Question: Please answer all questions and show step by step using BA II calculator. Question 1- Cost of Debt 12 points): The McDaniel Company's financing plans

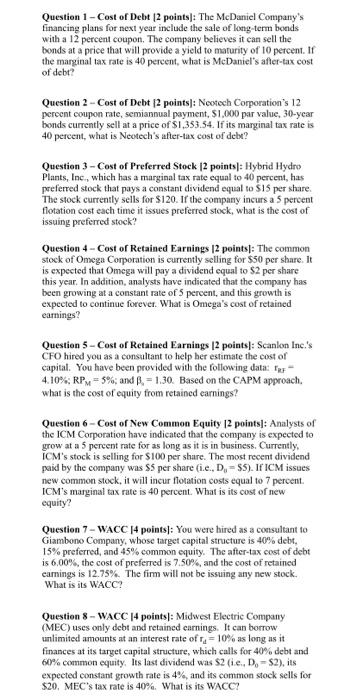

Question 1- Cost of Debt 12 points): The McDaniel Company's financing plans for next year include the sale of long-term bonds with a 12 percent coupon. The company believes it can sell the bonds at a price that will provide a yield to maturity of 10 percent. If the marginal tax rate is 40 percent, what is McDaniel's after-tax cost of debt? Question 2 - Cost of Debt 12 points): Nortech Corporation's 12 percent coupon rate, semiannual payment, $1.000 par value, 30-year bonds currently sell at a price of S1,353.54. If its marginal tax rate is 40 percent, what is Neotech's after-tax cost of delt? Question 3 - Cost of Preferred Stock 12 points: Hybrid Hydro Plants, Inc., which has a marginal tax rate equal to 40 percent, has preferred stock that pays a constant dividend equal to 15 per share. The stock currently sells for $120. If the company incurs a 5 percent flotation cost each time it issues preferred stock, what is the cost of issuing preferred stock? Question 4 - Cost of Retained Earnings 12 points: The common stock of Omega Corporation is currently selling for $50 per share. It is expected that Omega will pay a dividend equal to 52 per share this year. In addition, analysts have indicated that the company has been growing at a constant rate of 5 percent, and this growth is expected to continue forever. What is Omega's cost of retained earnings? Question 5 - Cost of Retained Earnings 12 points]: Scanlon Inc.'s CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the following data: Tre 4.10% RPM = 5%, and R. = 1.30. Based on the CAPM approach. what is the cost of equity from retained earnings? Question 6 - Cost of New Common Equity 12 points]: Analysts of the ICM Corporation have indicated that the company is expected to grow at a 5 percent rate for as long as it is in business. Currently, ICM's stock is selling for $100 per share. The most recent dividend paid by the company was $5 per share (i.e., D. - $5). If ICM issues new common stock, it will incur flotation costs equal to 7 percent. ICM's marginal tax rate is 40 percent. What is its cost of new equity? Question 7 - WACC 14 points: You were hired as a consultant to Giambono Company, whose target capital structure is 40% debt. 15% preferred, and 45% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of retained carings is 12.75%. The fim will not be issuing any new stock. What is its WACC? Question 8 - WACC 14 points: Midwest Electric Company (MEC) uses only debt and retained earnings. It can borrow unlimited amounts at an interest rate of t= 10% as long as it finances at its target capital structure, which calls for 40% debt and 60% common equity. Its last dividend was S2 (ie, D, - $2), its expected constant growth rate is 4%, and its common stock sells for $20, MEC's tax rate is 40%. What is its WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts