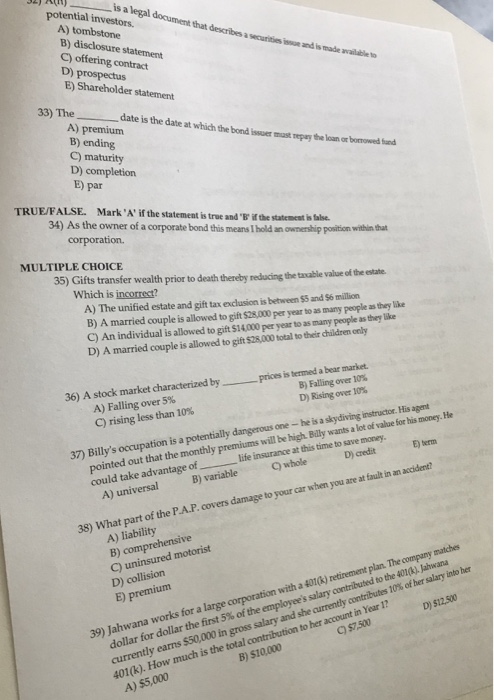

Question: Please answer all questions. B) disclosure statement C) offering contract D) prospectus E) Shareholder statement ential investors. is a legal document that describes a securities

B) disclosure statement C) offering contract D) prospectus E) Shareholder statement ential investors. is a legal document that describes a securities issoe and is made available to 33) The date is the date at which thebond issuer mast mpay the loan or borrowed tad A) premium B) ending C) maturity D) completion E) par TRUE/FALSE. Mark 'A'?f the statement is true and 34) As the owner of a corporate bond this means I hold an ownership position the statemoatbfb1 corporation. MULTIPLE CHOICE 35) Gifts transfer wealth prior to death thereby Which is incorrect? reducing the taxable value of the estate A) The unified estate and gift tax exclusion is between $5 and S6 million B) A married couple is allowed to gift $28,000 per year to as many people as they like D) A married couple is allowed to gift $28,000 total to their children only 36) A stock market characterized byprices is termed a A) Falling over 5% C) rising less than 10% B) Falling over 10% D)Rising over 10% skydiving instructor. His agent pointed out that the monthly premiums will be high. Bly wants a lot of value for his money. He could take advantage oflife insurance at this time to save 37) Billy's occupation is a potentially dangerous one - he isa E term D) credit C whole B) variable A) universal 38) What part of the P.A.P. covers damage to your car when you are at fault in an accident? A) liability B) comprehensive C) uninsured motorist D) collision E) premium wana works for a large corporation with a 4010)retirement plan. The company matches dollar for dollar the first 5% of the currently earns $50,000 in gross salary and she currently contributes 10% of her salary into her 401(k). How much is the total contribution to her account in Year 1? s salary contributed to the 401(k.). Jahwana D) $12,500 C) $7,500 B) $10,000 A) $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts