Question: please answer all questions correctly! 33. When converting an income statement from a cash basis to an accrual basis, expenses: A) Exceed cash payments to

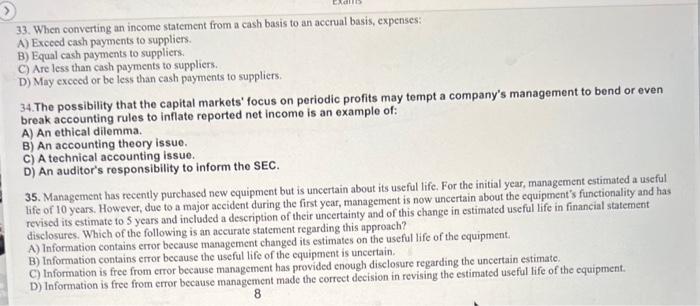

33. When converting an income statement from a cash basis to an accrual basis, expenses: A) Exceed cash payments to suppliers. B) Equal cash payments to suppliers. C) Are less than cash payments to suppliers. D) May exceed or be less than cash payments to suppliers. 34. The possibility that the capital markets' focus on periodic profits may tempt a company's management to bend or even break accounting rules to inflate reported net income is an example of: A) An ethical dilemma. B) An accounting theory issue. C) A technical accounting issue. D) An auditor's responsibility to inform the SEC. 35. Management has recently purchased new equipment but is uncertain about its useful life. For the initial year, management estimated a useful life of 10 years. However, due to a major accident during the first year, management is now uncertain about the equipment's functionality and has revised its estimate to 5 years and included a description of their uncertainty and of this change in estimated useful life in financial statement disclosures. Which of the following is an accurate statement regarding this approach? A) Information contains error because management changed its estimates on the useful life of the equipment B) Information contains crror because the useful life of the equipment is uncertain C) Information is free from crror because management has provided enough disclosure regarding the uncertain estimate D) Information is free from crror because management made the correct decision in revising the estimated useful life of the equipment. 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts