Question: Please answer all questions, I will thumbs up. Assume that you are the portfolio manager of the Coastal Fund, a $1 million hedge fund that

Please answer all questions, I will thumbs up.

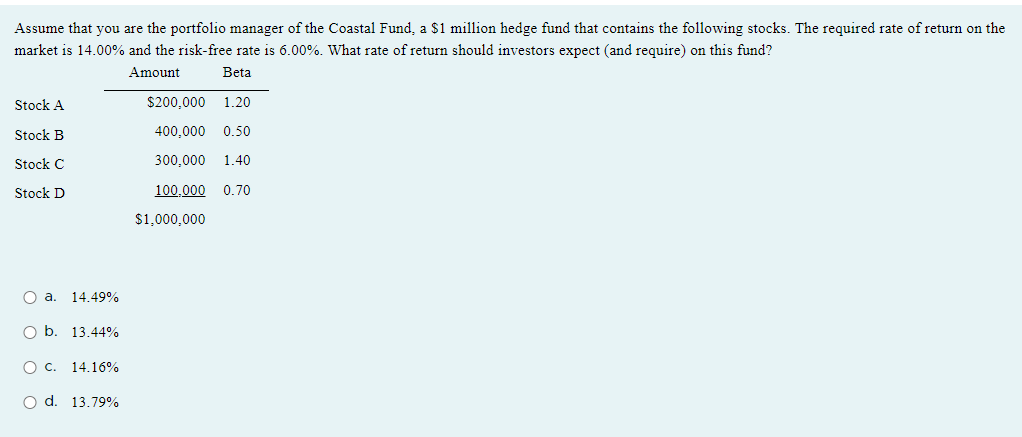

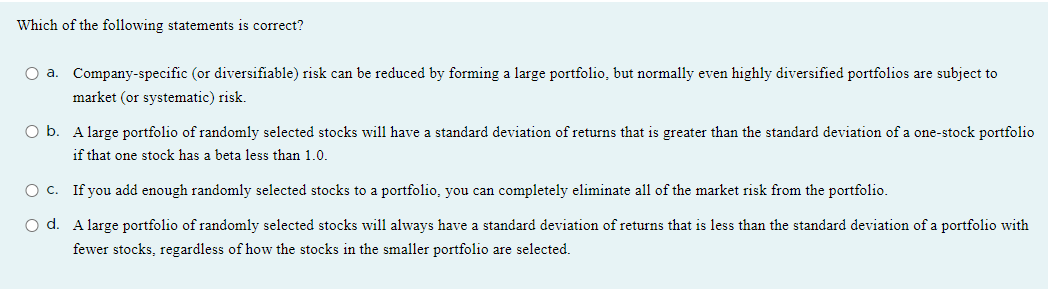

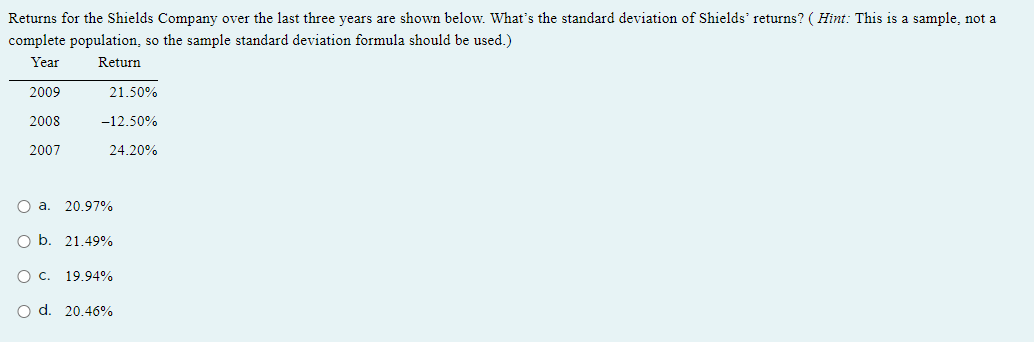

Assume that you are the portfolio manager of the Coastal Fund, a $1 million hedge fund that contains the following stocks. The required rate of return on the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on this fund? a. 14.49% b. 13.44% C. 14.16% d. 13.79% Which of the following statements is correct? a. Company-specific (or diversifiable) risk can be reduced by forming a large portfolio, but normally even highly diversified portfolios are subject to market (or systematic) risk. b. A large portfolio of randomly selected stocks will have a standard deviation of returns that is greater than the standard deviation of a one-stock portfolio if that one stock has a beta less than 1.0. c. If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio. d. A large portfolio of randomly selected stocks will always have a standard deviation of returns that is less than the standard deviation of a portfolio with fewer stocks, regardless of how the stocks in the smaller portfolio are selected. Returns for the Shields Company over the last three years are shown below. What's the standard deviation of Shields' returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.) a. 20.97% b. 21.49% C. 19.94% d. 20.46%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts