Question: PLEASE ANSWER ALL QUESTIONS FOR FULL CREDIT. The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was

PLEASE ANSWER ALL QUESTIONS FOR FULL CREDIT.

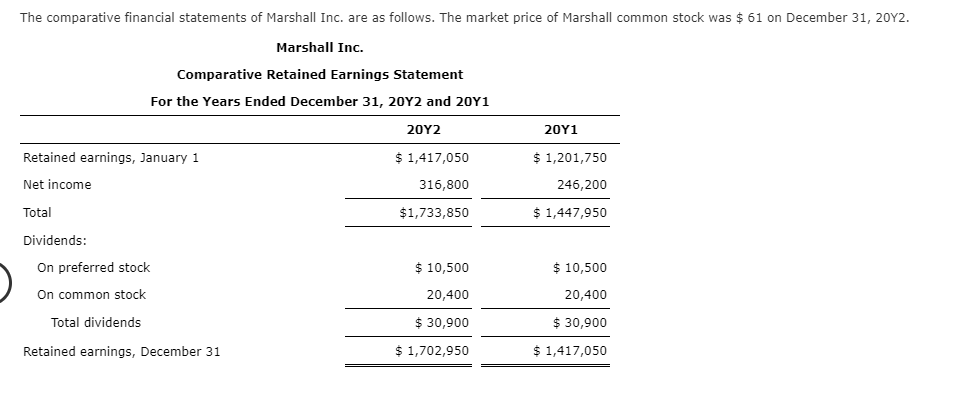

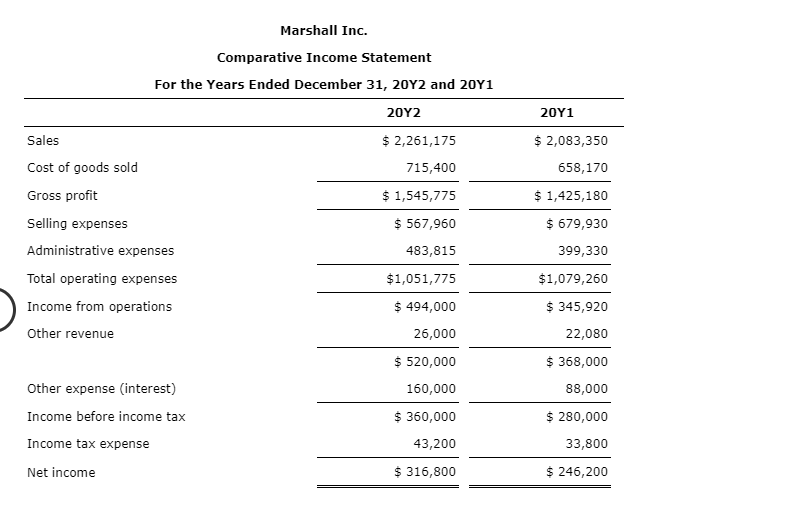

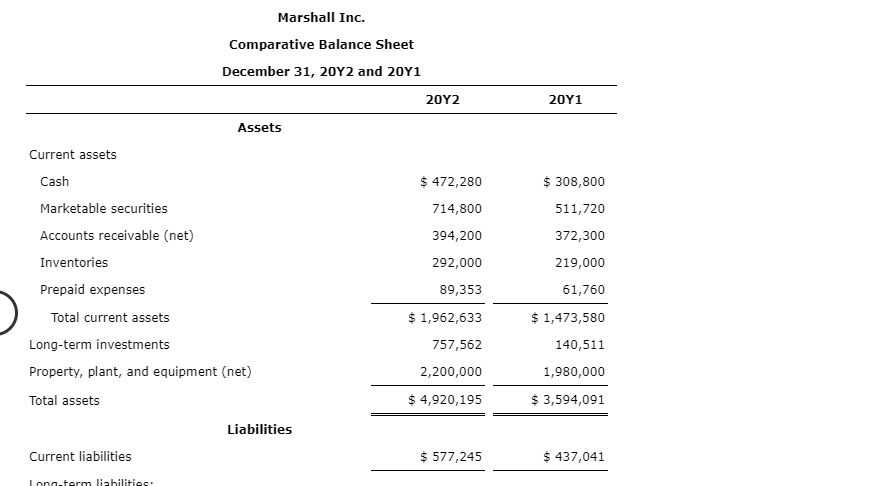

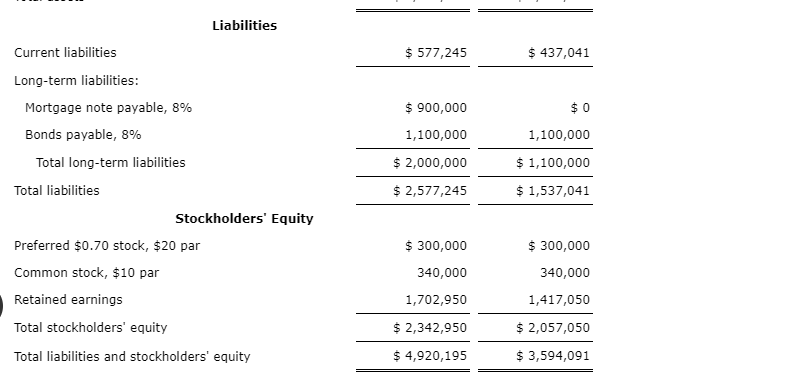

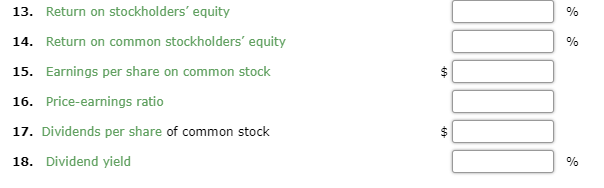

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $61 on December 31, 20Y2 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y1 20Y2 Retained earnings, January 1 Net income Total Dividends: $1,417,050 316,800 $1,733,850 $1,201,750 246,200 $1,447,950 $10,500 20,400 30,900 $ 1,702,950 $ 10,500 20,400 $30,900 1,417,050 On preferred stock On common stock Total dividends Retained earnings, December 31 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y1 20Y2 2,261,175 715,400 1,545,775 567,960 483,815 $1,051,775 494,000 26,000 520,000 160,000 360,000 43,200 316,800 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue 2,083,350 658,170 1,425,180 679,930 399,330 $1,079,260 345,920 22,080 368,000 88,000 280,000 33,800 246,200 Other expense (interest) Income before income tax Income tax expense Net income Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 20Y1 Assets Current assets 308,800 511,720 372,300 219,000 61,760 1,473,580 140,511 1,980,000 3,594,091 Cash Marketable securities Accounts receivable (net) Inventories Prepaid expenses $ 472,280 714,800 394,200 292,000 89,353 1,962,633 757,562 2,200,000 4,920,195 Total current assets Long-term investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities 577,245 $ 437,041 Liabilities 577,245 Current liabilities $ 437,041 Long-term liabilities: $0 1,100,000 1,100,000 1,537,041 Mortgage note payable, 8% 900,000 1,100,000 2,000,000 $2,577,245 Bonds payable, 8% Total long-term liabilities Total liabilities Stockholders' Equity 300,000 340,000 1,702,950 $2,342,950 $4,920,195 300,000 340,000 1,417,050 2,057,050 3,594,091 Preferred $0.70 stock, $20 par Common stock, $10 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity 14. 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield Return on common stockholders equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts