Question: please answer all questions Exercises Chapter 2 Organic Stand Power Stem 51 1. You manage a hotel resort located on the South Beach on the

please answer all questions

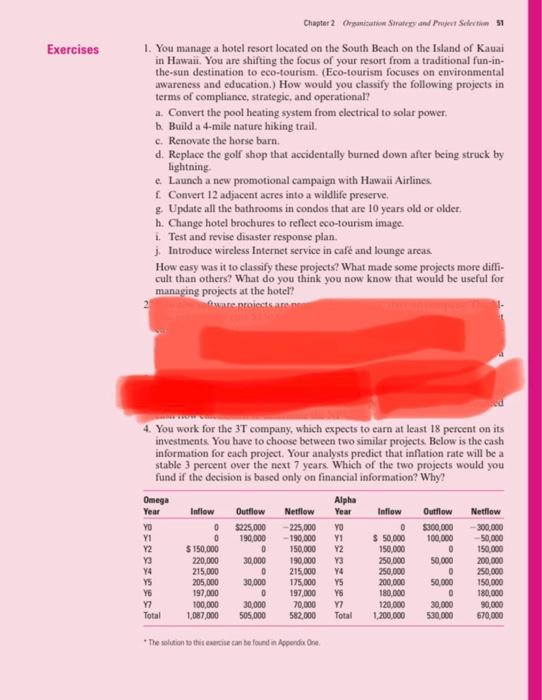

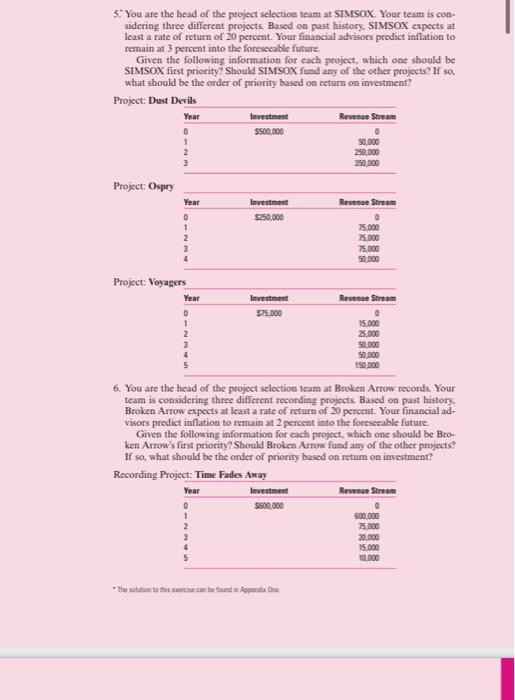

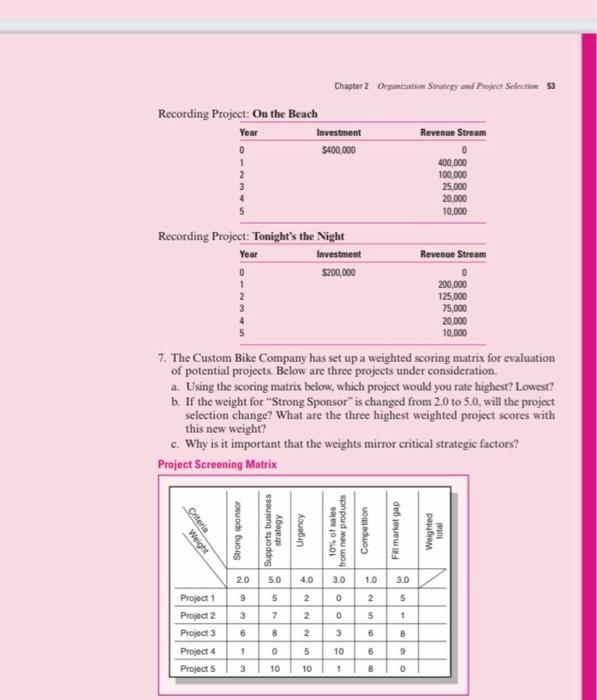

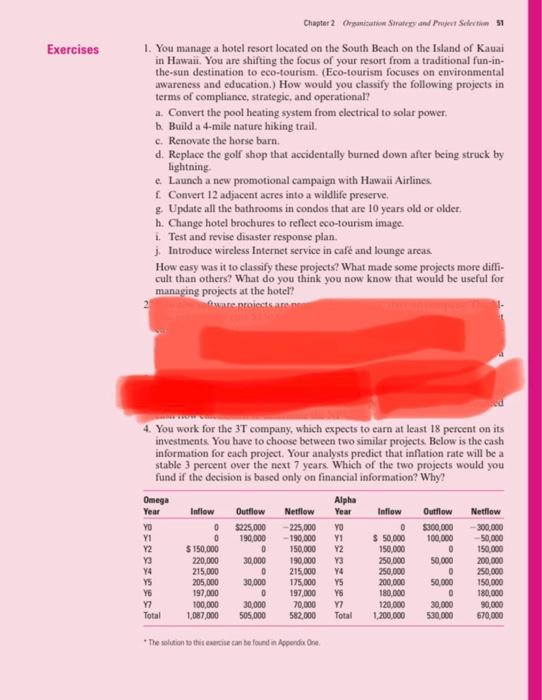

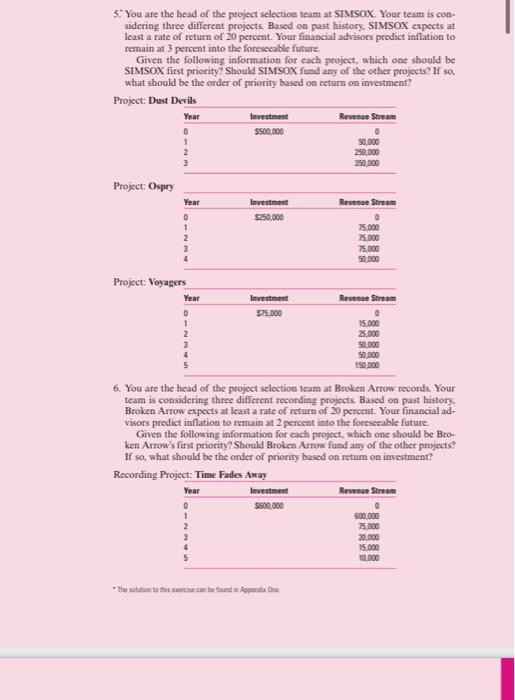

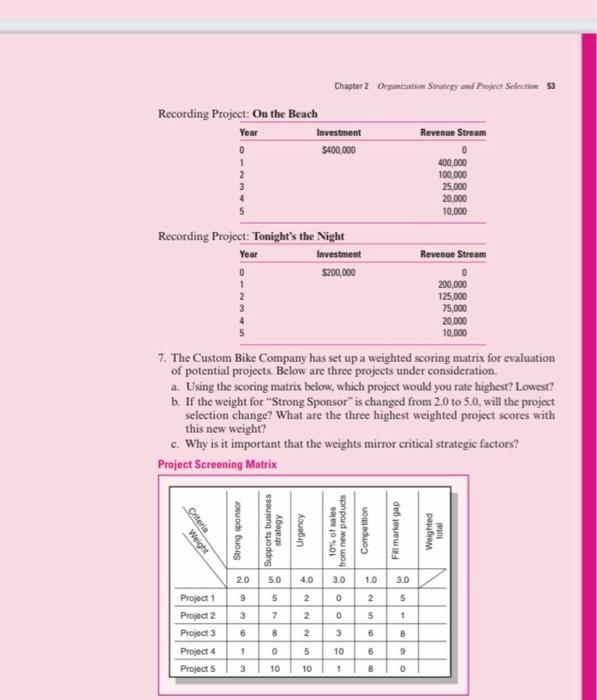

Exercises Chapter 2 Organic Stand Power Stem 51 1. You manage a hotel resort located on the South Beach on the Island of Kauai in Hawaii. You are shifting the focus of your resort from a traditional fun-in- the-sun destination to eco-tourism. (Eco-tourism focuses on environmental awareness and education.) How would you classify the following projects in terms of compliance, strategic, and operational? a. Convert the pool heating system from electrical to solar power b Build a 4-mile nature hiking trail c. Renovate the horse barn d. Replace the golf shop that accidentally burned down after being struck by lightning e Launch a new promotional campaign with Hawaii Airlines f. Convert 12 adjacent acres into a wildlife preserve. & Update all the bathrooms in condos that are 10 years old or older. h. Change hotel brochures to reflect eco-tourism image. 1. Test and revise disaster response plan j. Introduce wireless Internet service in caf and lounge areas. How easy was it to classify these projects? What made some projects more diffi- cult than others? What do you think you now know that would be useful for managing projects at the hotel? tware projects are 4. You work for the 3T company, which expects to earn at least 18 percent on its investments. You have to choose between two similar projects. Below is the cash information for each project. Your analysts predict that inflation rate will be a stable 3 percent over the next 7 years. Which of the two projects would you fund if the decision is based only on financial information? Why? Omega Alpha Year Inflow Outflow Netflow Year Inflow Outflow Netflow YO 0 $225,000 -225,000 YO 0 $300,000 -300,000 Y1 0 190,000 -190,000 YI $ 50.000 100.000 -50,000 Y2 $ 150,000 0 150,000 Y2 150,000 0 150.000 Y3 220,000 30,000 190.000 Y3 250.000 50,000 200,000 Y4 215,000 0 215.000 Y4 250,000 0 250.000 YS 205,000 30,000 175,000 YS 200.000 50.000 150,000 Y8 197,000 0 197,000 Y8 180.000 180.000 100.000 30,000 70,000 27 120.000 30,000 90,000 Total 1,087,000 505,000 582,000 Total 1.200.000 530,000 670,000 *The solution to this exercise can be found in Appendix One Year 5* You are the head of the project selection team at SIMSOX Your team is con- sidering three different projects. Based on past history, SIMSOX expects at least a rate of return of 20 percent. Your financial advisors predict inflation to remain at 3 percent into the foreseeable future Given the following information for each project, which one should be SIMSOX first priority? Should SIMSOX fund any of the other projects? If so, what should be the order of priority based on return on investment Project: Dust Devils Investment Revenue Stream 0 $500,000 1 50,000 250.000 3 350.000 Project: Ospry Year Investment Revenue Stream 0 $250,000 75.000 75.000 75.000 50.000 Project: Voyagers Year Investment Revenue Stream 0 $75.000 1 15.000 2 25,000 50.000 50.000 150.000 1 6. You are the head of the project selection team at Broken Arrow records Your team is considering three different recording projects. Based on past history, Broken Arrow expects at least a rate of return of 20 percent. Your financial ad- visors predict inflation to remain at 2 percent into the foreseeable future. Given the following information for each project, which one should be Bro- ken Arrow's first priority? Should Broken Arrow fund any of the other projects? If so, what should be the order of priority based on retum on investment? Recording Project: Time Fades Away Year Investment Revenue Stream 0 $800.000 1 500 000 2 75.000 3 20.000 4 15.000 10,000 * The le can be found in Andre Chapter 2 Organization Strategy and Project Selection SJ Recording Project: On the Beach Year Investment Revenue Stream S400,000 0 1 2 3 4 400.000 100,000 25,000 20,000 10,000 Recording Project: Tonight's the Night Investment $200,000 Year Revenue Stream 0 1 2 3 4 200.000 125.000 75,000 20,000 10,000 7. The Custom Bike Company has set up a weighted scoring matrix for evaluation of potential projects. Below are three projects under consideration. a. Using the scoring matrix below, which project would you rate highest? Lowest? b. If the weight for "Strong Sponsor" is changed from 2,0 to 5.0, will the project selection change? What are the three highest weighted project scores with this new weight? c. Why is it important that the weights mirror critical strategic factors? Project Screening Matrix Criteria Weight 20 5.0 4.0 3.0 1.0 3.0 9 5 2 0 2 5 2 0 Project 1 Project 2 Project 3 Project 4 Project 5 3 6 NO 5 6 1 8 8 2 3 - 1 5 10 6 3 10 10 1 8 0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock