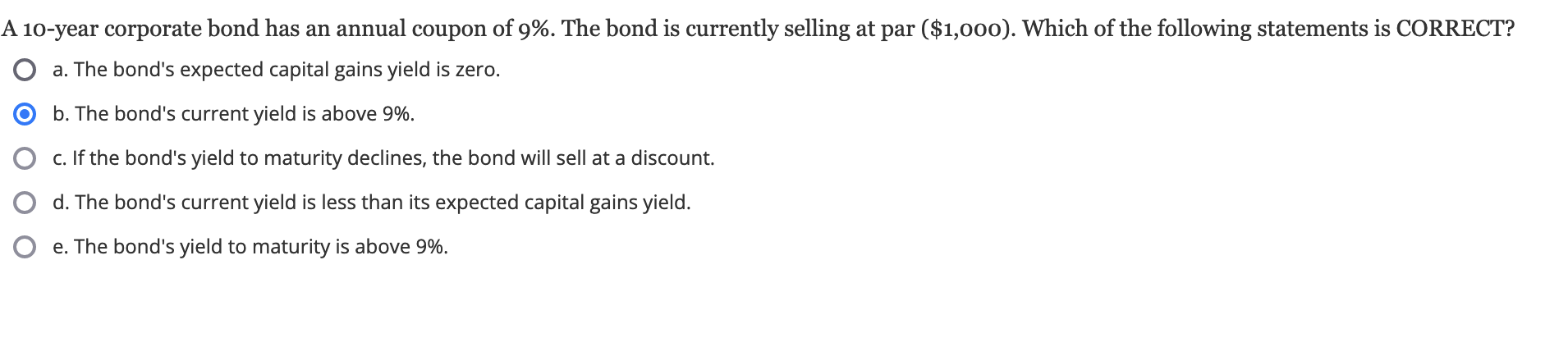

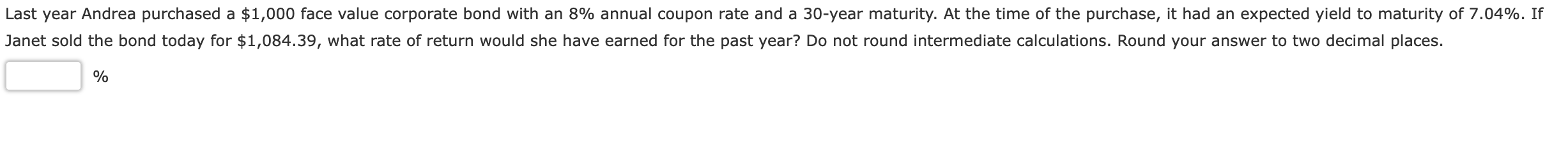

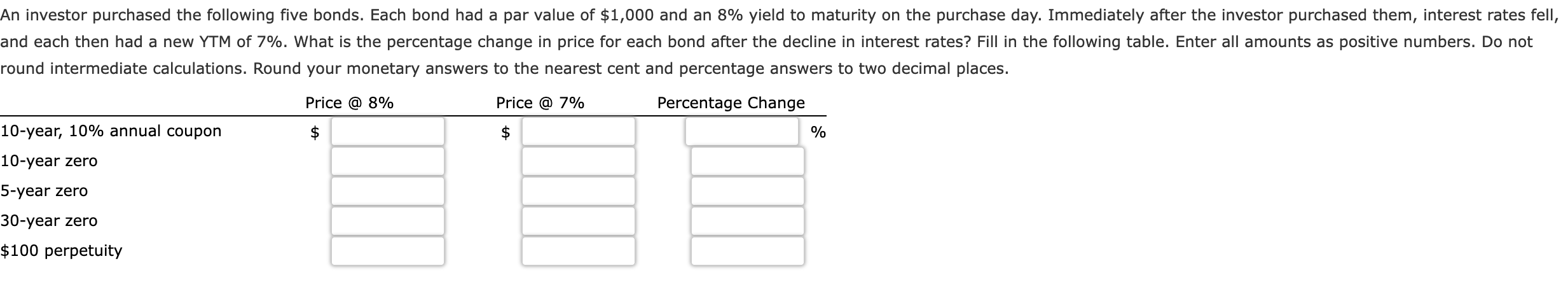

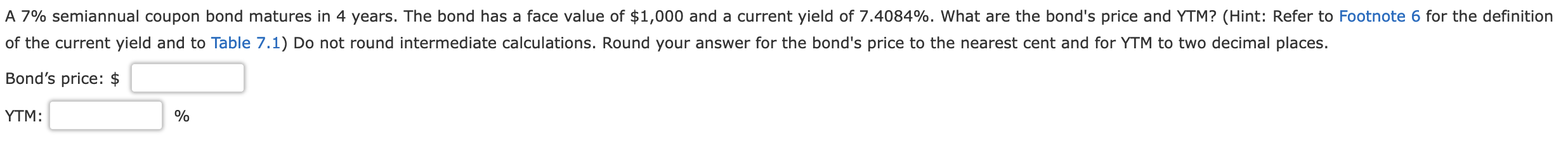

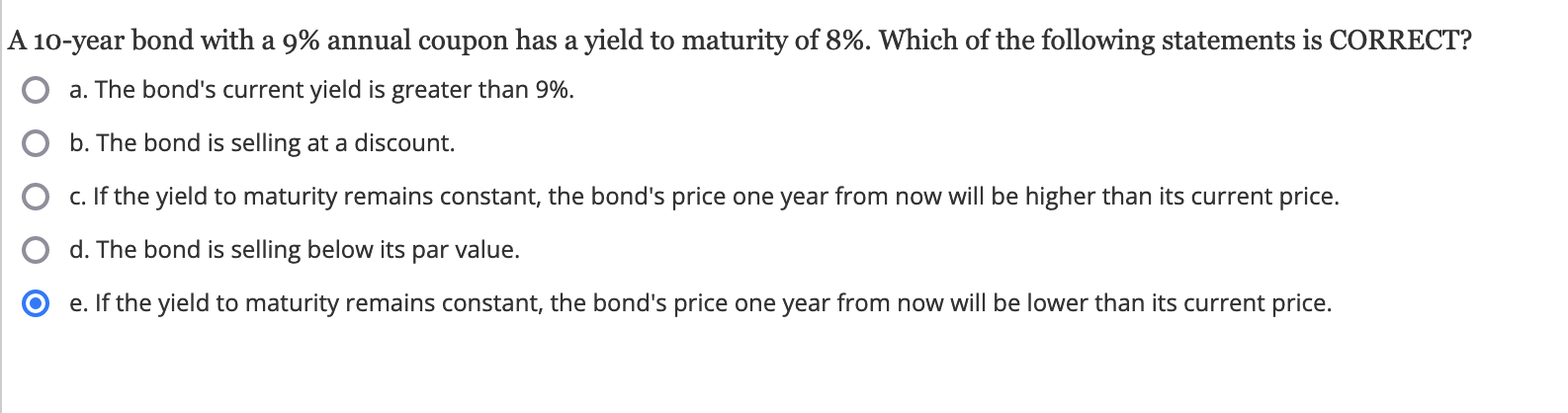

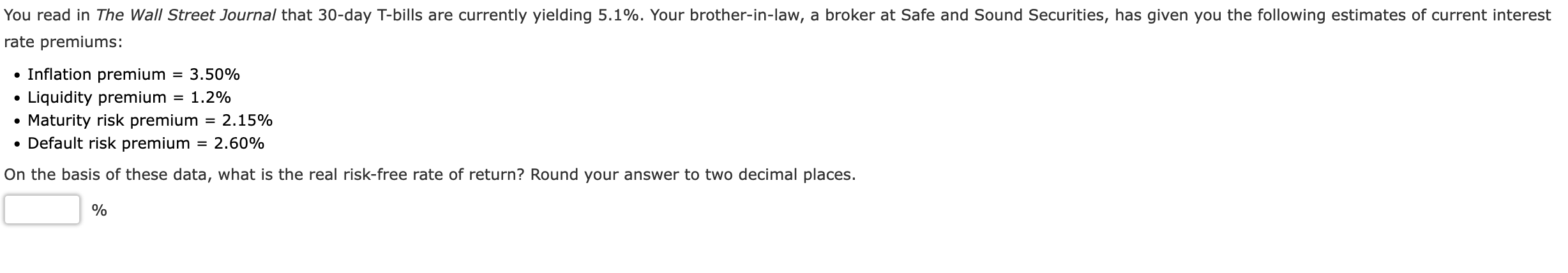

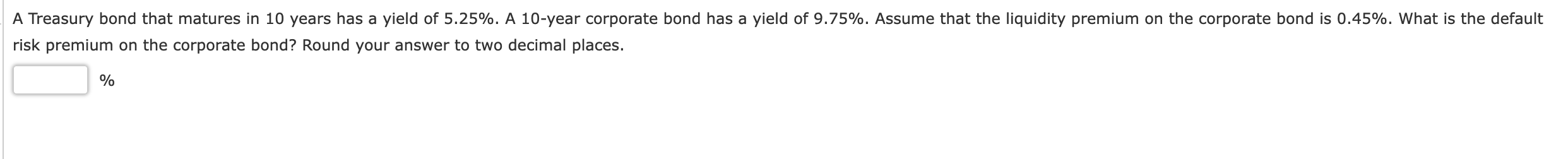

Question: PLEASE ANSWER ALL QUESTIONS FOR 5 STAR REVIEW!!!!! QUESTION #1 - A 10-year corporate bond has an annual coupon of 9%. The bond is currently

PLEASE ANSWER ALL QUESTIONS FOR 5 STAR REVIEW!!!!!

QUESTION #1 -

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock