Question: Please answer all questions for E10-30 our amaly u1u use tiis additional information in Interpreting and Capitalizing Operating Leases g10-30. Analyzing, 0nc. reports the following

Please answer all questions for E10-30

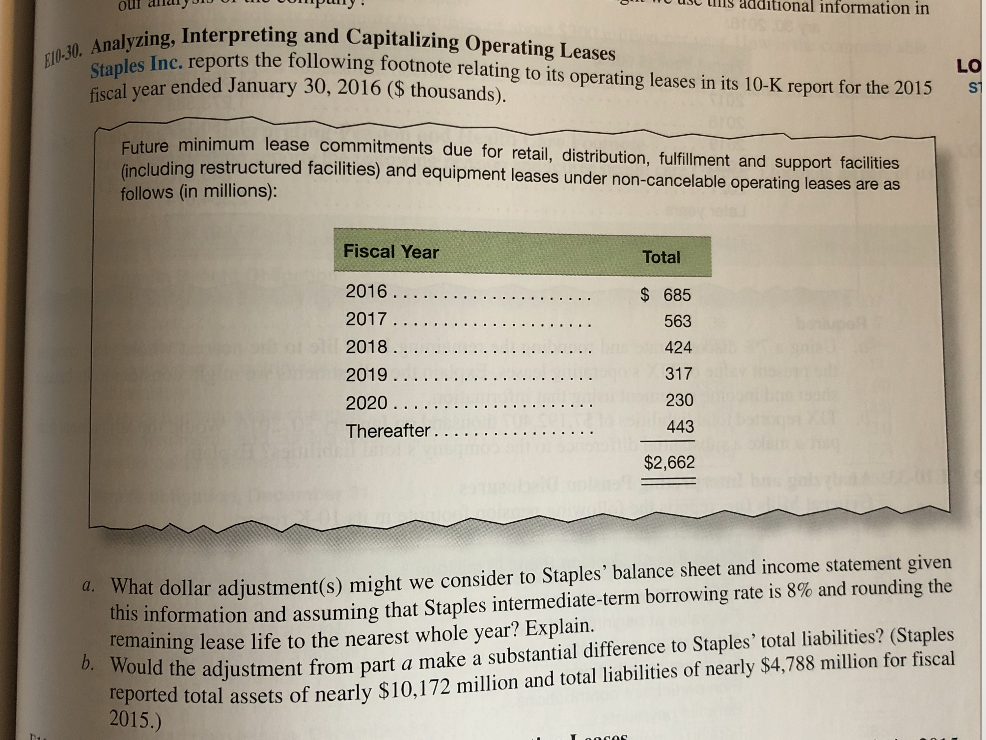

our amaly u1u use tiis additional information in Interpreting and Capitalizing Operating Leases g10-30. Analyzing, 0nc. reports the following footnote relating to its operating leases in its 10-K report for the 2015 Staples I LO ar ended January 30, 2016 (S thousands). Future (including restructure follows (in millions): minimum lease commitments due for retail, distribution, fulfillment and support facilities d facilities) and equipment leases under non-cancelable operating leases are as Fiscal Year Total 2016.. $ 685 563 424 317 230 443 $2,662 2018 this information and assuming that Staples intermediate-term borrowing rate is 8% and rounding the remaining lease life to the nearest whole year? Explain. a. What dollar adjustment(s) might we consider to Staples' balance sheet and income statement given reported total assets of nearly $10,172 million and total liabilities of nearly S4,788 million for fiscal 2015.) 0. Would the adjustment from part a make a substantial difference to Staples'total liabilities? (Stapless our amaly u1u use tiis additional information in Interpreting and Capitalizing Operating Leases g10-30. Analyzing, 0nc. reports the following footnote relating to its operating leases in its 10-K report for the 2015 Staples I LO ar ended January 30, 2016 (S thousands). Future (including restructure follows (in millions): minimum lease commitments due for retail, distribution, fulfillment and support facilities d facilities) and equipment leases under non-cancelable operating leases are as Fiscal Year Total 2016.. $ 685 563 424 317 230 443 $2,662 2018 this information and assuming that Staples intermediate-term borrowing rate is 8% and rounding the remaining lease life to the nearest whole year? Explain. a. What dollar adjustment(s) might we consider to Staples' balance sheet and income statement given reported total assets of nearly $10,172 million and total liabilities of nearly S4,788 million for fiscal 2015.) 0. Would the adjustment from part a make a substantial difference to Staples'total liabilities? (Stapless

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts