Question: PLEASE ANSWER ALL QUESTIONS FULLY PICTURE BELOW IS A LIST OF ALL THE OTHER CONSOLIDATION ENTRIES YOU NEED. Plaza Corporation purchased 70 percent of Square

PLEASE ANSWER ALL QUESTIONS FULLY

PICTURE BELOW IS A LIST OF ALL THE OTHER CONSOLIDATION ENTRIES YOU NEED.

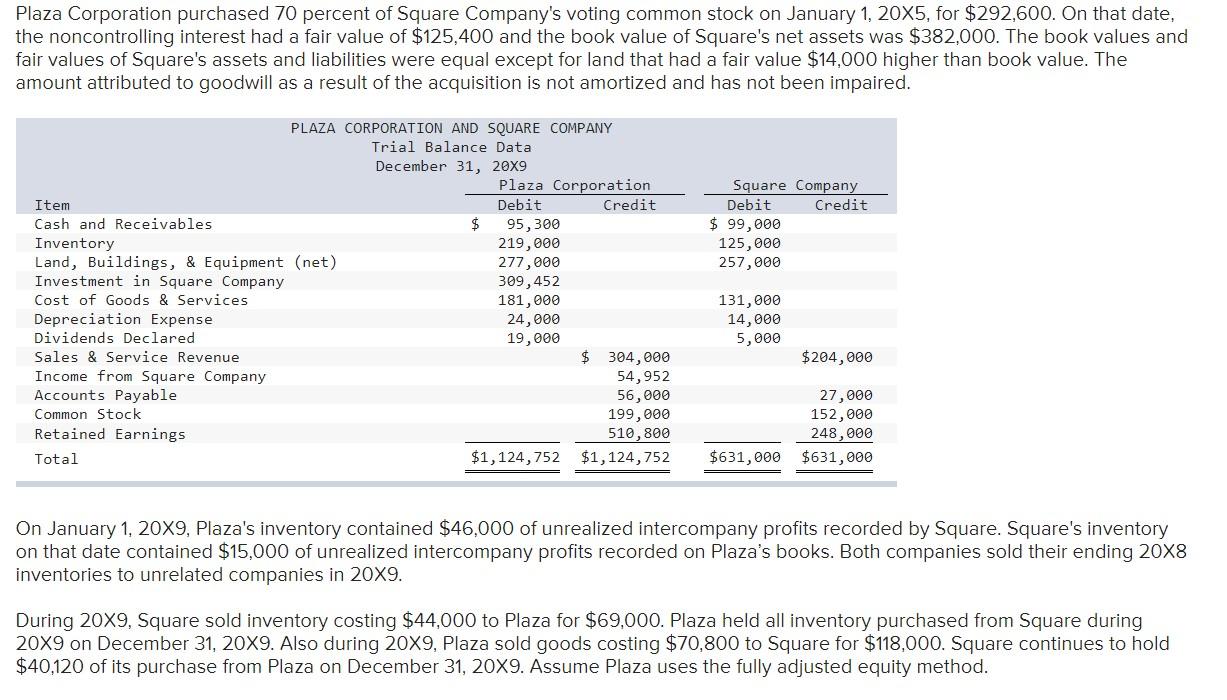

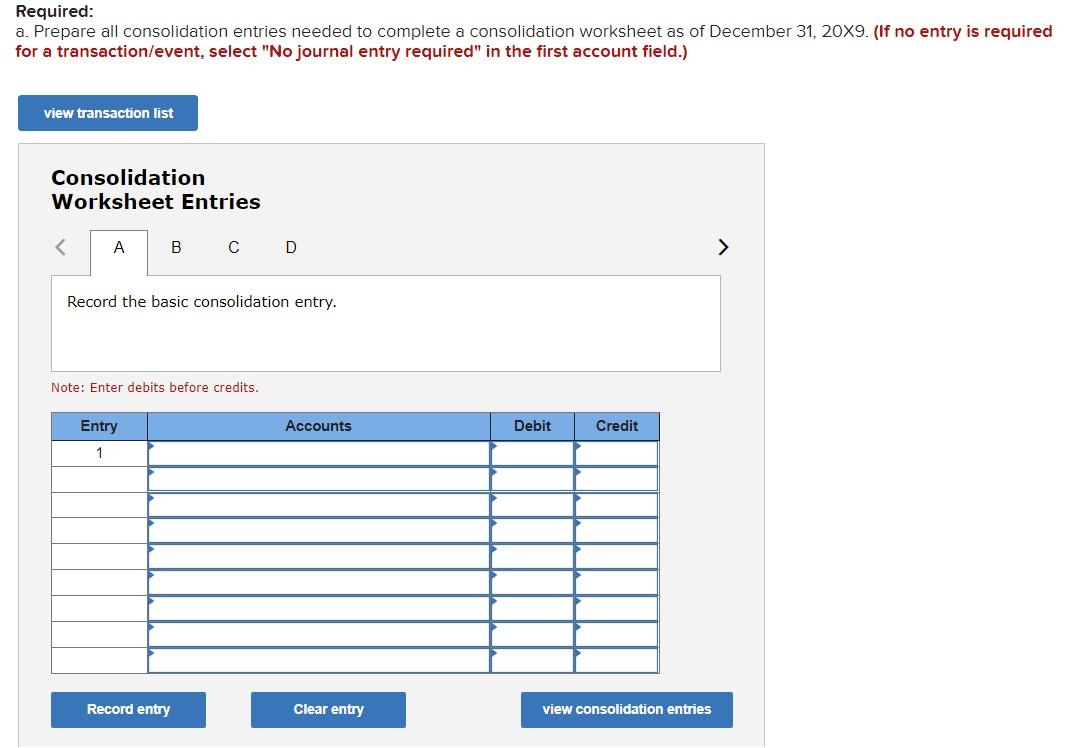

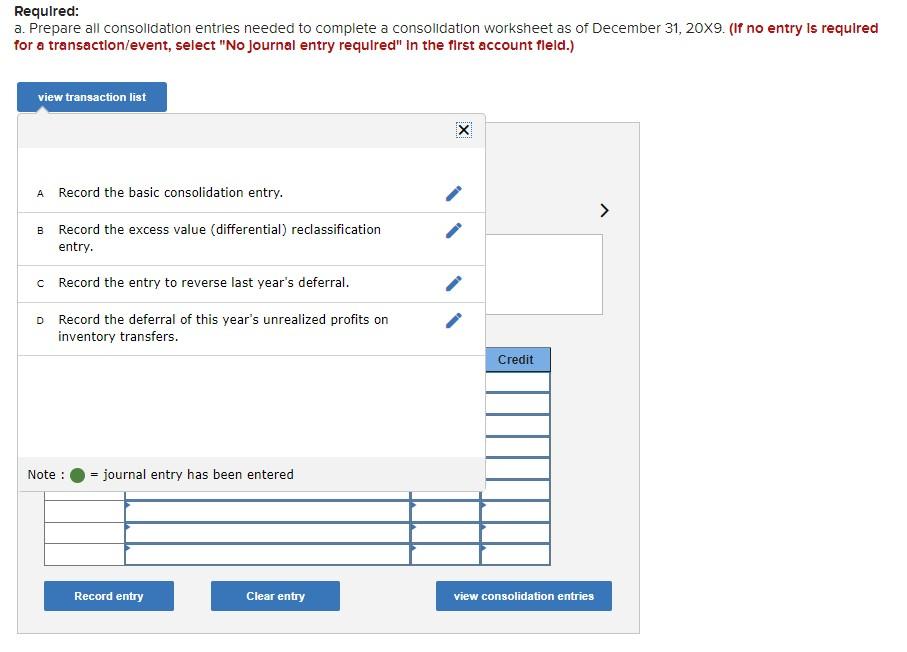

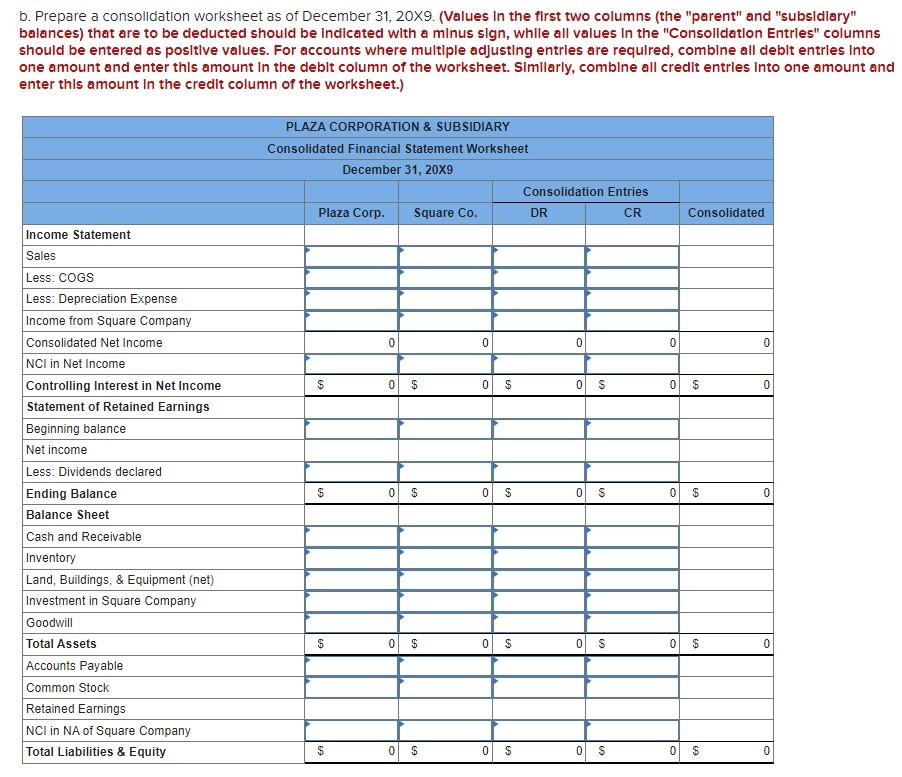

Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1,205, for $292,600. On that date, the noncontrolling interest had a fair value of $125,400 and the book value of Square's net assets was $382,000. The book values and fair values of Square's assets and liabilities were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impaired. On January 1, 20X9, Plaza's inventory contained $46,000 of unrealized intercompany profits recorded by Square. Square's inventory on that date contained $15,000 of unrealized intercompany profits recorded on Plaza's books. Both companies sold their ending 208 inventories to unrelated companies in 209. During 209, Square sold inventory costing $44,000 to Plaza for $69,000. Plaza held all inventory purchased from Square during 209 on December 31,209. Also during 209, Plaza sold goods costing $70,800 to Square for $118,000. Square continues to hold $40,120 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equity method. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries D Record the basic consolidation entry. Note: Enter debits before credits. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31,209. (If no entry Is required for a transaction/event, select "No journal entry required" in the first account fleld.) b. Prepare a consolidation worksheet as of December 31,209. (Values In the flrst two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, whlle all values In the "Consolidation Entrles" columns one amount and Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1,205, for $292,600. On that date, the noncontrolling interest had a fair value of $125,400 and the book value of Square's net assets was $382,000. The book values and fair values of Square's assets and liabilities were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impaired. On January 1, 20X9, Plaza's inventory contained $46,000 of unrealized intercompany profits recorded by Square. Square's inventory on that date contained $15,000 of unrealized intercompany profits recorded on Plaza's books. Both companies sold their ending 208 inventories to unrelated companies in 209. During 209, Square sold inventory costing $44,000 to Plaza for $69,000. Plaza held all inventory purchased from Square during 209 on December 31,209. Also during 209, Plaza sold goods costing $70,800 to Square for $118,000. Square continues to hold $40,120 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equity method. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries D Record the basic consolidation entry. Note: Enter debits before credits. Required: a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31,209. (If no entry Is required for a transaction/event, select "No journal entry required" in the first account fleld.) b. Prepare a consolidation worksheet as of December 31,209. (Values In the flrst two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, whlle all values In the "Consolidation Entrles" columns one amount and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts