Question: please answer all questions correctly for a like! Tanner and Teresa share income and losses in a 2:1 ratio (2/3 to Tanner and 1/3 to

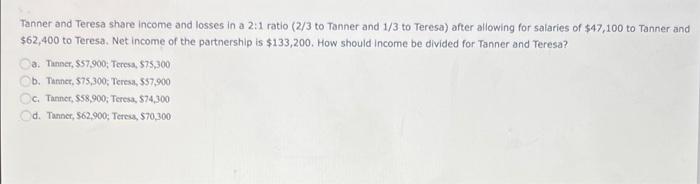

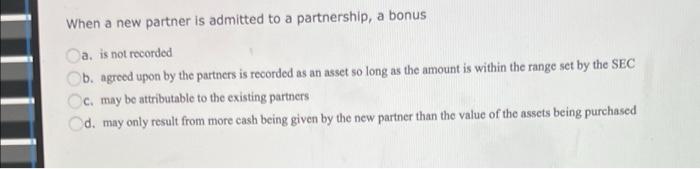

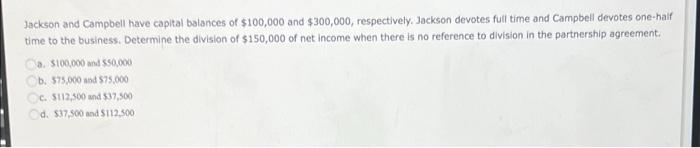

Tanner and Teresa share income and losses in a 2:1 ratio (2/3 to Tanner and 1/3 to Teresa) after allowing for salaries of $47,100 to Tanner and $62,400 to Teresa, Net Income of the partnership is $133,200. How should Income be divided for Tanner and Teresa? Ca. Tinner, $57.900; Teresa, $75,300 b. Tanner, 575,300: Teresa, 557,900 Tanner, 858,900; Teresa, 574,300 d. Tunner, $62,900: Teres, S70,300 When a new partner is admitted to a partnership, a bonus a. is not recorded b. agreed upon by the partners is recorded as an asset so long as the amount is within the range set by the SEC c. may be attributable to the existing partners d. may only result from more cash being given by the new partner than the value of the assets being purchased Jackson and Campbell have capital balances of $100,000 and $300,000, respectively, Jackson devotes full time and Campbell devotes one-half time to the business. Determine the division of $150,000 of net Income when there is no reference to division in the partnership agreement a $100,000 and $50,000 b. 575,000 and $75,000 C. 5112.500 and $37,500 d. 537,500 and $112.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts