Question: Please answer all questions or don't answer at all. thank you s0. Sensicivy analysis: A. is more difficulf so conduct than simulatice analysik. 13. phovides

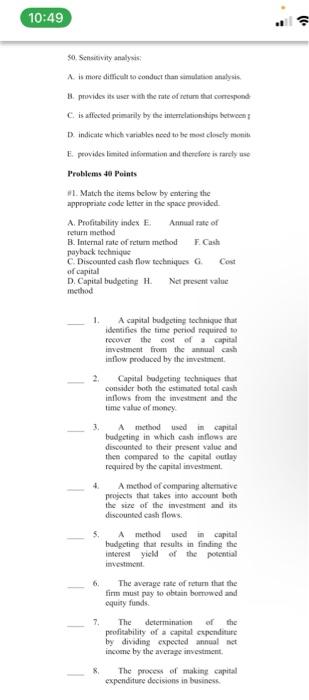

s0. Sensicivy analysis: A. is more difficulf so conduct than simulatice analysik. 13. phovides its wer with the rate of return that sorresponst- C. is affected priearily by the interelationshigs betwoen D. indicale whick variables need to he towet clincly monite E. peovides limited insiemation and therefort is rarely use Problems 46 Fuints 1. Match the itcms below by cancring the appropriate code letter in the space prowided. A. Profitabilaty index, E. Annual rate of return incthod B. Internal raic of return method F. Cash nayback tochinique C. Discounted cash flow techmiques G . Cont of capital D. Capital bucketing H. Net prescnt value itsethoul 1. A capital budgeting technique that idenifies the time period required bo reconer the cost of a capital imvestment from the annual cast intlow produced by the imiestment. 2. Capital badgeting tochnques that consider both the estimated fotal cash isme valae of money. 3. A method uscd in capital budgeting in which cash intlows are discountid to their present value and toce cotnfared to the capital outlay required by the capital investment. 4. A method of compariag allemative peojects that takes into account both the sire of the investment and its discountod cash flows. 5. A method used in capital budgcting that results in finding the iaterest yield of the polential imyestakent. 6. The average rate of return that the firm must jay 90 obtain burrowod and equaty funds. 7. The determanation af the profitability of a capial cepocnditare by dividiag expected annual net income by the average investment. 8. The jocces of making capital expenditure decisions in tarsinesk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts