Question: Please answer all questions and make sure they are correct~!! Thank you :) On November 1, 2020. Cheng Company (a U.S.-based company) forecasts the purchase

Please answer all questions and make sure they are correct~!!

Thank you :)

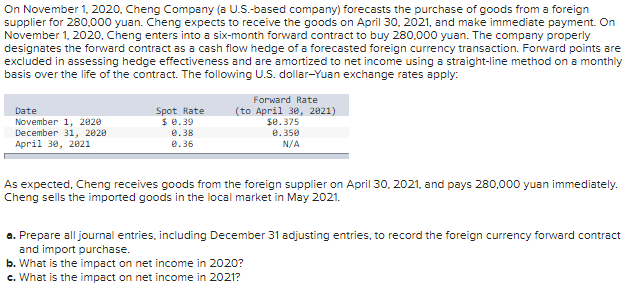

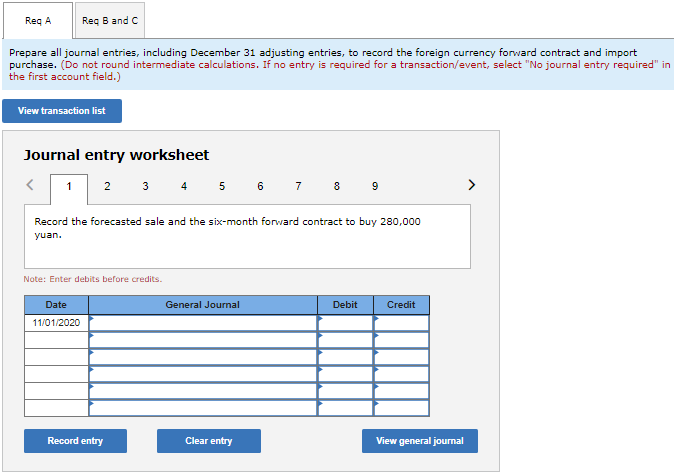

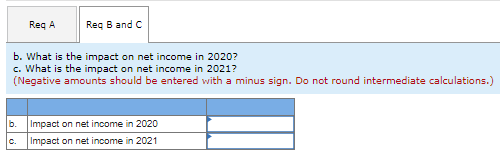

On November 1, 2020. Cheng Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 280.000 yuan. Cheng expects to receive the goods on April 30, 2021, and make immediate payment. On November 1, 2020, Cheng enters into a six-month forward contract to buy 280.000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar-Yuan exchange rates apply: Date November 1, 2020 December 31, 2029 April 30, 2021 Spot Rate $ 0.39 2.38 2.36 Forward Rate (to April 30, 2821) $0.375 0.350 N/A As expected, Cheng receives goods from the foreign supplier on April 30.2021, and pays 280,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021. a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2020? c. What is the impact on net income in 2021? Reg A Reg B and C Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts