Question: Please answer all questions for a good rating and like :) THANKS!! Based on the information in the Portfolio Analysis Problems Data 042223A Excel file

Please answer all questions for a good rating and like :) THANKS!!

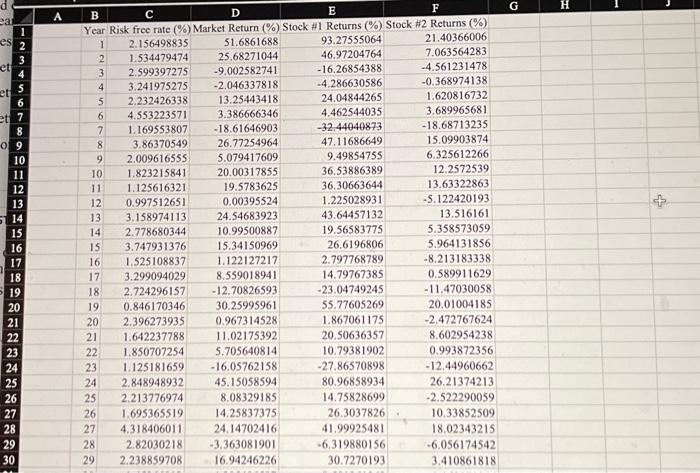

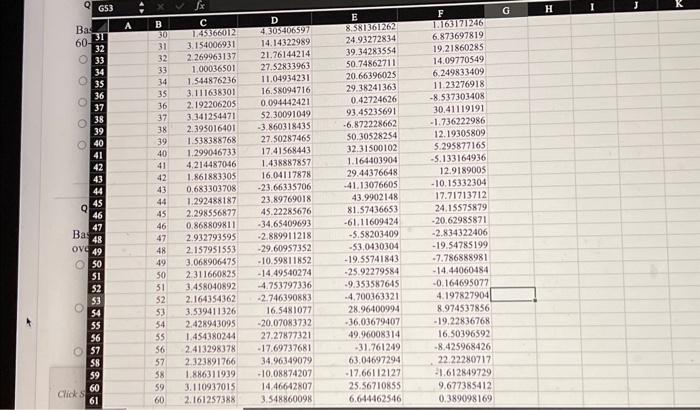

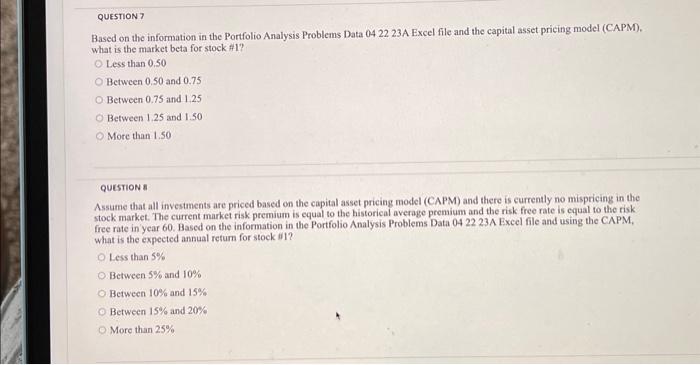

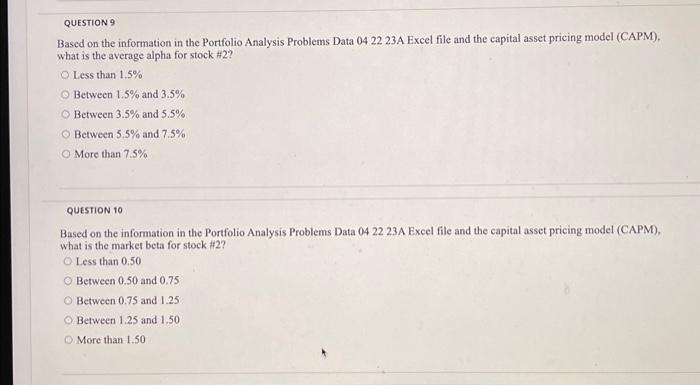

Based on the information in the Portfolio Analysis Problems Data 042223A Excel file and the capital asset pricing model (CAPM), what is the market beta for stock \#1? Less than 0.50 Between 0.50 and 0.75 Between 0.75 and 1.25 Between 1.25 and 1.50 More than 1.50 QuesTion Assume that all investments are priced based on the capial asset pricing model (CAPM) and there is currently no mispricing in the stock market. The current market risk premium is equal to the historical average premium and the risk free rate is equal to the risk free rate in year 60 . Based on the information in the Portfolio Analysis Problems Data 04 22 23. Excel file and using the CAPM, what is the expected annual return for stock 11 ? Less than 5% Between 5% and 10% Between 10% and 15% Between 15\% and 20% More than 25\% Based on the information in the Portfolio Analysis Problems Data 04 22.23A Excel file and the capital asset pricing model (CAPM). what is the average alpha for stock \#2? Less than 1.5% Between 1.5% and 3.5% Between 3.5% and 5.5% Between 5.5% and 7.5% More than 7.5\% QUESTION 10 Based on the information in the Portfolio Analysis Problems Data 042223A Excel file and the capital asset pricing model (CAPM), what is the market beta for stock #2 ? Less than 0.50 Between 0.50 and 0.75 Between 0.75 and 1.25 Between 1.25 and 1.50 More than 1.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts