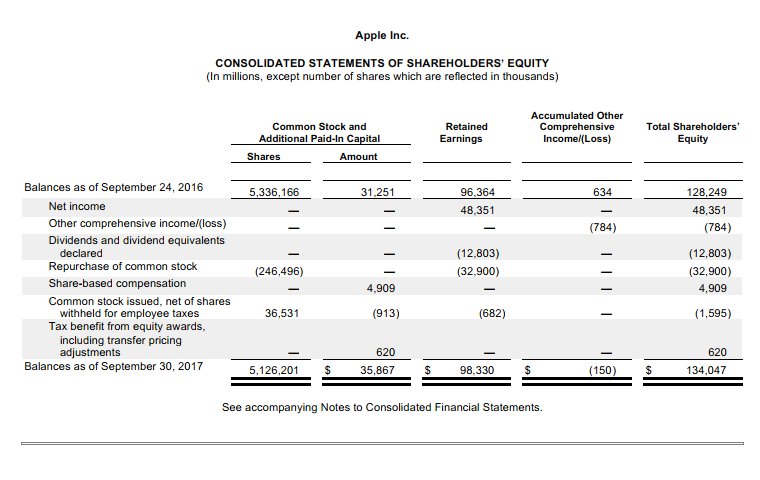

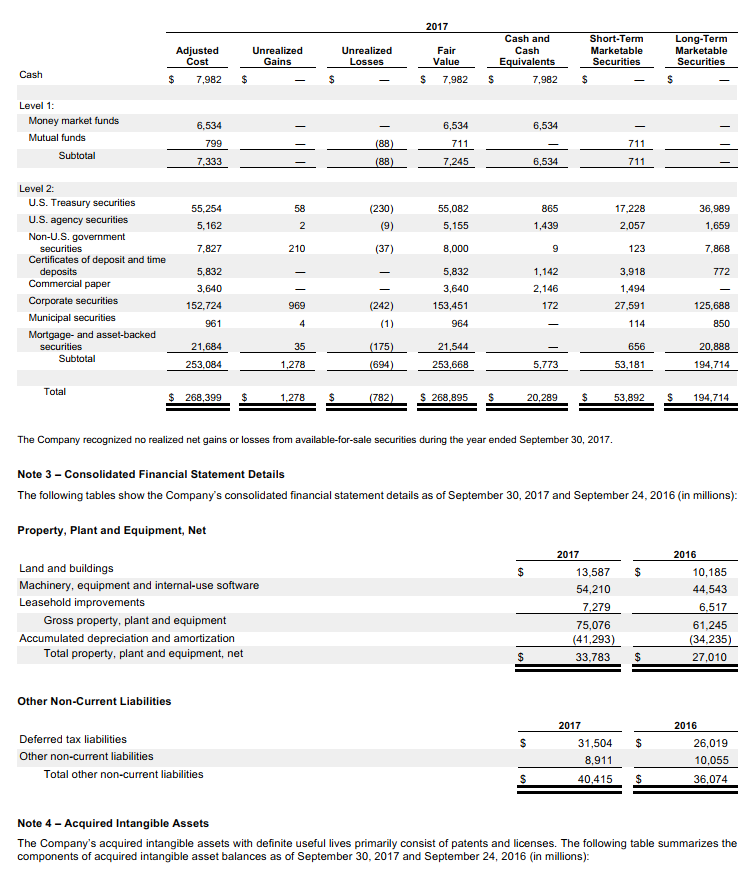

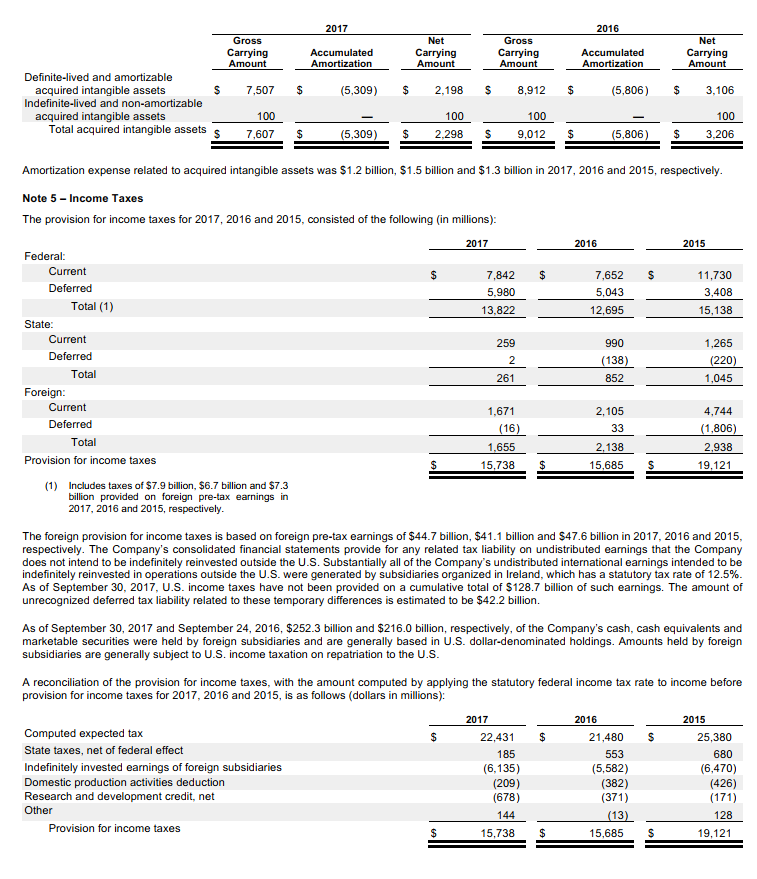

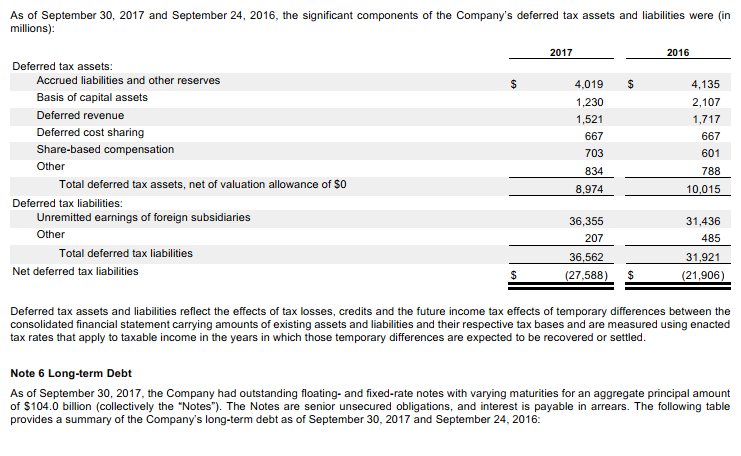

Apple Inc. C.NNSA IN TF ST TFMFNTS AF RPFR TIONS CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares which are reflected in thousands) Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) The Company recognized no realized net gains or losses from available-for-sale securities during the year ended September 30,2017 . Note 3 - Consolidated Financial Statement Details The following tables show the Company's consolidated financial statement details as of September 30,2017 and September 24,2016 (in millions): Dranarto Dlant and Eeuinmant Mat Other Non-Current Liabilities Deferred tax liabilities Other non-current liabilities Total other non-current liabilities Note 4 - Acquired Intangible Assets The Company's acquired intangible assets with definite useful lives primarily consist of patents and licenses. The following table summarizes the components of acquired intangible asset balances as of September 30, 2017 and September 24,2016 (in millions): Amortization expense related to acquired intangible assets was $1.2 billion, $1.5 billion and $1.3 billion in 2017,2016 and 2015 , respectively. Note 5 - Income Taxes The provision for income taxes for 2017, 2016 and 2015, consisted of the following (in millions): billion provided on foreign pre-tax earnings in 2017,2016 and 2015 , respectively. The foreign provision for income taxes is based on foreign pre-tax earnings of $44.7 billion, $41.1 billion and $47.6 billion in 2017,2016 and 2015 , respectively. The Company's consolidated financial statements provide for any related tax liability on undistributed earnings that the Company does not intend to be indefinitely reinvested outside the U.S. Substantially all of the Company's undistributed international earnings intended to be indefinitely reinvested in operations outside the U.S. were generated by subsidiaries organized in Ireland, which has a statutory tax rate of 12.5%. As of September 30, 2017, U.S. income taxes have not been provided on a cumulative total of $128.7 billion of such earnings. The amount of unrecognized deferred tax liability related to these temporary differences is estimated to be $42.2 billion. As of September 30, 2017 and September 24, 2016, $252.3 billion and $216.0 billion, respectively, of the Company's cash, cash equivalents and marketable securities were held by foreign subsidiaries and are generally based in U.S. dollar-denominated holdings. Amounts held by foreign subsidiaries are generally subject to U.S. income taxation on repatriation to the U.S. A reconciliation of the provision for income taxes, with the amount computed by applying the statutory federal income tax rate to income before provision for income taxes for 2017,2016 and 2015 , is as follows (dollars in millions): As of September 30, 2017 and September 24, 2016, the significant components of the Company's deferred tax assets and liabilities were (in millions): Deferred tax assets and liabilities reflect the effects of tax losses, credits and the future income tax effects of temporary differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases and are measured using enacted tax rates that apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Note 6 Long-term Debt As of September 30, 2017, the Company had outstanding floating- and fixed-rate notes with varying maturities for an aggregate principal amount of $104.0 billion (collectively the "Notes"). The Notes are senior unsecured obligations, and interest is payable in arrears. The following table provides a summary of the Company's long-term debt as of September 30, 2017 and September 24, 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts