Question: please answer all questions completely using multiple choice. Suppose you invest $20,000 by purchasing 200 shares of Abbott Labs (ABT) at $50 per share 200

please answer all questions completely using multiple choice.

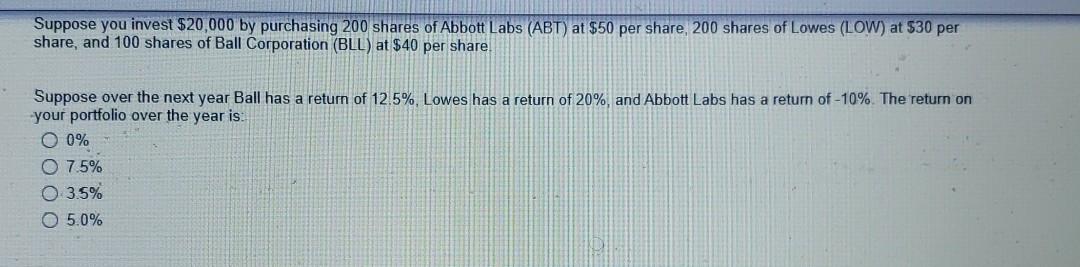

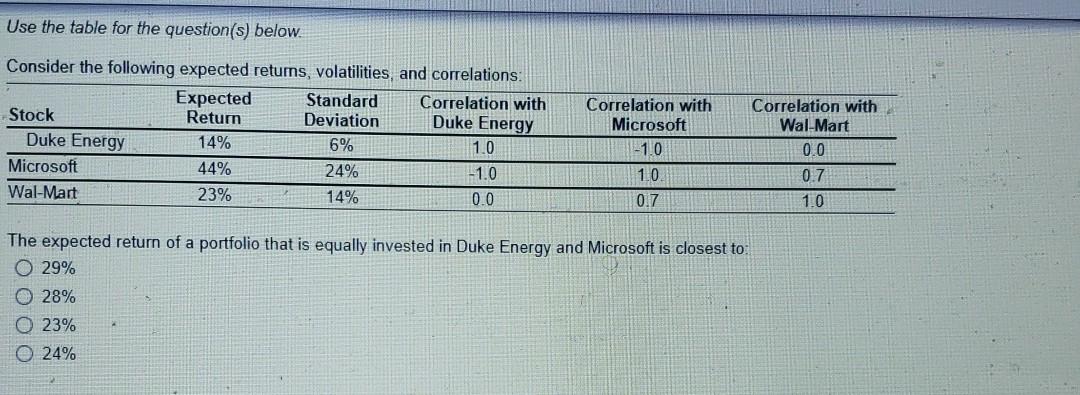

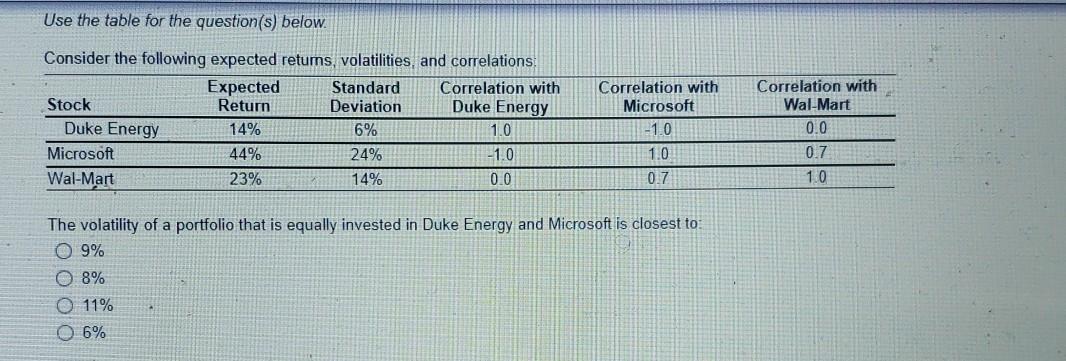

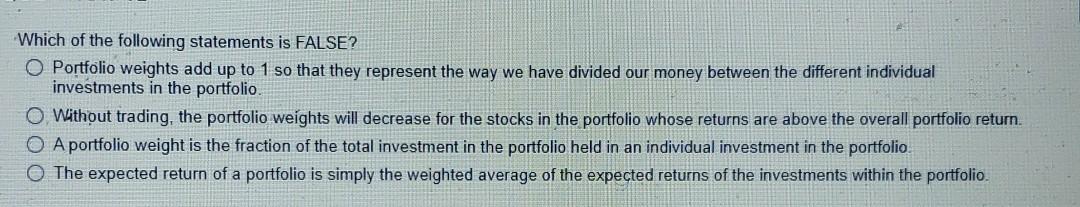

Suppose you invest $20,000 by purchasing 200 shares of Abbott Labs (ABT) at $50 per share 200 shares of Lowes (LOW) at $30 per share, and 100 shares of Ball Corporation (BLL) at $40 per share Suppose over the next year Ball has a return of 12.5%, Lowes has a return of 20%, and Abbott Labs has a return of -10% The return on your portfolio over the year is: O 0% O 7.5% O 3.5% O 5.0% Use the table for the question(s) below. Consider the following expected retums, volatilities, and correlations: Expected Standard Correlation with Stock Return Deviation Duke Energy Duke Energy 14% 1.0 Microsoft 44% 24% -1.0 Wal-Mart 23% 14% 0.0 6% Correlation with Microsoft -1.0 10 0.7 Correlation with Wal-Mart 0.0 0.7 1.0 The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to: 0 29% O 28% O 23% 24% Use the table for the question(s) below. Consider the following expected retums, volatilities, and correlations, Expected Standard Correlation with Stock Return Deviation Duke Energy Duke Energy 14% 6% 1.0 Microsoft 44% 24% -1.0 Wal-Mart 23% 14% 0.0 Correlation with Microsoft -1.0 1.0 0.7 Correlation with Wal-Mart 0.0 0.7 1.0 The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to 09% 8% 11% O 6% OOO Which of the following statements is FALSE? O Portfolio weights add up to 1 so that they represent the way we have divided our money between the different individual investments in the portfolio. O Without trading, the portfolio weights will decrease for the stocks in the portfolio whose returns are above the overall portfolio return. O A portfolio weight is the fraction of the total investment in the portfolio held in an individual investment in the portfolio The expected return of a portfolio is simply the weighted average of the expected returns of the investments within the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts