Question: Please answer all questions ASAP , No Explanation need it, Thank you very much! Consider a put option to sell Kraft Heinz Corporation common stock

Please answer all questions ASAP , No Explanation need it, Thank you very much!

, No Explanation need it, Thank you very much!

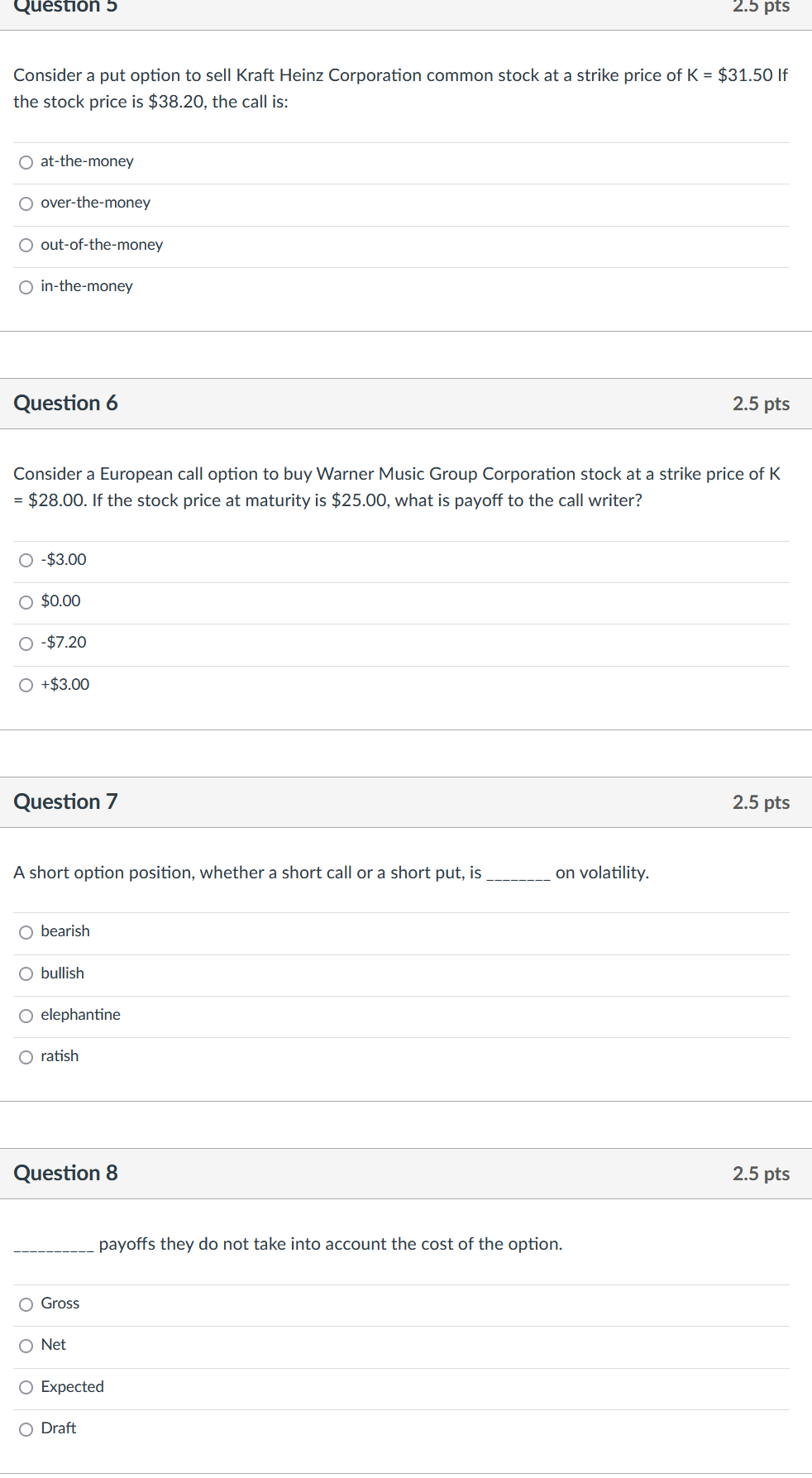

Consider a put option to sell Kraft Heinz Corporation common stock at a strike price of K=$31.50 If the stock price is $38.20, the call is: at-the-money over-the-money out-of-the-money in-the-money Question 6 2.5pts Consider a European call option to buy Warner Music Group Corporation stock at a strike price of K =$28.00. If the stock price at maturity is $25.00, what is payoff to the call writer? Question 7 2.5pts A short option position, whether a short call or a short put, is on volatility. bearish bullish elephantine ratish Question 8 2.5pts payoffs they do not take into account the cost of the option. Gross Net Expected Draft

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts