Question: Please answer all questions. I really appreciate it, and will give it a thumbs up on your behalf. Thank you Rodriguez Corporation issues 12,000 shares

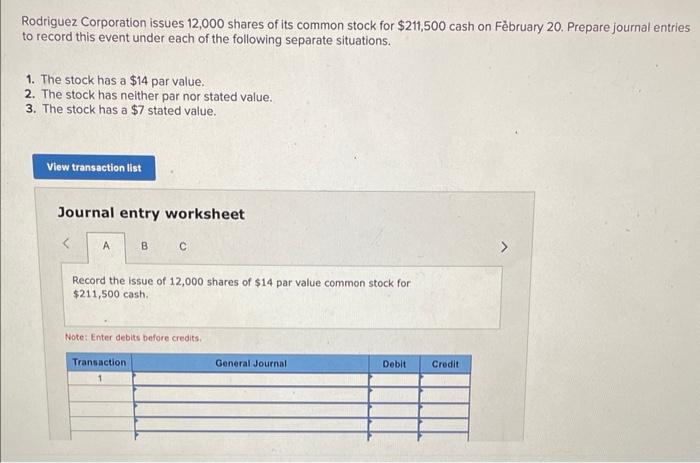

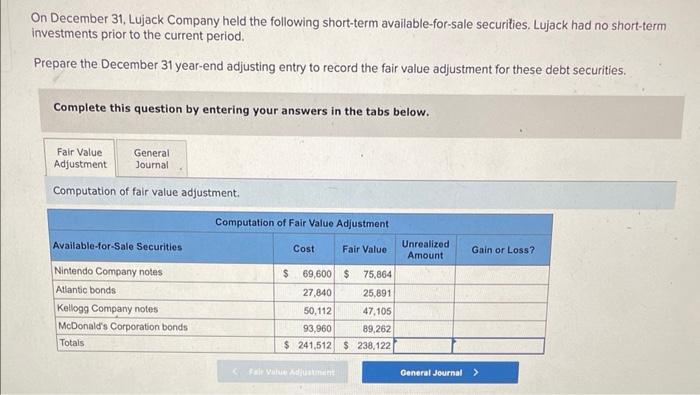

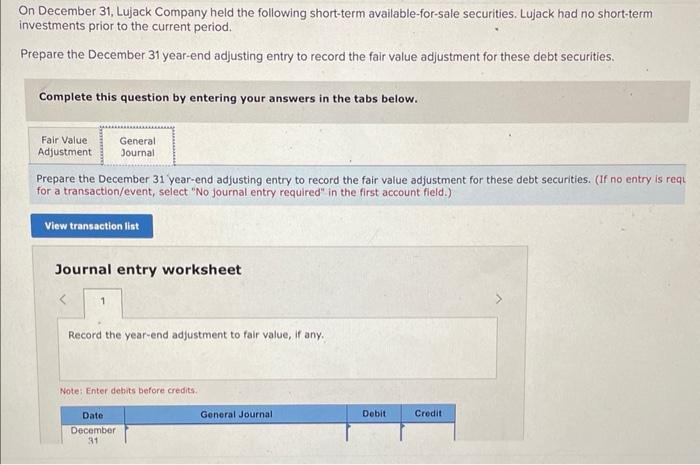

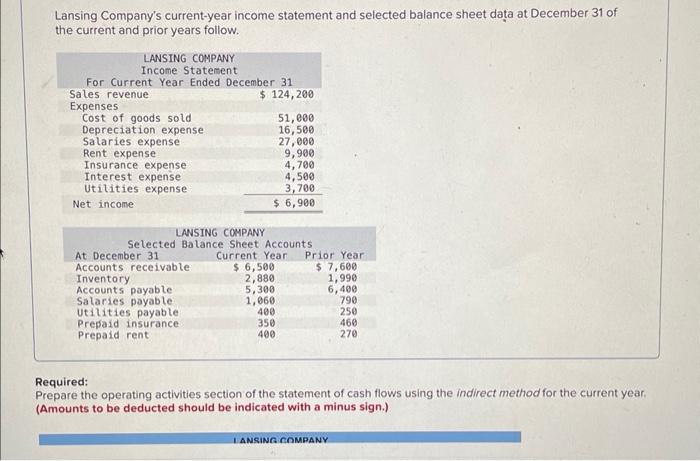

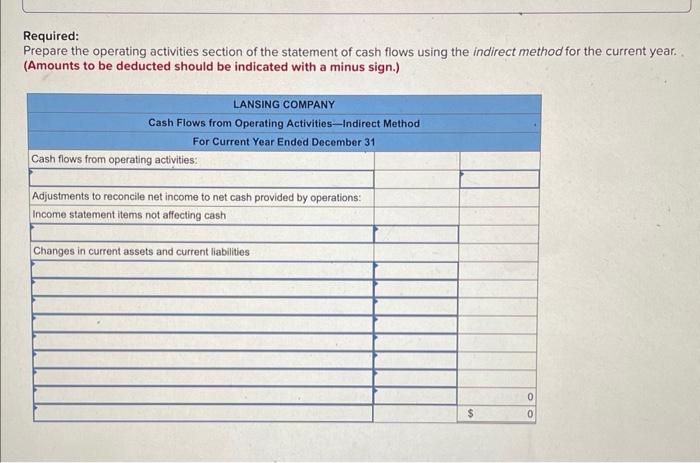

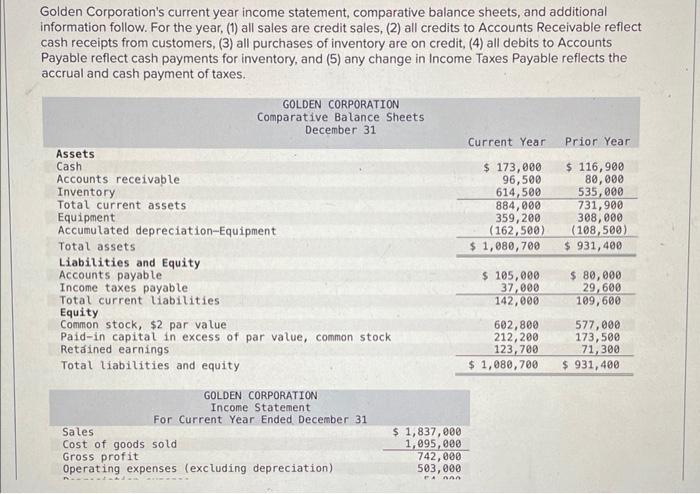

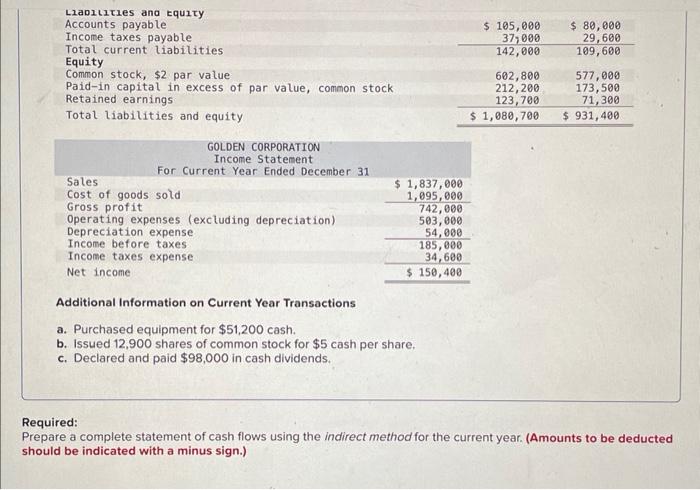

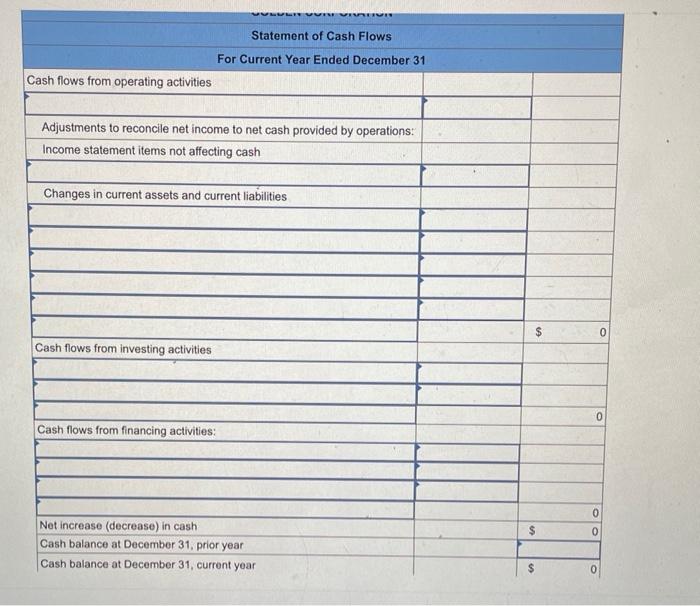

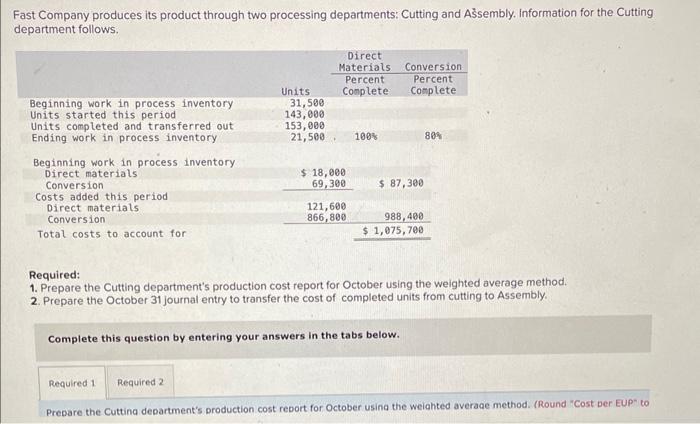

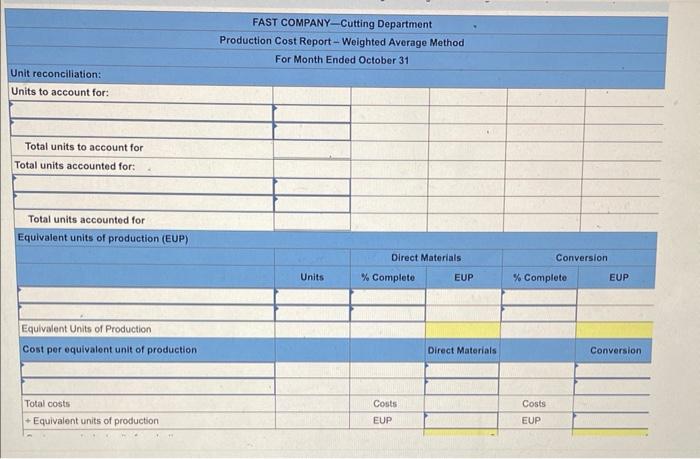

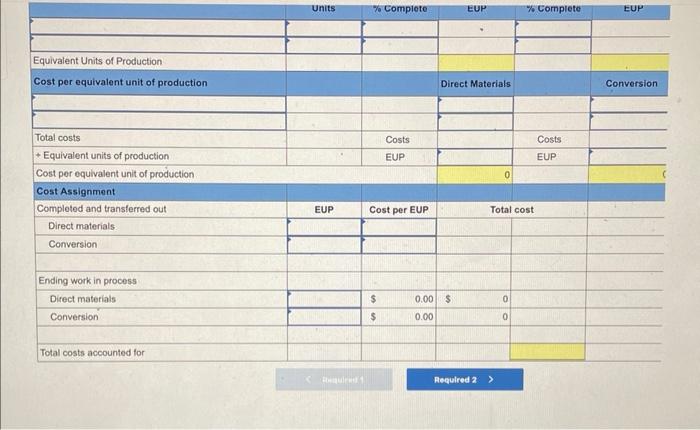

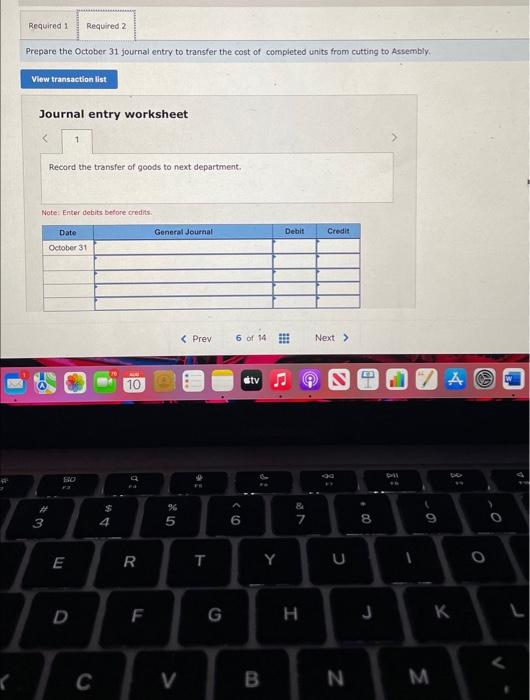

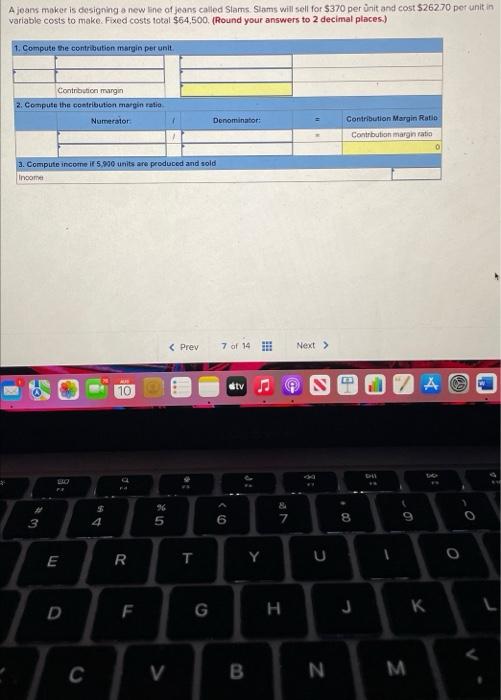

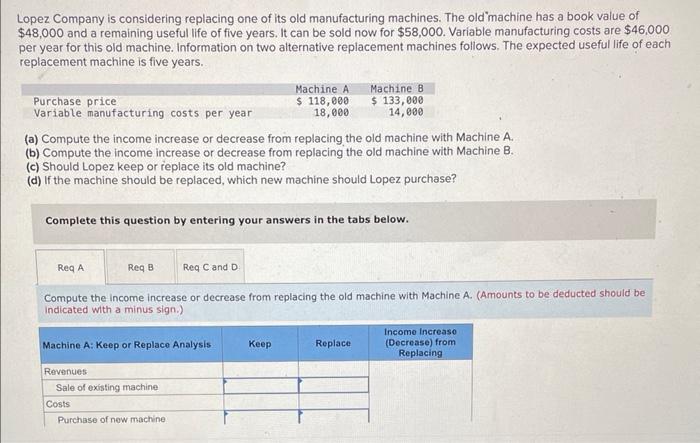

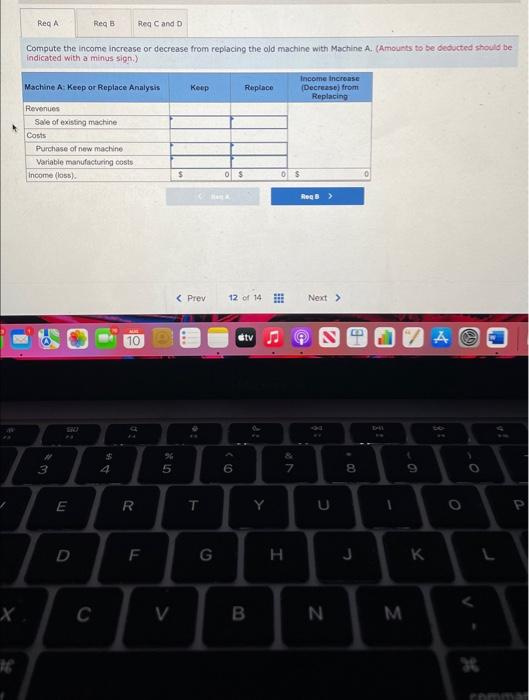

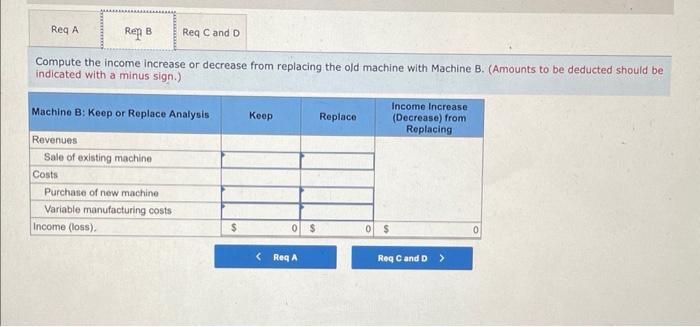

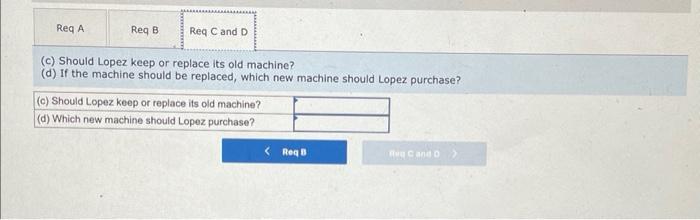

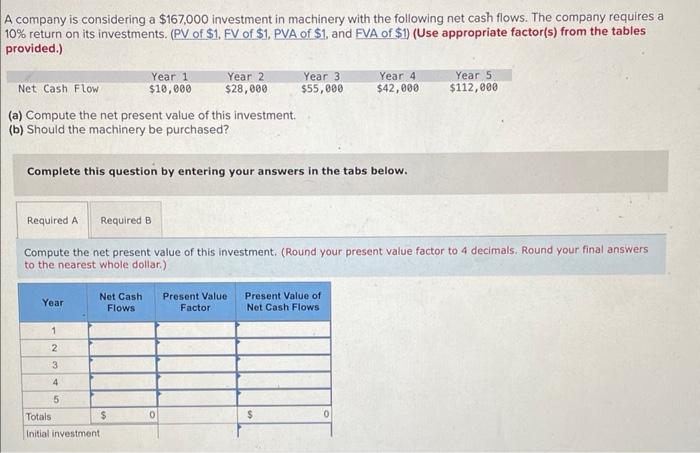

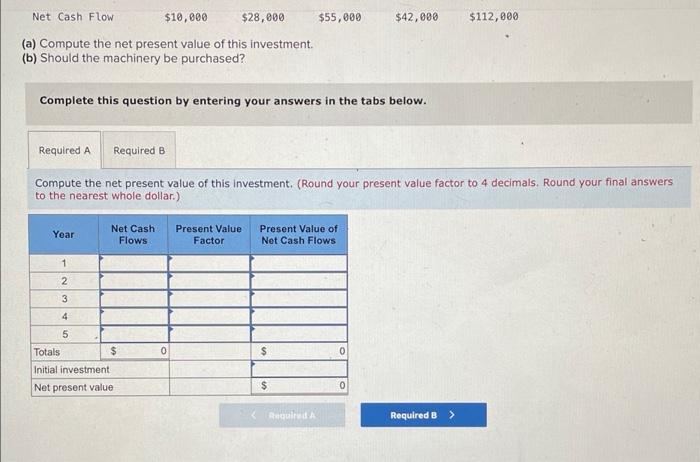

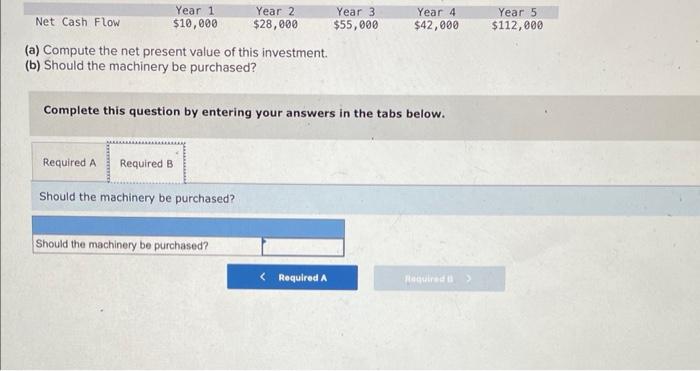

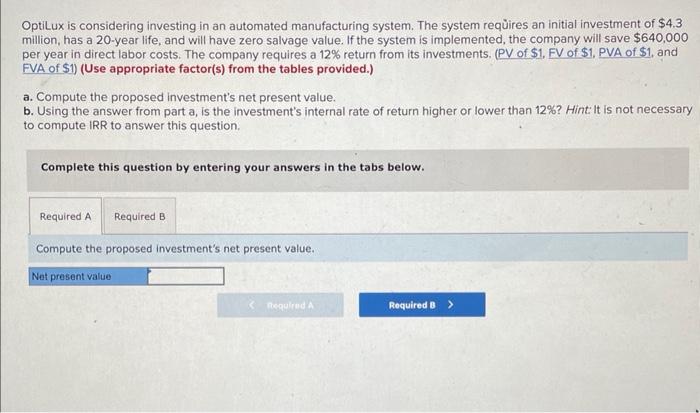

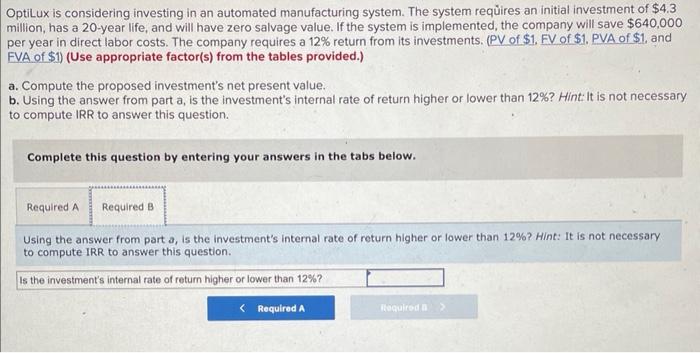

Rodriguez Corporation issues 12,000 shares of its common stock for $211,500 cash on Fbruary 20 . Prepare journal entries to record this event under each of the following separate situations. 1. The stock has a $14 par value. 2. The stock has neither par nor stated value. 3. The stock has a $7 stated value. Journal entry worksheet Record the issue of 12,000 shares of $14 par value common stock for $211,500 cash. Note: Enter debits before credits. On December 31, Lujack Company held the following short-term available-for-sale securities. Lujack had no short-term investments prior to the current period. Prepare the December 31 year-end adjusting entry to record the fair value adjustment for these debt securities. Complete this question by entering your answers in the tabs below. Computation of fair value adjustment. On December 31, Lujack Company held the following short-term available-for-sale securities. Lujack had no short-term investments prior to the current period. Prepare the December 31 year-end adjusting entry to record the fair value adjustment for these debt securities. Complete this question by entering your answers in the tabs below. Prepare the December 31 year-end adjusting entry to record the fair value adjustment for these debt securities. (If no entry is refor a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the year-end adjustment to fair value, if any. Note: Enter dehits before credits. Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and prior years follow. Required: repare the operating activities section of the statement of cash flows using the indirect method for the current year. Amounts to be deducted should be indicated with a minus sign.) Required: Prepare the operating activities section of the statement of cash flows using the indirect method for the current year. (Amounts to be deducted should be indicated with a minus sign.) Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Additional Information on Current Year Transactions a. Purchased equipment for $51,200 cash. b. Issued 12,900 shares of common stock for $5 cash per share. c. Declared and paid $98,000 in cash dividends. equired: repare a complete statement of cash flows using the indirect method for the current year. (Amounts to be deducted hould be indicated with a minus sign.) Fast Company produces its product through two processing departments: Cutting and Assembly. Information for the Cutting department follows. Required: 1. Prepare the Cutting department's production cost report for October using the weighted average method. 2. Prepare the October 31 journal entry to transfer the cost of completed units from cutting to Assembly. Complete this question by entering your answers in the tabs below. Prepare the Cuttina department's production cost rebort for October usina the weiahted averaee method. (Round "Cost ber Eup" to Conversion Prepare the October 31 journal entry to transfer the cost of completed units from cutting to Assembly. Journal entry worksheet Record the transfer of goods to next department. Note: Enter debits before credits. A jeans maker is designing a new tine of jeans called Slams. Slams will sell for $370 per nit and cost $26270 per unit in variable costs to make. Fixed costs total $64,500. (Round your answers to 2 decimal places.) Lopez Company is considering replacing one of its old manufacturing machines. The old'machine has a book value of $48,000 and a remaining useful life of five years. It can be sold now for $58,000. Variable manufacturing costs are $46,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted should be indicated with a minus sign.) Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted shoull be indicated with a minus-sign.) Compute the income increase or decrease from replacing the old machine with Machine B. (Amounts to be deducted should be indicated with a minus sign.) (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? A company is considering a $167,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of \$1. FV of \$1. PVA of \$1, and FVA of \$1) (Use appropriate factor(s) from the tables provided.) (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Complete this question by entering your answers in the tabs below. Compute the net present value of this investment. (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Complete this question by entering your answers in the tabs below. Compute the net present value of this investment. (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Complete this question by entering your answers in the tabs below. Should the machinery be purchased? OptiLux is considering investing in an automated manufacturing system. The system reqires an initial investment of $4.3 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $640,000 per year in direct labor costs. The company requires a 12% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of \$1) (Use appropriate factor(s) from the tables provided.) a. Compute the proposed investment's net present value. b. Using the answer from part a, is the investment's internal rate of return higher or lower than 12% ? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Compute the proposed investment's net present value. OptiLux is considering investing in an automated manufacturing system. The system reqires an initial investment of $4.3 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $640,000 per year in direct labor costs. The company requires a 12% return from its investments. (PV of $1. FV of $1. PVA of $1, and EVA of \$1) (Use appropriate factor(s) from the tables provided.) a. Compute the proposed investment's net present value. b. Using the answer from part a, is the investment's internal rate of return higher or lower than 12% ? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Using the answer from part a, is the investment's internal rate of return higher or lower than 12% ? Hint: It is not necessary to compute IRR to answer this question. Is the investment's internal rate of return higher or lower than 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts