Question: please answer all questions or dont answer at all 2. Capital market instruments include all of the following except a. U.S. Treasury notes and bonds.

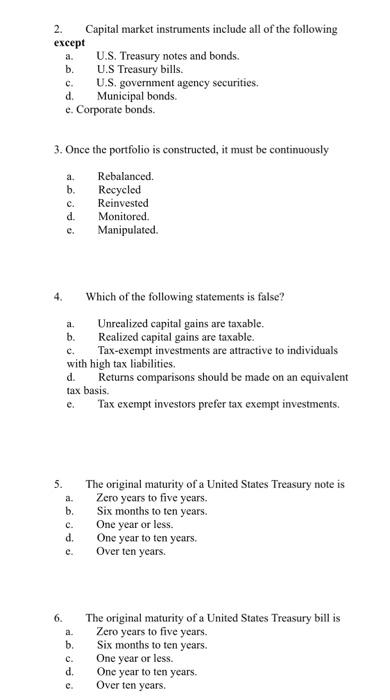

2. Capital market instruments include all of the following except a. U.S. Treasury notes and bonds. b. U.S Treasury bills. c. U.S. government agency securities. d. Municipal bonds. e. Corporate bonds. 3. Once the portfolio is constructed, it must be continuously a. Rebalanced. b. Recycled c. Reinvested d. Monitored. c. Manipulated. 4. Which of the following statements is false? a. Unrealized capital gains are taxable. b. Realized capital gains are taxable. c. Tax-exempt investments are attractive to individuals with high tax liabilities. d. Retums comparisons should be made on an equivalent tax basis. e. Tax exempt investors prefer tax exempt investments. 5. The original maturity of a United States Treasury note is a. Zero years to five years. b. Six months to ten years. c. One year or less. d. One year to ten years. e. Over ten years. 6. The original maturity of a United States Treasury bill is a. Zero years to five years. b. Six months to ten years. c. One year or less. d. One year to ten years. e. Overten years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts