Question: Please answer all questions and provide step by step solution for each question, provide explanation of the formulas used to obtain your spread-sheet outputs, plots,

Please answer all questions and provide step by step solution for each question, provide explanation of the formulas used to obtain your spread-sheet outputs, plots, tables and spreadsheet data which are clearly la-belled (e.g., where appropriate include the question num-ber, title, parameter names, axis labels, clearly identified final solutions (e.g., if asked to calculate a premium, then do not just present a binomial tree which calculates the premium; instead clearly identify the answer with "The premium is $..."); all numerical results correct to at least four significant figures (unless otherwise specified). Use excel to answer some questions and show the PDF outputs of Excel.

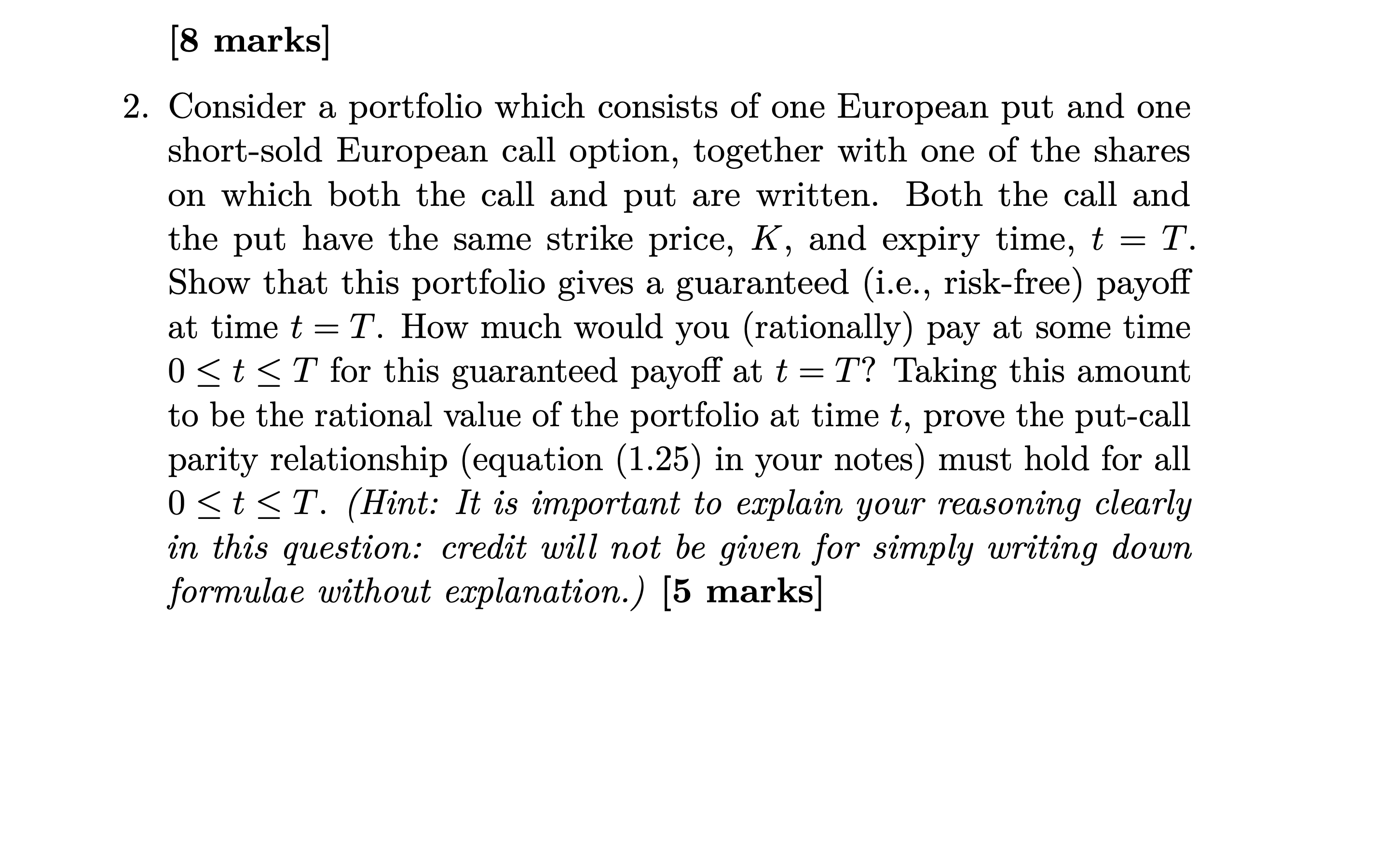

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts