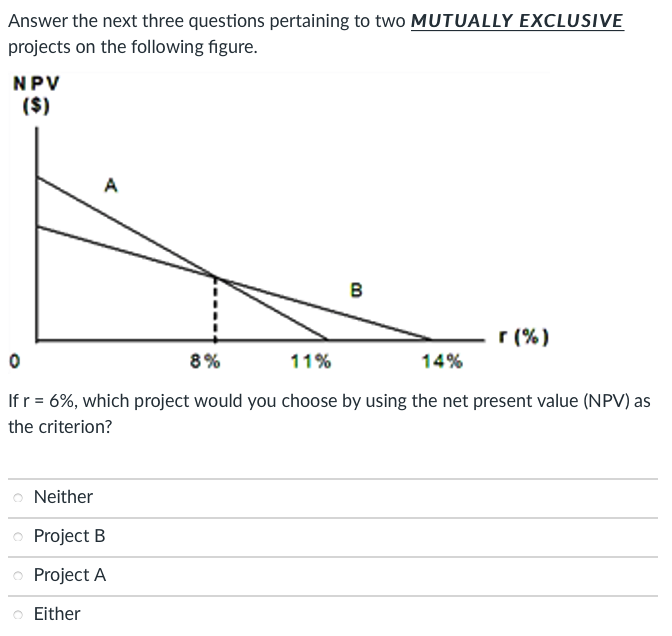

Question: Please answer all questions because I can't post them separately. Thank You. Answer the next three questions pertaining to two MUTUALLY EXCLUSIVE projects on the

Please answer all questions because I can't post them separately. Thank You.

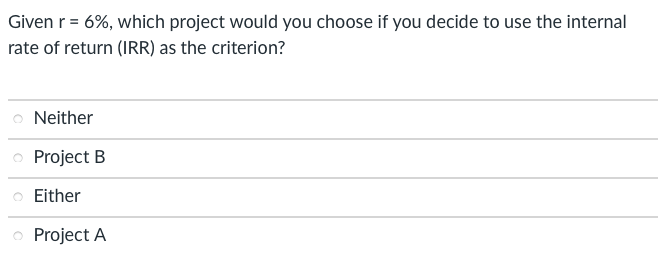

Answer the next three questions pertaining to two MUTUALLY EXCLUSIVE projects on the following figure. NPV ($) A B r (%) 0 8% 11% 14% If r = 6%, which project would you choose by using the net present value (NPV) as the criterion? Neither Project B Project A Either Given r = 6%, which project would you choose if you decide to use the internal rate of return (IRR) as the criterion? o Neither Project B Either Project A At what discount rate will you be indifferent to these two projects under the NPV rule? 11% 0% 14% 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts