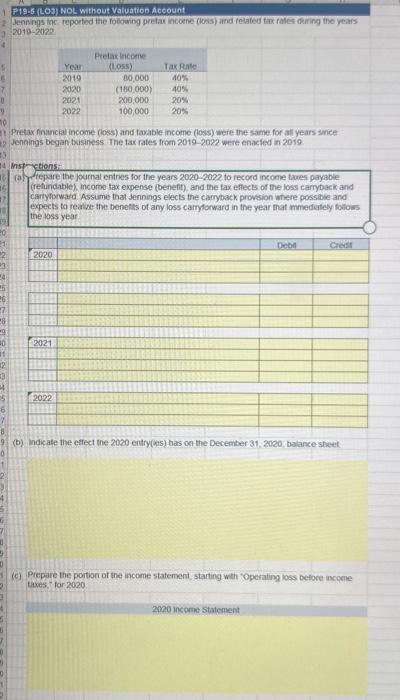

Question: Please answer all questions :) P19-6. (LO2) NOL without Valuation Account Jennngs inc. reported the fowing pretau incoene (loss) and related tax fales diring ine

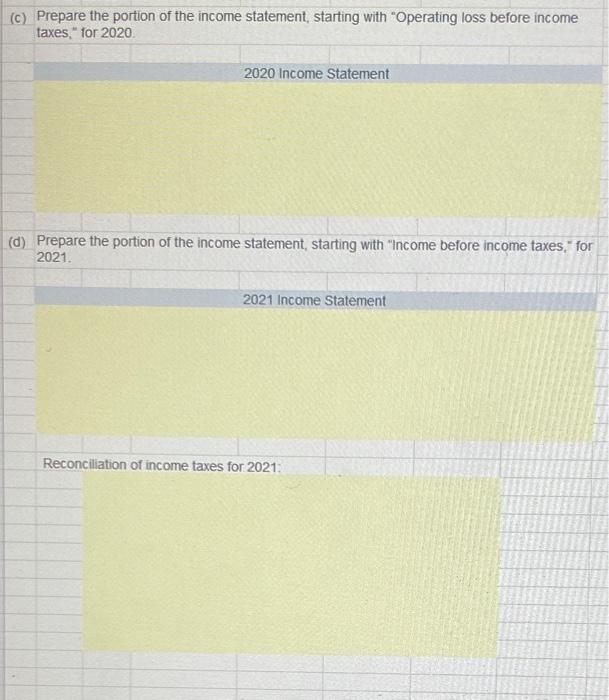

P19-6. (LO2) NOL without Valuation Account Jennngs inc. reported the fowing pretau incoene (loss) and related tax fales diring ine years 20102023 Pretax financia income (loss) and taxable income (loss) were the same for al years since Jengings began basiness The tax rates froen 2019-2022 were enacted in 2019 Misf etiensi ta cicpare the joumal enines for ine years 20202022 to recond income tares payabie (retundable). incormo tax expense (benefit), and the tax eflects of the loss carryback and caryerward. Assume that Jennings elects the caryback provsion where possibie and epects to reacse the benetts of any loss carydonard in the year that mmeditely folooss the toss year. \begin{tabular}{|l|l|l|l|} \hline \hline 2020 & & Debd & Crest \\ \hline & & & \\ \hline \end{tabular} (b) bidiale the effect the 2020 entyy(ens) has on the December 31,2020 , bolance steet (c) Pcepare the portion of the income statement, starting with 'Operating loss pelore income taxes, for 2000 (c) Prepare the portion of the income statement, starting with "Operating loss before income taxes, " for 2020 2020 Income Statement (d) Prepare the portion of the income statement, starting with "Income before income taxes," for 2021. P19-6. (LO2) NOL without Valuation Account Jennngs inc. reported the fowing pretau incoene (loss) and related tax fales diring ine years 20102023 Pretax financia income (loss) and taxable income (loss) were the same for al years since Jengings began basiness The tax rates froen 2019-2022 were enacted in 2019 Misf etiensi ta cicpare the joumal enines for ine years 20202022 to recond income tares payabie (retundable). incormo tax expense (benefit), and the tax eflects of the loss carryback and caryerward. Assume that Jennings elects the caryback provsion where possibie and epects to reacse the benetts of any loss carydonard in the year that mmeditely folooss the toss year. \begin{tabular}{|l|l|l|l|} \hline \hline 2020 & & Debd & Crest \\ \hline & & & \\ \hline \end{tabular} (b) bidiale the effect the 2020 entyy(ens) has on the December 31,2020 , bolance steet (c) Pcepare the portion of the income statement, starting with 'Operating loss pelore income taxes, for 2000 (c) Prepare the portion of the income statement, starting with "Operating loss before income taxes, " for 2020 2020 Income Statement (d) Prepare the portion of the income statement, starting with "Income before income taxes," for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts