Question: Please answer all questions or don't answer at all. True or False Only. 1. Corporate dividends are taxable as personal income when received by shareholders

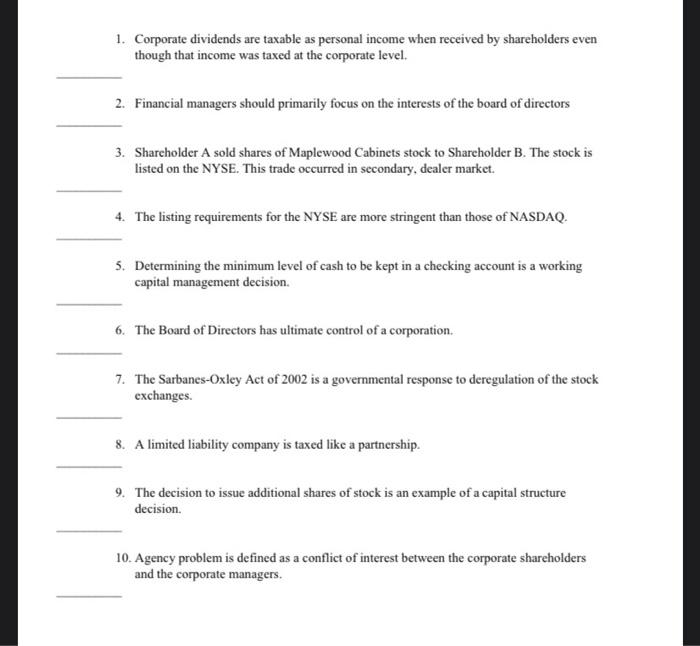

1. Corporate dividends are taxable as personal income when received by shareholders even though that income was taxed at the corporate level. 2. Financial managers should primarily focus on the interests of the board of directors 3. Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in secondary, dealer market. 4. The listing requirements for the NYSE are more stringent than those of NASDAQ. 5. Determining the minimum level of cash to be kept in a checking account is a working capital management decision. 6. The Board of Directors has ultimate control of a corporation. 7. The Sarbanes-Oxley Act of 2002 is a governmental response to deregulation of the stock exchanges 8. A limited liability company is taxed like a partnership 9. The decision to issue additional shares of stock is an example of a capital structure decision. 10. Agency problem is defined as a conflict of interest between the corporate shareholders and the corporate managers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts