Question: please answer all questions or dont answer at all 7) The cheapest business entity to form is typically the: A) limited liability company. B) joint

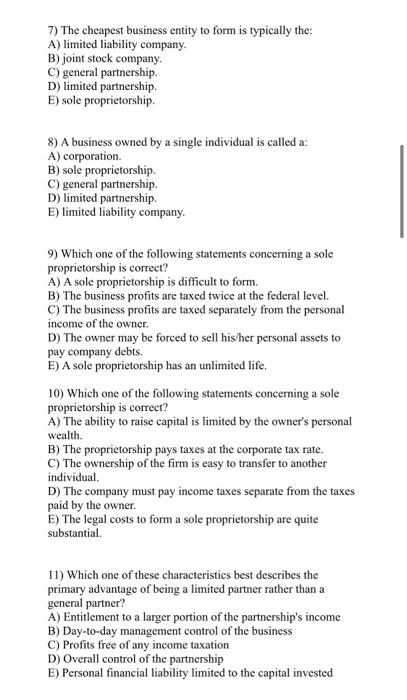

7) The cheapest business entity to form is typically the: A) limited liability company. B) joint stock company. C) general partnership. D) limited partnership. E) sole proprietorship. 8) A business owned by a single individual is called a: A) corporation. B) sole proprietorship. C) general partnership. D) limited partnership. E) limited liability company. 9) Which one of the following statements concerning a sole proprietorship is correct? A) A sole proprietorship is difficult to form. B) The business profits are taxed twice at the federal level. C) The business profits are taxed separately from the personal income of the owner. D) The owner may be forced to sell his/her personal assets to pay company debts. E) A sole proprietorship has an unlimited life. 10) Which one of the following statements concerning a sole proprietorship is correct? A) The ability to raise capital is limited by the owner's personal wealth. B) The proprietorship pays taxes at the corporate tax rate. C) The ownership of the firm is easy to transfer to another individual. D) The company must pay income taxes separate from the taxes paid by the owner. E) The legal costs to form a sole proprietorship are quite substantial. 11) Which one of these characteristics best describes the primary advantage of being a limited partner rather than a general partner? A) Entitlement to a larger portion of the partnership's income B) Day-to-day management control of the business C) Profits free of any income taxation D) Overall control of the partnership E) Personal financial liability limited to the capital invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts