Question: please answer all questions. if you can answer quick i would appreciate it a lot. thank you soo much Suppose a firm's tax rate is

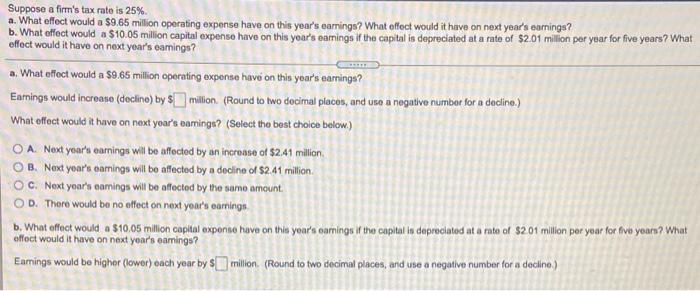

Suppose a firm's tax rate is 25% a. What effect would a $9.65 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would a $10.05 million capital expense have on this year's eamings if the capital in depreciated at a rate of $2.01 million per year for five years? What effect would it have on next year's eamings? a. What effect would a $9.65 million operating expense have on this year's earnings? Earnings would increase (decline) by $ million (Round to two decimal places, and use a negative number for a decline) What effect would it have on next year's bamings? (Select the best choice below.) O A Next year's earnings will be affected by an increase of $2.41 million OB. Next year's earnings will be affected by a decline of $2.41 million OC. Next year's comings will be affected by the same amount OD. There would be no effect on next your's earnings b. What effect would a $10.05 million capital expense have on this year's earnings if the capital is deprecated at a rate of $201 million per year for five year? What effect would it have on next year's eamings? Enmings would be higher (lower) each year by $ million (Round to two decimal places, and use a negative number for a decline)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts