Question: Please answer all questions on a Microsoft Excel spreadsheet ONLY and show calculations. P 10-9 [EPS] Computations (subsidiary preferred stock and warrants) Pit Corporation's net

Please answer all questions on a Microsoft Excel spreadsheet ONLY and show calculations.

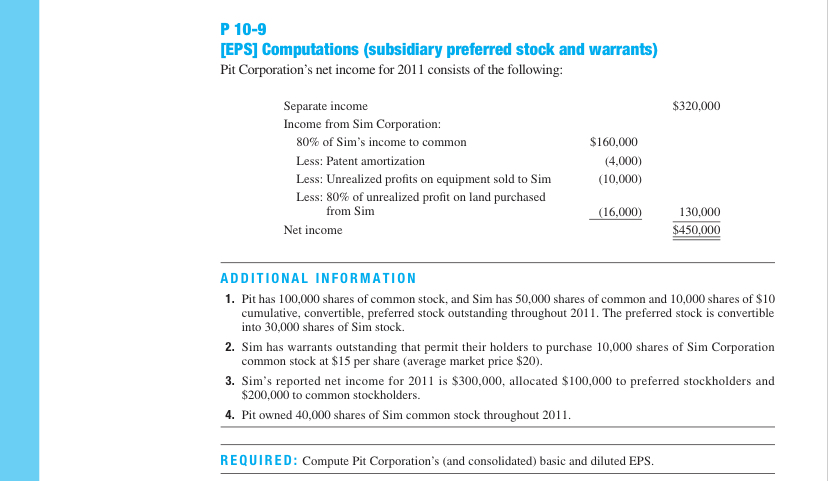

P 10-9 [EPS] Computations (subsidiary preferred stock and warrants) Pit Corporation's net income for 2011 consists of the following: $320,000 Separate income Income from Sim Corporation: 80% of Sim's income to common Less: Patent amortization Less: Unrealized profits on equipment sold to Sim Less: 80% of unrealized profit on land purchased from Sim Net income $160,000 (4,000) (10,000) (16,000) 130,000 $450,000 ADDITIONAL INFORMATION 1. Pit has 100,000 shares of common stock, and Sim has 50,000 shares of common and 10,000 shares of $10 cumulative, convertible, preferred stock outstanding throughout 2011. The preferred stock is convertible into 30,000 shares of Sim stock. 2. Sim has warrants outstanding that permit their holders to purchase 10,000 shares of Sim Corporation common stock at $15 per share (average market price $20). 3. Sim's reported net income for 2011 is $300,000, allocated $100,000 to preferred stockholders and $200,000 to common stockholders. 4. Pit owned 40,000 shares of Sim common stock throughout 2011. REQUIRED: Compute Pit Corporation's (and consolidated) basic and diluted EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts