Question: please answer all questions in 10 min as this is all 1 big question The following information applies to the next four questions. You have

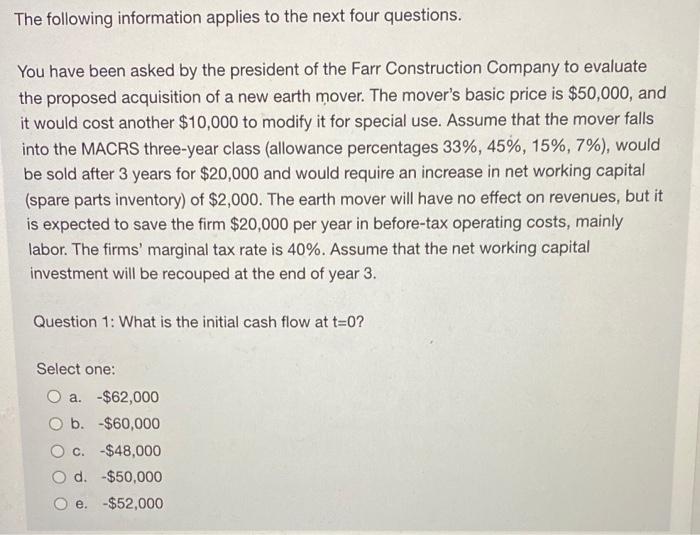

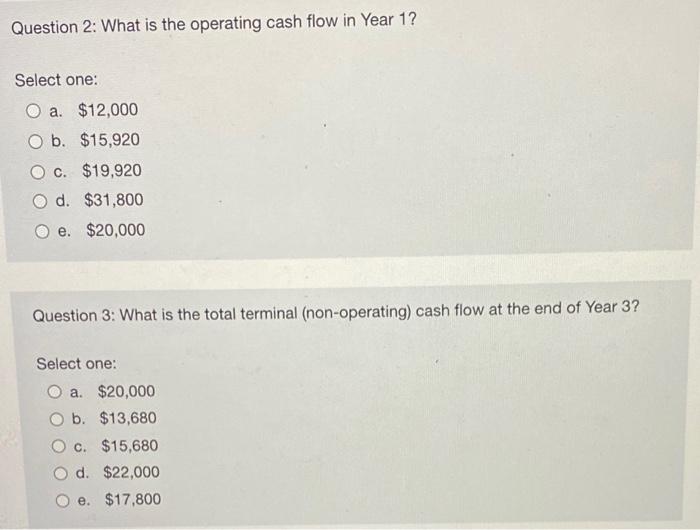

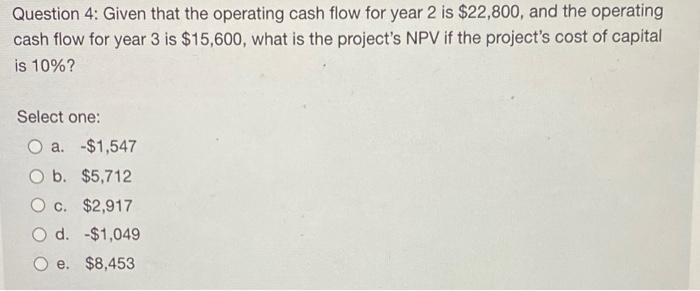

The following information applies to the next four questions. You have been asked by the president of the Farr Construction Company to evaluate the proposed acquisition of a new earth mover. The mover's basic price is $50,000, and it would cost another $10,000 to modify it for special use. Assume that the mover falls into the MACRS three-year class (allowance percentages 33%, 45%, 15%, 7%), would be sold after 3 years for $20,000 and would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firms' marginal tax rate is 40%. Assume that the net working capital investment will be recouped at the end of year 3. Question 1: What is the initial cash flow at t=0? Select one: O a. -$62,000 O b. $60,000 c. -$48,000 d. $50,000 e. -$52,000 Question 2: What is the operating cash flow in Year 1? Select one: O a. $12,000 O b. $15,920 O c. $19,920 O d. $31,800 O e. $20,000 Question 3: What is the total terminal (non-operating) cash flow at the end of Year 3? Select one: O a $20,000 O b. $13,680 O c. $15,680 O d. $22,000 e. $17,800 Question 4: Given that the operating cash flow for year 2 is $22,800, and the operating cash flow for year 3 is $15,600, what is the project's NPV if the project's cost of capital is 10%? Select one: O a $1,547 b. $5,712 O c. $2,917 d. -$1,049 O e. $8,453

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts