Question: Please answer all questions and show working out please. Question 4 (27 Marks) a) Discuss contemporary valuation approaches to the alternative asset class assigned to

Please answer all questions and show working out please.

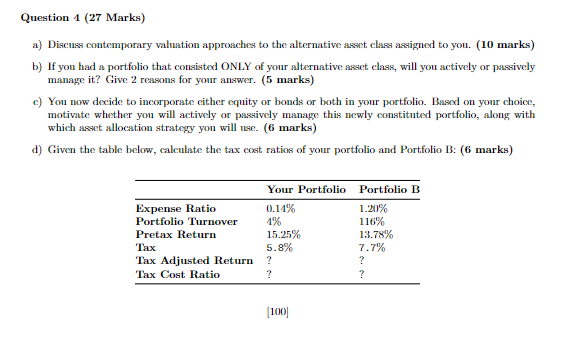

Question 4 (27 Marks) a) Discuss contemporary valuation approaches to the alternative asset class assigned to you. (10 marks) b) If you had a portfolio that consisted ONLY of your alternative asset class, will you actively or passively manage it? Give 2 reasons for your answer. (5 marks) c) You now decide to incorporate either equity or bonds or both in your portfolio. Based on your choice, motivate whether you will actively or passively manage this newly constituted portfolio, along with which asset allocation strategy you will use. (6 marks) d) Given the table below, calculate the tax cost ratios of your portfolio and Portfolio B: (6 marks) Your Portfolio Portfolio B Expense Ratio 0.14% 1.20% Portfolio Turnover 1% 116% Pretax Return 15.25% 13.78% Tax 5.8% 7.7% Tax Adjusted Return ? ? Tax Cost Ratio ? ? [100] Question 4 (27 Marks) a) Discuss contemporary valuation approaches to the alternative asset class assigned to you. (10 marks) b) If you had a portfolio that consisted ONLY of your alternative asset class, will you actively or passively manage it? Give 2 reasons for your answer. (5 marks) c) You now decide to incorporate either equity or bonds or both in your portfolio. Based on your choice, motivate whether you will actively or passively manage this newly constituted portfolio, along with which asset allocation strategy you will use. (6 marks) d) Given the table below, calculate the tax cost ratios of your portfolio and Portfolio B: (6 marks) Your Portfolio Portfolio B Expense Ratio 0.14% 1.20% Portfolio Turnover 1% 116% Pretax Return 15.25% 13.78% Tax 5.8% 7.7% Tax Adjusted Return ? ? Tax Cost Ratio ? ? [100]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts