Question: Please answer all questions, I have 0 questions left on chegg. I will leave a good review. 52. RAK Inc. has no debt outstanding and

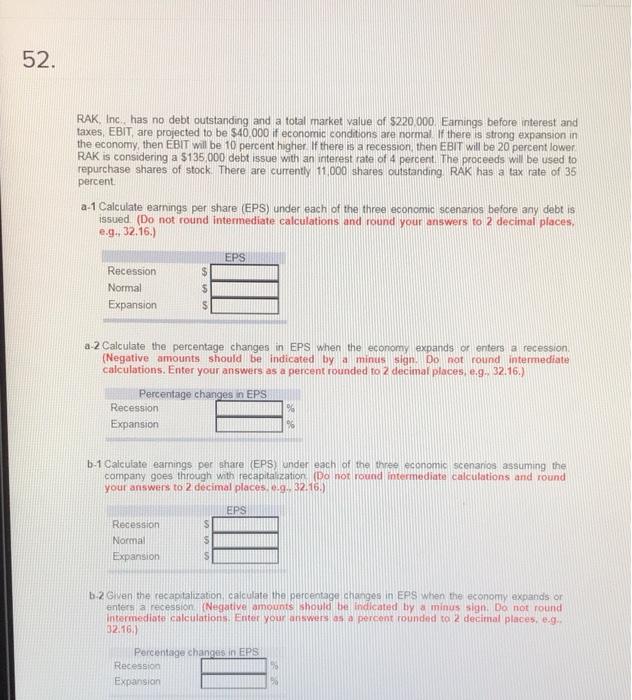

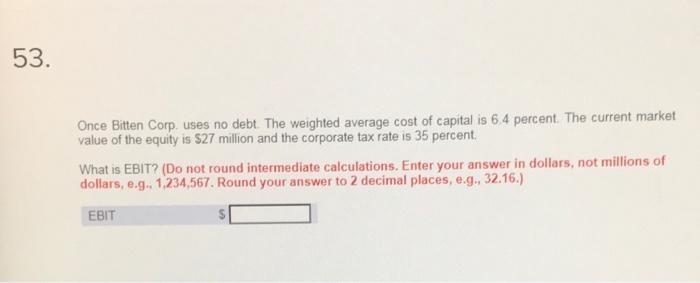

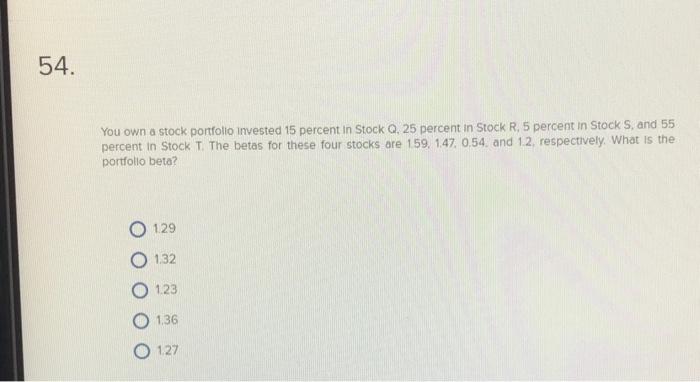

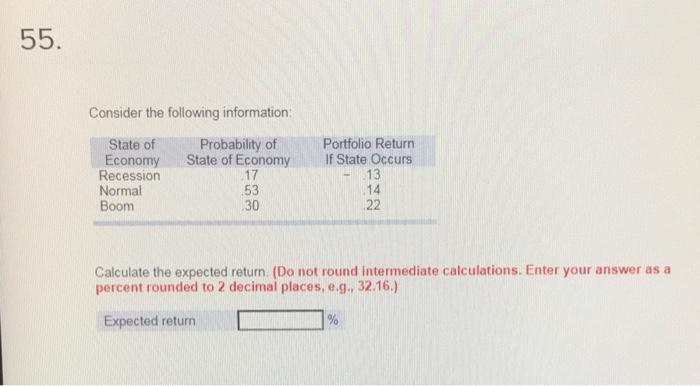

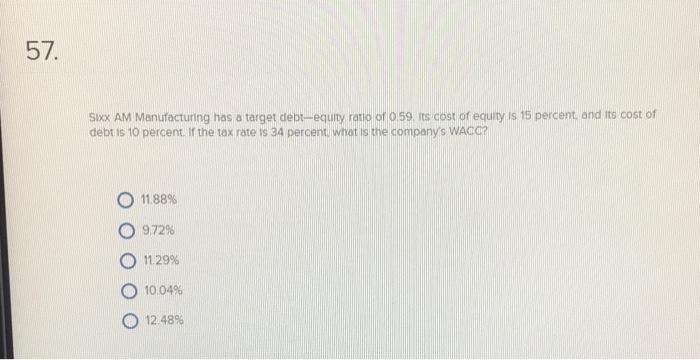

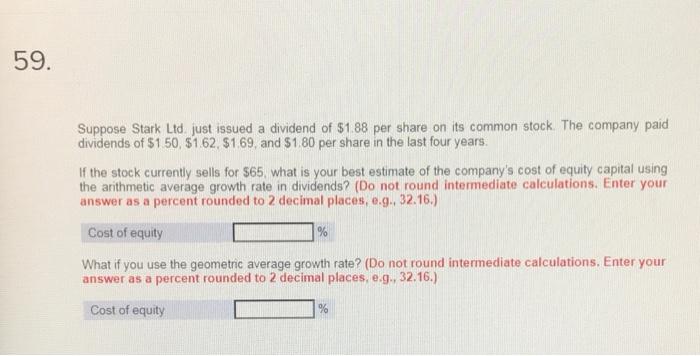

52. RAK Inc. has no debt outstanding and a total market value of $220 000 Eamings before interest and taxes EBIT, are projected to be $40.000 if economic conditions are normal there is strong expansion in the economy then EBIT will be 10 percent higher. If there is a recession then EBIT will be 20 percent lower RAK is considering a $135.000 debt issue with an interest rate of 4 percent. The proceeds will be used to repurchase shares of stock. There are currently 11 000 shares outstanding RAK has a tax rate of 35 percent a-1 Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.... 32.16.) EPS Recession Normal Expansion $ $ a-2 Calculate the percentage changes in EPS when the economy expands or enters a recession (Negative amounts should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g. 32.16.) Percentage changes in EPS Recession Expansion b-1 Calculate earnings per share (EPSunder each of the three economic scenarios assuming the company goes through with recapitalization (Do not round intermediate calculations and round your answers to 2 decimal places. c.9. 32.16.) EPS Recession Normal Expansion S 6-2 Given the recapitalization calculate the percentage changes in EPS when the economy expands or enters a recession (Negative amounts should be indicated by a minus sign. Do not round Intermediate calculations Enter your answers as a percent rounded to 2 decimal places, e.g. 32.16.1 Percentage changes in EPS Recession Expansion 53. Once Bitten Corp. uses no debt. The weighted average cost of capital is 6.4 percent. The current market value of the equity is S27 million and the corporate tax rate is 35 percent What is EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g. 1,234,567. Round your answer to 2 decimal places, e.g. 32.16.) EBIT 54. You own a stock portfolio invested 15 percent in Stock Q, 25 percent in Stock R, 5 percent in Stock S, and 55 percent in Stock T The betas for these four stocks are 159, 147, 0,54 and 12, respectively. What is the portfolio beta? 129 1.32 123 136 127 55. Consider the following information: State of Probability of Economy State of Economy Recession 17 Normal 53 Boom 30 Portfolio Return If State Occurs 13 14 22 Calculate the expected return (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Expected return % 57. Sixx AM Manufacturing has a target debrequity ratio of 059. its cost of equity is 15 percent and its cost of debt is 10 percent. If the tax rate is 34 percent what is the company's WAC G 11.88% 9729 11.29% 10.04% 12:48 59. Suppose Stark Ltd, just issued a dividend of $1.88 per share on its common stock. The company paid dividends of $150, $162. $169, and $180 per share in the last four years. If the stock currently sells for $65, what is your best estimate of the company's cost of equity capital using the arithmetic average growth rate in dividends? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, 0.9., 32.16.) Cost of equity % What if you use the geometric average growth rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts