Question: Please answer all questions in the problem. Please, and thank you so much! (Financial statement analysis) The T.P. Jarmon Company manufactures and sells a line

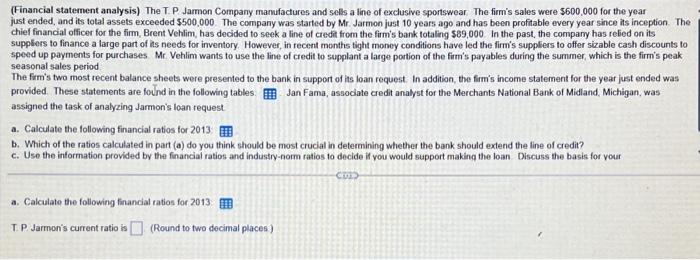

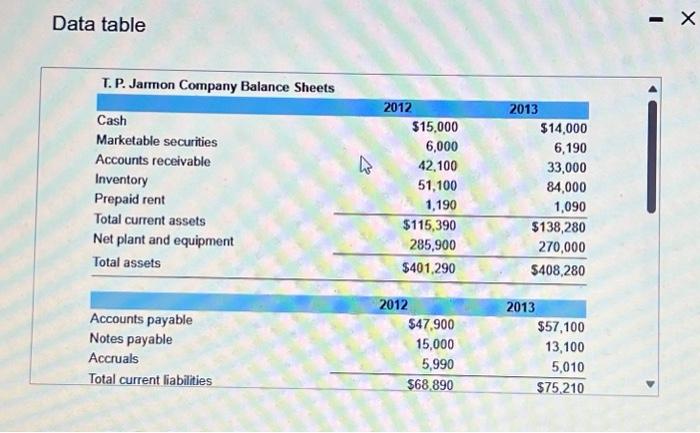

(Financial statement analysis) The T.P. Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets exceeded $500,000. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception. The chiel financial officer for the firm, Brent Vehlim, has decided to seek a line of credit from the firm's bank totaling $89,000. In the past, the company has relied on its suppliors to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Vehlim wants to use the line of credit to supplant a large portion of the firm's paryables during the summer, which is the firm's peak seasonal sales period The firm's two most recent balance sheets were presented to the bank in support of its loan request. In addition, the firm's income statement for the year just ended was provided. These statements are found in the following tables. Jan Fama, assodate credit analyst for the Merchants National Bank of Midland, Michigan, was assigned the task of analyzing Jarmon's loan request. a. Calculate the following financial ratios for 2013 b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line of credit? c. Use the information provided by the financial ratios and industry-norm ratios to decide if vou would support making the loan. Discuss the basis for vour a. Calculato the following financial ratios for 2013 T. P. Jarmon's current ratio is (Round to two decimal places) Data table Data table (Click on the icon in order to copy its contents into a spreadsheet)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts