Question: Please answer all questions, if not, just skip! Thanks! Please make your answers CLEAR and EASILY READABLE! And be specific with your numberings and answers.

Please answer all questions, if not, just skip! Thanks! Please make your answers CLEAR and EASILY READABLE! And be specific with your numberings and answers.

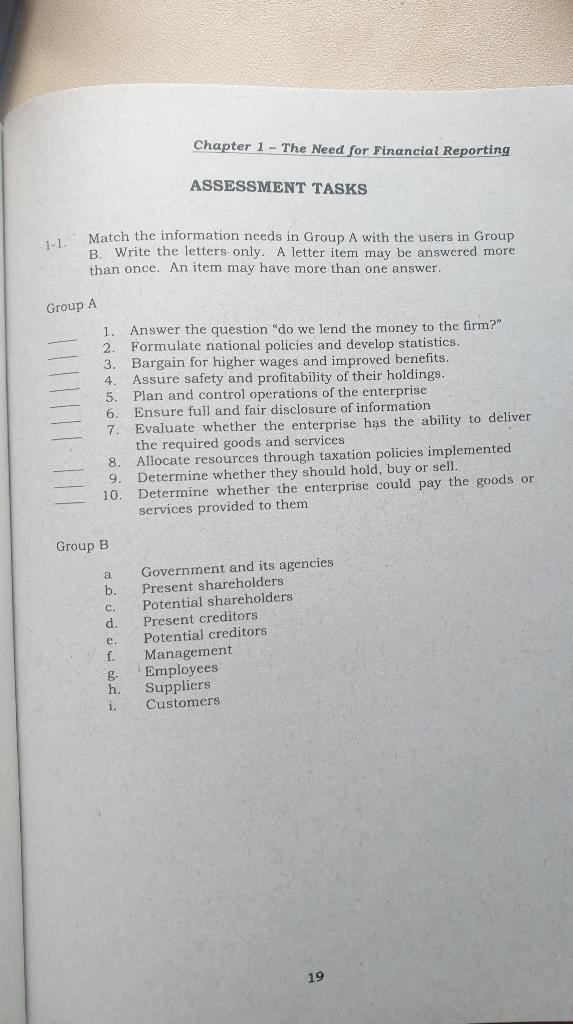

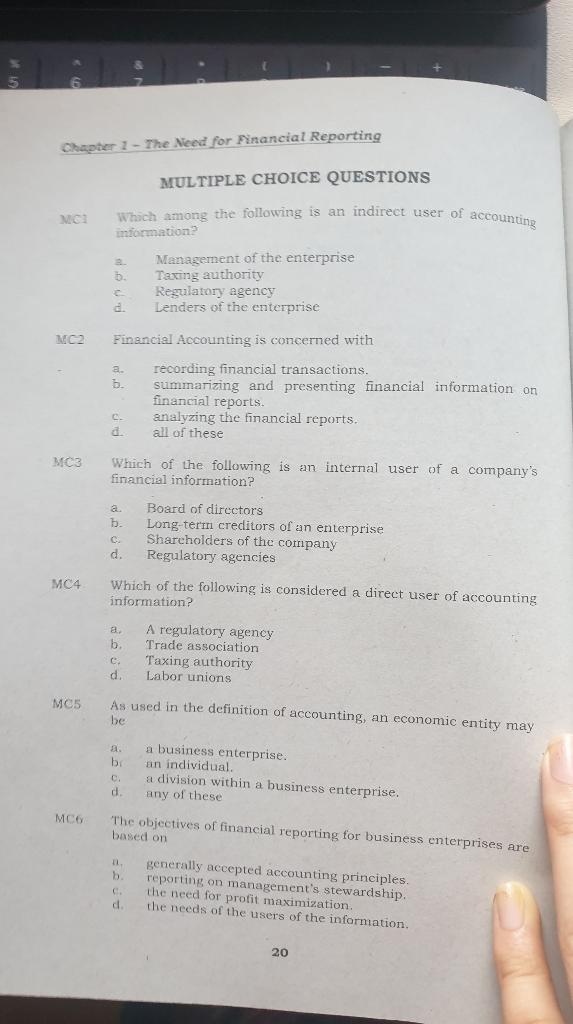

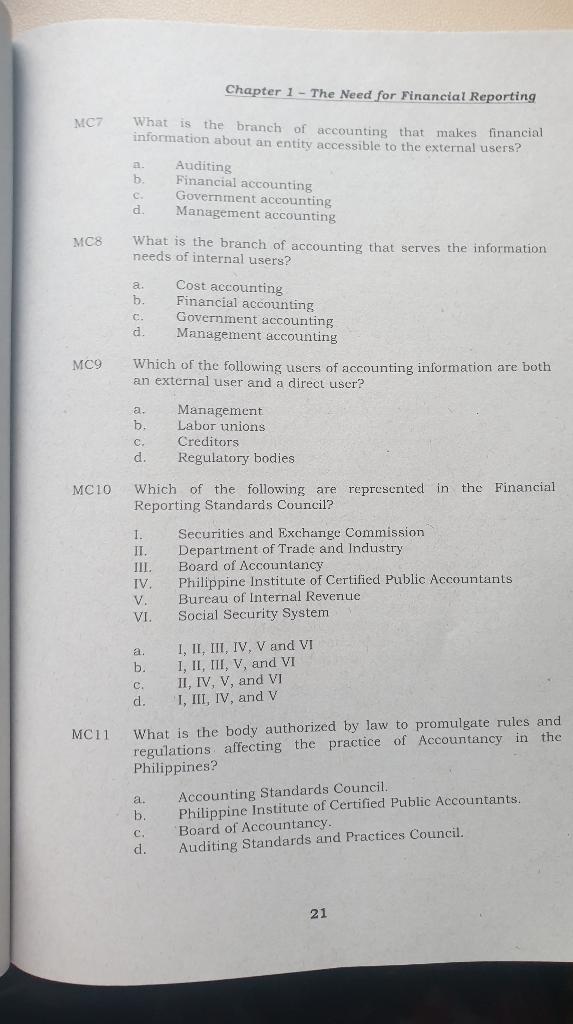

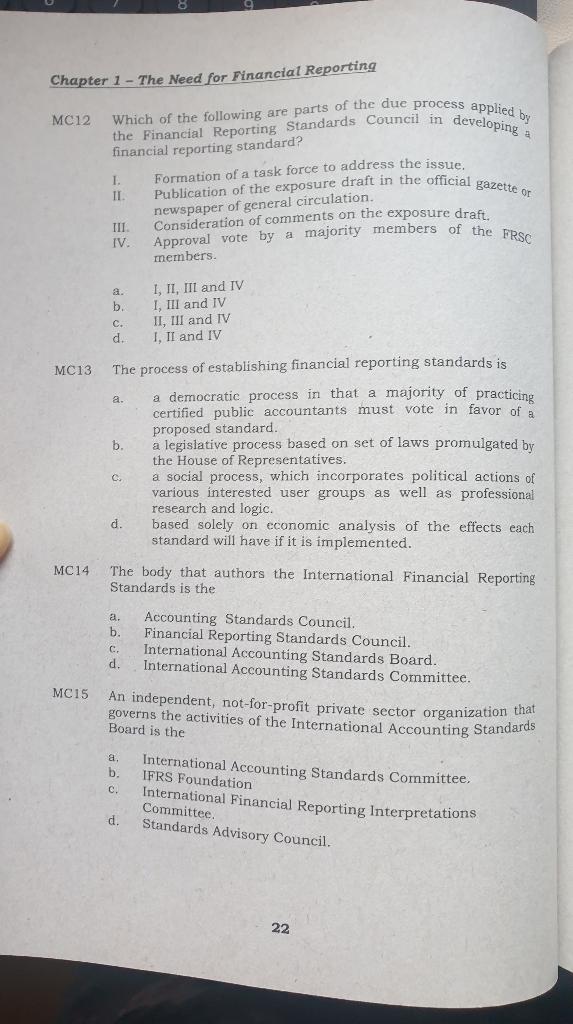

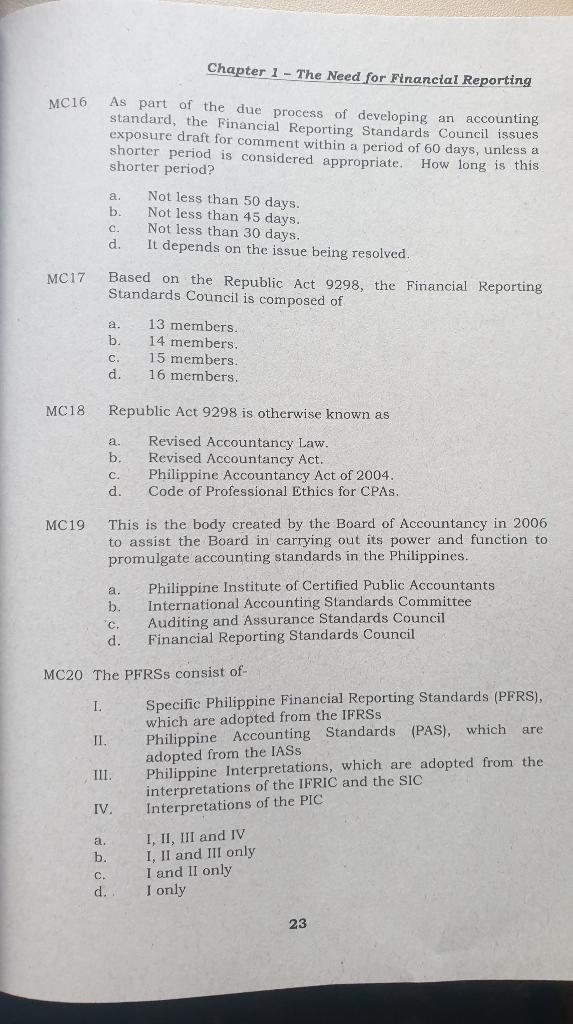

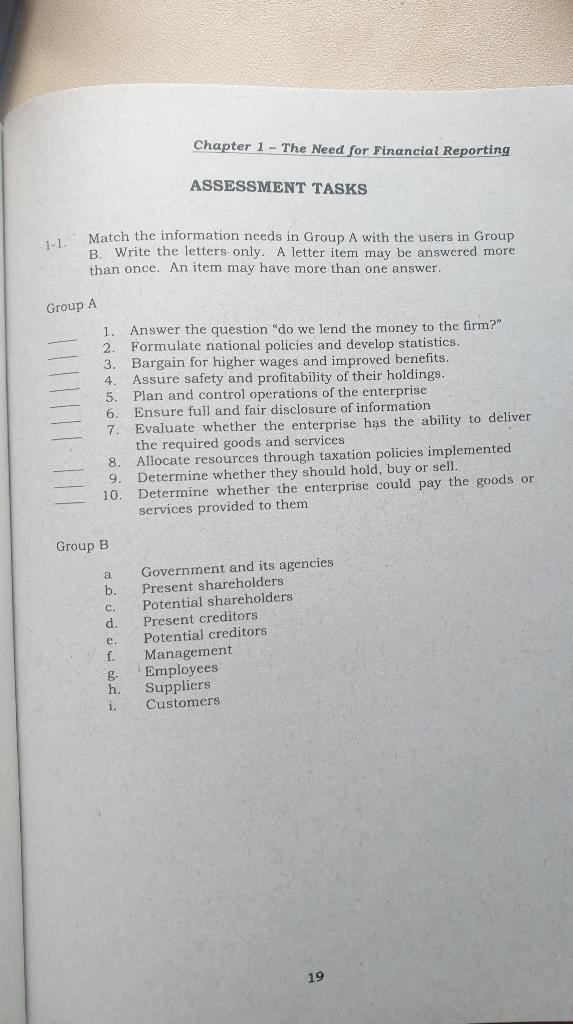

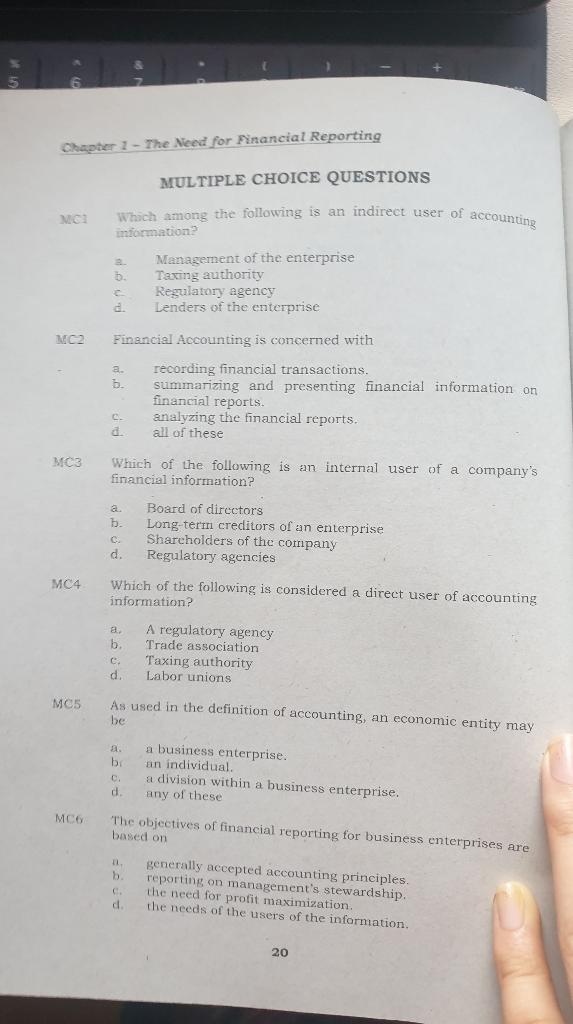

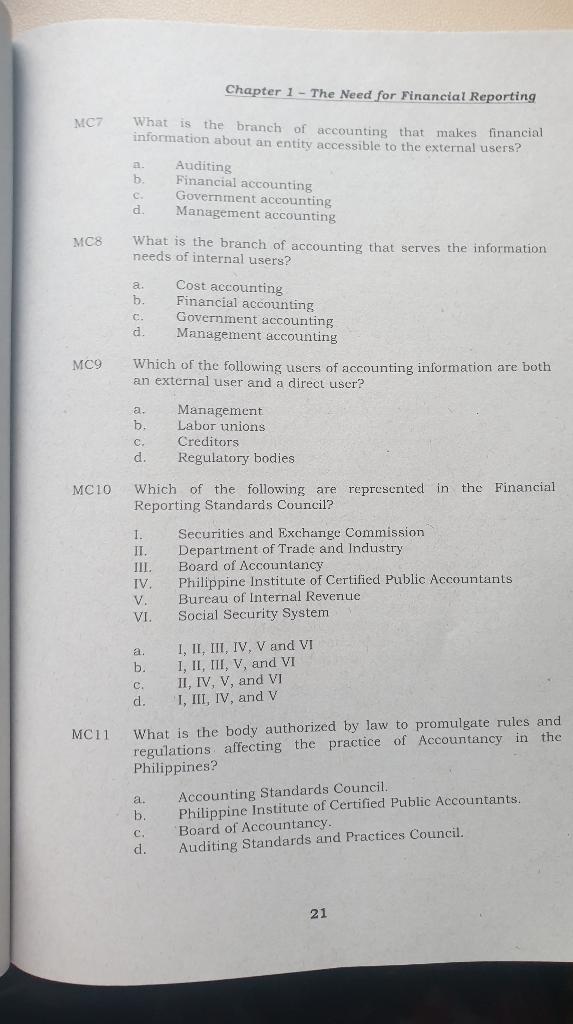

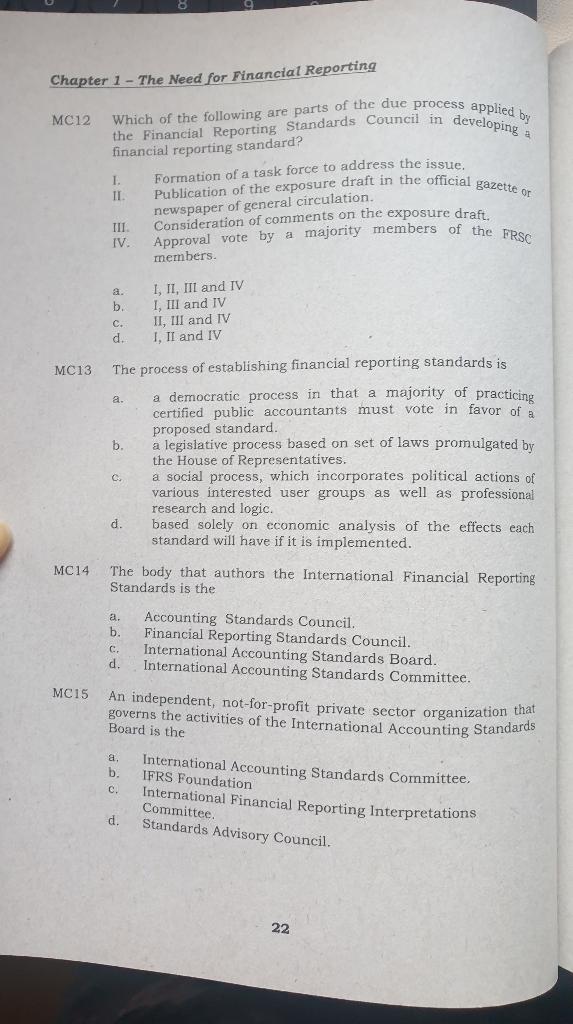

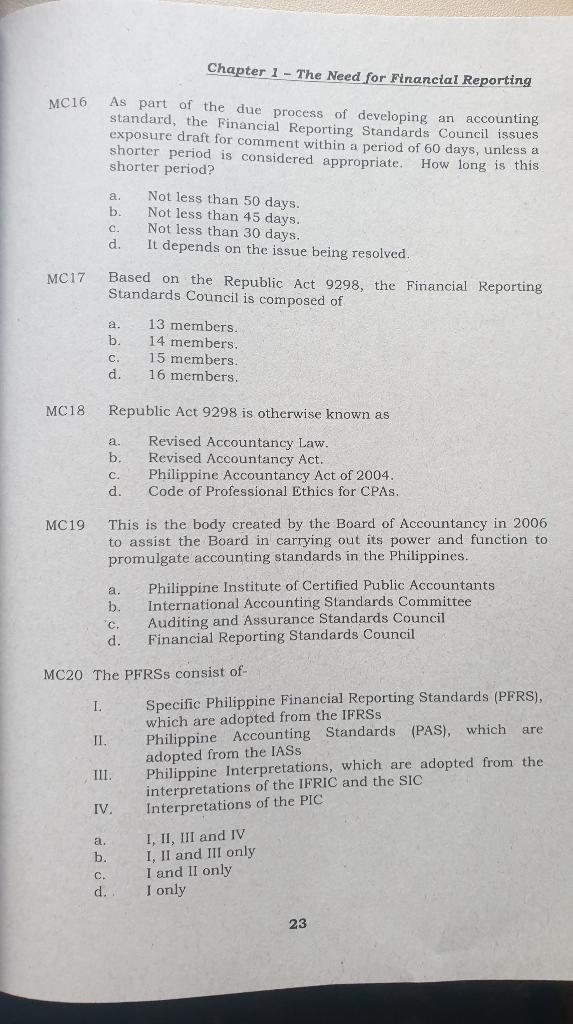

Chapter 1 - The Need for Financial Reporting ASSESSMENT TASKS Match the information needs in Group A with the users in Group B. Write the letters only. A letter item may be answered more than once. An item may have more than one answer. Group A 1. 2 4 disclosure of Answer the question "do we lend the money to the firm?" Formulate national policies and develop statistics. 3. Bargain for higher wages and improved benefits. Assure safety and profitability of their holdings. 5. Plan and control operations of f the enterprise 6. Ensure full and fair of information 7. Evaluate whether the enterprise has the ability to deliver the required goods and services Allocate resources through taxation policies implemented Determine whether they should hold, buy or sell. 10. Determine whether the enterprise could pay the goods or services provided to them 8 9 Group B a b. C d e f. g h. i. Government and its agencies Present shareholders Potential shareholders Present creditors Potential creditors Management Employees Suppliers Customers 19 Which among the following is an indirect user of accounting Chapter 1 - The Need for Financial Reporting MULTIPLE CHOICE QUESTIONS NCE information? b Management of the enterprise Taxing authority Regulatory agency Lenders of the enterprise MC2 a. Financial Accounting is concerned with recording financial transactions. b. summarizing and presenting financial information on financial reports analyzing the financial reports. d all these a. Which of the following is an internal user of a company's financial information? Board of directors Long-term creditors of an enterprise Shareholders of the company d. Regulatory agencies Which of the following is considered a direct user of accounting information? MC4 a b. c. d. A regulatory agency Trade association Taxing authority Labor unions MC5 As used in the definition of accounting, an economic entity may be a b a business enterprise. an individual a division within a business enterprise. any of these d MCG The objectives of financial reporting for business enterprises are based on b. C generally accepted accounting principles. reporting on management's stewardship the need for profit maximization the needs of the users of the information. 20 Chapter 1 - The Need for Financial Reporting MC a b. What is the branch of accounting that makes financial information about an entity accessible to the external users? Auditing Financial accounting, Government accounting d Management accounting What is the branch of accounting that serves the information needs of internal users? a Cost accounting b. Financial accounting c. Government accounting d. Management accounting MC8 MC9 Which of the following users of accounting information are both an external user and a direct user? a. b. c. d. Management Labor unions Creditors Regulatory bodies MC10 Which of the following are represented in the Financial Reporting Standards Council? 1. Securities and Exchange Commission II. Department of Trade and Industry III. Board of Accountancy IV Philippine Institute of Certified Public Accountants V. Bureau of Internal Revenue VI. Social Security System a. b I, II, III, IV, V and VI I, II, III, V, and VI II, IV, V, and VI I, III, IV, and V C d. MC11 What is the body authorized by law to promulgate rules and regulations affecting the practice of Accountancy in the Philippines? Accounting Standards Council. Philippine Institute of Certified Public Accountants. Board of Accountancy. Auditing Standards and Practices Council. a. b. C d. 21 Which of the following are parts of the due process appiled by the Financial Reporting Standards Council in developing Publication of the exposure draft in the official gazette or Approval vote by a majority members of the FRSC Chapter 1 - The Need for Financial Reporting MC12 financial reporting standard? 1 Formation of a task force to address the issue. II newspaper of general circulation. III Consideration of comments on the exposure draft, IV. members. b C. d. I, II, III and IV 1. III and IV II, III and IV 1. II and IV MC13 a. The process of establishing financial reporting standards is a democratic process in that a majority of practicing certified public accountants must vote in favor of a proposed standard. b. a legislative process based on set of laws promulgated by the House of Representatives. a social process, which incorporates political actions of various interested user groups as well as professional research and logic. d. based solely on economic analysis of the effects each standard will have if it is implemented. C MC14 The body that authors the International Financial Reporting Standards is the a. b. C. d. Accounting Standards Council. Financial Reporting Standards Council. International Accounting Standards Board. International Accounting Standards Committee. An independent, not-for-profit private sector organization that governs the activities of the International Accounting Standards Board is the MC15 a. b. c. International Accounting Standards Committee. IFRS Foundation International Financial Reporting Interpretations Committee Standards Advisory Council. d. 22 Chapter 1 - The Need for Financial Reporting MC16 As part of the due process of developing an accounting standard, the Financial Reporting Standards Council issues exposure draft for comment within a period of 60 days, unless a shorter period is considered appropriate. How long is this shorter period? a. b. Not less than 50 days. Not less than 45 days. Not less than 30 days. It depends on the issue being resolved. d. MC17 a. Based on the Republic Act 9298, the Financial Reporting Standards Council is composed of 13 members b. 14 members. 15 members. d. 16 members. C. MC18 Republic Act 9298 is otherwise known as a. Revised Accountancy Law. b Revised Accountancy Act. C. Philippine Accountancy Act of 2004. d. Code of Professional Ethics for CPAs. MC19 This is the body created by the Board of Accountancy in 2006 to assist the Board in carrying out its power and function to promulgate accounting standards in the Philippines. Philippine Institute of Certified Public Accountants b. International Accounting Standards Committee C. Auditing and Assurance Standards Council d. Financial Reporting Standards Council a. MC20 The PFRSs consist of- 1. Specific Philippine Financial Reporting Standards (PFRS), which are adopted from the IFRSs II. Philippine Accounting Standards (PAS), which are adopted from the IASs III. Philippine Interpretations, which are adopted from the interpretations of the IFRIC and the SIC IV. Interpretations of the PIC I, II, III and IV I, II and III only I and II only d. I only a. b. C 23